This regularly-scheduled sponsored Q&A column is written by Adam Gallegos of Arlington-based real estate firm Arbour Realty, voted one of Arlington Magazine’s Best Realtors of 2013. Please submit follow-up questions in the comments section or via email.

Question: It has been a while since I purchased a home and I would like to get your advice on the various pitfalls a homebuyer should be careful to avoid.

There are hundreds if not thousands of potential pitfalls to avoid when purchasing a home. These are the five pitfalls that are top of mind:

1) Choose a local lender — Nothing spoils the home buying experience more often than a non-local lender and I’ve seen way too many people learn this the hard way. I beg you not to dial a toll free number or even one of your friends in the mortgage business if they are not based in the D.C. area.

The mortgage process can be daunting no matter who you work with, but exponentially so when you are using someone unfamiliar with the local contract, closing costs and closing process.

If the lender is on the other end of a toll free number, they have no vested interest in earning your long term business. They are definitely not going to pick up the phone after hours when you have an urgent question or need a custom pre-approval letter in a hurry. They may even hurt your chances if a seller is picking between competing buyers, because too many listing agents have been burned by the non-local lenders who fails to meet the closing date, let alone the financial contingency deadline.

If you find a better interest rate elsewhere, you are far better off using it to negotiate a lower rate with a local lender than going with the out-of-town guy.

2) Avoid wasting time on Trulia, Zillow, etc — I can’t tell you how many emails I receive from clients that think they found a gem on one of the aforementioned websites, only to find out that it sold months ago. The best source for 99.9% of the listings out there is the MLS. Our local MLS is called MRIS and they have a public website that you can use MRISHomes.com. I should also mention that ArbourRealty.com pulls listing directly from MRIS so the information is always current.

We offer our clients custom MLS alerts that let you know the moment new listings hits the market that match your criteria. It saves you time from having to search the thousands of various real estate websites and provides you with access to the same information that Realtors have.

3) Buy for the long haul — If the downturn in the real estate market has taught us anything it is that we cannot always assume our home is going to be worth more than we paid for it. If you think that you will want/need to sell in less than five years, then renting is probably the better option. It is certainly the safer option.

I’m fully aware of how resilient the Arlington market is, but buying a home is still an investment that will always carry risk. In my opinion, the best way to mitigate that risk is to plan on owning for a longer period of time. You should see appreciation over time, but by owning longer you will not be exposed to the dips that may occur along the way.

The rental market is so strong in Arlington that many homeowners are deciding not to sell even when it is time for them to make a move. It’s a great strategy for their financial portfolio, though it is contributing to the problem of low inventory in Arlington.

4) Hire a good Realtor — I have read enough of your comments to know that some of the people who read my column feel that they are better off without a Realtor. You may have had a terrible experience with a Realtor in the past or you think we get paid too much or maybe your last purchase went so smoothly that a Realtor doesn’t seem necessary. I should also point out I am biassed on this subject because I make a living as a real estate broker.

Please note that there are around 10,000 licensed Realtors in the Northern Virginia area. Some are just getting started or only do a handful of transactions each year. Others are too busy to provide you with the level service you deserve. When you pare down the group to those that consistently provide great results in the specific area you want to live, the group is actually quite small, but this is the group I am referring to.

There is plenty of information on the internet to teach you about real estate, but it is no substitute for being engrossed on a daily basis. Even if you have purchased a dozen homes in the past, it is no comparison to someone who has helped a dozen buyers in the last few months. This market and the rules of engagement, shift constantly. Ask yourself how you would handle the intricacies of a rent-back, a seller who has changed his/her mind about selling to you or a delayed closing that is going to put you in breach of contract. The standard contract is full of ways you could be putting your earnest money at risk and that may not be the full extent of damages you could face.

A good Realtor will help you avoid the many costly pitfalls that can arise during a home purchase. They can also make sure you are one of the first to know about new and upcoming listings. A large number of the buyers we have helped this year, found homes before they were on the market so they didn’t have to face competition from other buyers. How would you accomplish this on your own? A good Realtor will also customize a strategy to put you in the most favorable position when competing with other buyers. There are no guarantees, but at least you are maximizing your chances.

5) Sign a short term buyer agreement — Make us continue to earn your business. I hate hearing about buyers who feel trapped by a buyers agreement they signed with an agent who is providing substandard service. I recommend a 90 day agreement to start with, but I have also been willing to go with a shorter agreement. The buyer can always extend our agreement if they feel as though I deserve it. I also include language that allows buyers to cancel at any time, no questions asked.

By the way, if you are one of the home buyers who feels stuck in your current buyer agreement… I suggest asking the principal broker for a release. I think that most brokers will comply rather than risk a blow to their reputation.

Though the homebuying process can be riddled with pitfalls, there are plenty of homebuyers who are able to navigate the process unscathed with the right planning and guidance.

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

Recent Stories

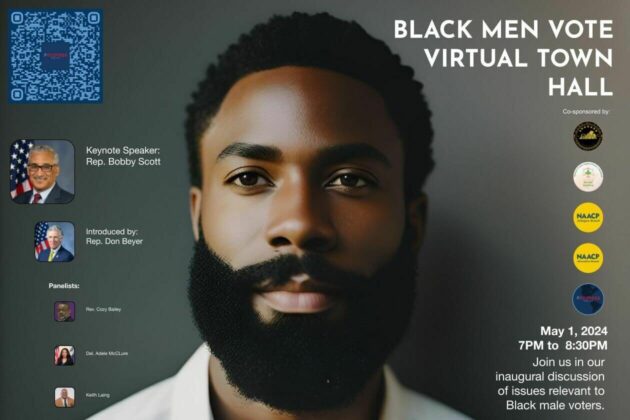

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.