(Updated at 3:35 p.m.) Some 6.3 million square feet of office space is either currently under construction or approved and awaiting construction, according to latest figures from Arlington County.

(Updated at 3:35 p.m.) Some 6.3 million square feet of office space is either currently under construction or approved and awaiting construction, according to latest figures from Arlington County.

The development of 5.3 million square feet of office, 836,543 square feet of retail and 7,572 residential units in Arlington has been approved by the county but is not yet under construction, according to the 2012 Arlington County Government annual report. That’s up from last year’s annual report, when 4.3 million square feet of office, 813,479 square feet of retail and 5,839 residential units were approved and awaiting construction.

As of Sept. 30, approximately 1 million square feet of office, 150,000 square feet of retail and 1,380 residential units were under construction, up about 50 percent, 70 percent and 20 percent year-over-year, respectively.

The figures are a reflection of continued developer interest in Arlington County, despite economic competition from D.C. and the new Silver Line corridor.

“The increased competition from the Silver Line construction certainly exists, and our team is working diligently to showcase the opportunity that exists in Arlington,” said Arlington Economic Development spokeswoman Cara O’Donnell. “Developers are continuing to plan new and exciting projects in Arlington, and our BizLaunch program works with as many as 3,000 entrepreneurs and small businesses every year.”

Still, some believe that the Silver Line may take some Metro-oriented development away from Arlington, particularly after the first section of the rail line — running from Reston and Tysons to Arlington and D.C. — opens in late 2013 or early 2014.

Most of the projects not yet under construction in Arlington were approved in the past 5 years, although some date back to the 1990s and one dates back to 1981. All told, there is about 40 million square feet of office space in Arlington, plus 43,000 residential units along Metro corridors and 105,000 residential units countywide, based on the county’s 2012 profile.

The developments approved but not yet under construction (as of 11/1/12) include:

- Rosslyn Gateway Phases 1 & 2 — 1901 Ft. Myer Drive — 490,056 sq ft office / 26,376 sq ft retail / 273 residential units / 148 hotel rooms

- Rosslyn Commons Townhouses — 1500 Clarendon Blvd — 25 residential units

- Central Place — 1801 N. Moore Street — 570,549 sq ft office / 44,554 sq ft retail / 374 residential units

- Wakefield Manor — 2025 Fairfax Drive — 188 residential units

- 1919 Clarendon Blvd (Hollywood Video Site) — 1919 Clarendon Blvd — 24,657 sq ft retail / 198 residential units

- The Tellus — 2009 14th Street N. — 10,674 sq ft office / 4,354 sq ft retail / 254 residential units

- Washington View — 2001 Clarendon Blvd — 32,840 sq ft retail / 154 residential units

- NTSA Office Site — 1840 Wilson Blvd — 107,920 sq ft office / 10,000 sq ft retail

- Demar Office Building — 2311 Wilson Blvd — 100,328 sq ft office / 4,906 sq ft retail

- 3001 Washington Blvd (Penzance) — 3001 Washington Blvd — 284,012 sq ft office / 22,479 sq ft retail

- Beacon at Clarendon West (formerly The Waverly) — 1200 N. Irving Street — 18,299 sq ft retail / 195 residential units

- 3901 Fairfax Drive — 3901 Fairfax Drive — 178,131 sq ft office / 3,200 sq ft retail

- Virginia Square Towers — 3440 Fairfax Drive — 12,815 sq ft retail / 540 residential units

- 3803 Fairfax Drive Expansion — 3803 Fairfax Drive — 43,045 sq ft office

- 650 N. Glebe Road (Goodyear Site) — 650 N. Glebe Road — 2,203 sq ft retail / 163 residential units

- Founder’s Square North Office — 707 N. Randolph Street — 418,810 sq ft office / 7,670 sq ft retail

- The Place (Founder’s Square North Residential) — 4000 Wilson Blvd — 9,035 sq ft retail / 256 residential units

- Peck/Staples/AHC Townhouses — 815 N. Woodrow Street — 28 residential units

- The Spire/Fairmont — 4420 Fairfax Drive — 9,200 sq ft retail / 237 residential units

- 1900 Crystal Drive — 1900 Crystal Drive — 719,704 sq ft office / 11,290 sq ft retail

- Boeing Site — 608 S. Ball Street — 453,422 sq ft office

- Potomac Yard Land Bays C & D — 3001 Jefferson Davis Hwy — 1,064,298 sq ft office / 73,696 sq ft retail / 691 residential units

- Lofts at Crystal Houses — 1900 S. Eads Street — 252 residential units

- Crystal City Retail Phase II — 2010 Crystal Drive — 84,034 sq ft office / 92,920 sq ft retail

- Airport Plaza IV — 2600 Crystal Drive — 198 residential units

- Pentagon City PDSP Parcel 3 — 501 15th Street S. — 64,231 sq ft retail / 1,172 residential units / 300 hotel rooms

- Pentagon City PDSP Parcel 1D — 1197 S. Fern Street — 930 residential units / 582 hotel rooms

- The Acadia (Three Metropolitan Park) — 1201 S. Fern Street — 16,345 sq ft retail / 411 residential units

- Pentagon Centre Phases 1-3 — 1201 S. Hayes Street — 776,982 sq ft office / 327,070 sq ft retail / 600 residential units / 250 hotel rooms

- Pike 3400 — 3400 Columbia Pike — 15,443 sq ft retail / 301 residential units

- Axumite Village — 1100 S. Highland Street — 36 residential units

- Columbia Place — 1100 S. Edgewood Street — 2,960 sq ft retail / 22 residential units

- Buckingham Townhomes Village I — 424 N. George Mason Drive — 68 residential units

- Greenbrier Village Phase II — 2251 N. Greenbrier Street — 4 residential units

- 705/707 N. Barton Street — 705 N. Barton Street — 2 residential units

Recent Stories

For Immediate Release

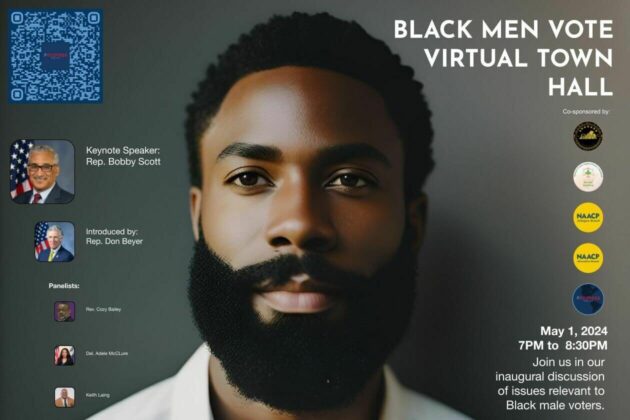

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.