Pentagon City Mall Renovations — Coming on the heels of the news that Ballston Common Mall will be getting a revamp, the owners of Fashion Centre at Pentagon City announced plans to renovate that mall as well. Although no formal plan has been revealed, changes could include adding office space or apartments. Renovations for the 24-year-old mall would be paid for out of a pot of about $1 billion that Simon Property Group Inc. has set aside for updating its properties. [Washington Business Journal]

Fire Hydrant Color Meaning — Arlington doesn’t have one standard color for fire hydrants; instead, the county adopted a coloring system in the 1990s indicating the flow of water at each particular hydrant. Blue hydrants have water flow above 1,500 gallons per minute (gpm), green is between 1,000 and 1,500 gpm, orange is 500 to 1,000 gpm and red is below 500 gpm. The color scheme allows firefighters to quickly determine if one hydrant will be enough to fight a fire, or if a water relay system is necessary. [Washington Post]

More Signs Requested for Westover Market — Organizers of the Westover Market believe a drop in attendance occurred for the new winter market because of the county’s sign restrictions. There has been a drop of up to 90 percent, according to organizers, and they believe the attendance would be greater if they were allowed to post more signs advertising the market. The County Board asked County Manager Barbara Donnellan to investigate the issue. [Sun Gazette]

Library Hosts Croatian Ambassador — The Central Library (1015 N. Quincy Street) will host a celebration of Croatia tonight featuring music, food, cultural displays and a visit from Croatian Ambassador Joško Paro. The event begins at 7:00 p.m. [Arlington Public Library]

Hybrid Tax Petition — Virginia Senator Adam Ebbin and Delegate Scott Surovell launched a petition to get Gov. Bob McDonnell to eliminate the so-called hybrid tax in the newly passed transportation bill. Under the bill, drivers of hybrid vehicles would have to pay a $100 fee each year. McDonnell said he’d review that portion of the bill. [NBC 4]

Recent Stories

For Immediate Release

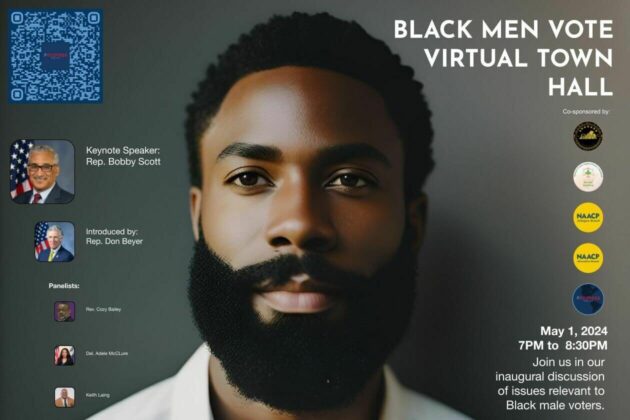

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.