Editor’s note: Money Monday is a new weekly column on personal finance, edited by Arlington Community Federal Credit Union investment advisor Momodou Bojang.

According to the 2011 Retirement Re-Set study by SunAmerica Financial Group, nearly half of Americans 55 and older say they expect to provide support for their adult children while simultaneously saving for their own retirement. While helping your children may seem like the right thing to do, you should avoid letting yourself become the Bank of Mom and Dad.

As more baby boomers reach retirement, they are finding their savings diminished due to unrecognized overspending. For some retirees, they found much of their savings went to helping their adult children in financial difficulty. According to CNN, parents in the U.S. extend about $45 billion in loans to their children each year, for everything from student loans to credit-card debt to buying a home or starting a business. A study by Ameriprise found that 90 percent of boomer-age parents have provided financial assistance to their adult children – including 40 percent who had to use their own savings and 17 percent who had to take a loan to do so.

Even parents who have taken a hard line against bailing their adult kids out of financial trouble have softened their stance in the face of the economy and its fallout. If you decide to provide financial help to your child or grandchild, follow these guidelines to avoid tapping into your own savings.

Loan or a gift? Parents often start out resolved to make their child repay the money but fail to follow through. Keep in mind that you can gift up to $13,000 a year (for 2012) without filing a gift-tax return. Remember though, if you call it a gift, don’t harbor expectations your child will repay it. In general you should aim for a one-time gift. “If you can spare the cash, give your adult children a lump sum for them to budget rather than just paying their expenses or paying off their debt, and make it clear that’s all you are willing to give,” advises Kiplinger’s Kimberly Lankford. This will generally incite them to stretch the funding and cut out nonessential expenses.

Only offer essential assistance. If handing over a chunk of cash is not appealing, offer to help pay for only a few critical bills, such as health insurance or car insurance so coverage is never lost. If you decide you will or can help your children only in an emergency situation, make sure you stick by this. Explain to them in detail what you consider an emergency and avoid granting any assistance unless it constitutes what you both agreed upon originally.

Make this as formal a process as possible. If you decide to lend your child money and have them repay you, consult with a tax advisor to set a reasonable interest rate in accordance with IRS rules. Charging nothing or too little could result in the IRS considering that unclaimed interest as income to you and a gift to your child. Set a repayment schedule. By leaving it open-ended, you will be less likely to be repaid, ultimately creating hard feelings on both sides if you have to press the issue or you begin questioning your child’s spending and why he or she’s not repaying you. Also, write everything down including the purpose of the loan, the amount, interest rate and the payment schedule. It also wouldn’t hurt to have you both sign everything once the agreement is made.

Be in charge of your home. If you allow your children to move back in when they can no longer afford rent on their own, make sure they know what you will expect before they make the move. Create a written agreement that outlines rent or how the child will contribute to the household upkeep in lieu of rent. Set a target end date or a set of conditions that would trigger the child moving back out – such as finding a job at a specific income level. Review the agreement together regularly to determine if any changes are needed. “Some parents let their kids stay at home for a given number of months, then charge rent after that, setting aside the money to build up an emergency fund or savings the kids can use for rent or other expenses when they do move out,” Lankford said.

Look for options to save together. If your children are in college, or under the age of 26 and without jobs, you may be able to add them to your health insurance policy for a lower cost than a stand-alone health insurance policy. The same goes for car insurance. You may also want to consider consolidating your cell phone expenses into a family plan.

Weigh the consequences with other options. If you have to tap into your retirement savings to help your child financially, look at every other available option first. For example, while you may feel it necessary to pay for a child’s college education, you shouldn’t draw from your retirement to do so. Some financial obligations need to remain with the child. Students have access to grants, scholarships, low-interest deferred loans and student employment. Discussing the options available with your child and a financial planner can help you determine if there are alternatives to diminishing your retirement to assist your child financially.

Wanting to help your child or grandchild during times of financial stress can be well intentioned. With planning and guidance, loaning or giving your child money can also be well executed without burdening your own finances. A financial professional can help you determine the impact a gift or loan may have for your own lifestyle or future plans.

Securities offered through Securities America, Inc., Member FINRA/SIPC. Advisory Services offered through USAdvisors Wealth Management, LLC, SEC Registered Investment Advisor Firm. Momodou Bojang, Representative. Arlington Community Financial Services, USAdvisors Wealth Management, LLC and the Securities America companies are unaffiliated. Securities America and its advisors do not provide tax advice. Please consult with your tax professional regarding your individual tax situation. Written by Securities America for distribution by Momodou Bojang. * Not NCUA Insured * No Credit Union Guarantee * May Lose Value

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

Recent Stories

Unlike our competitors, Well-Paid Maids doesn’t clean your home with harsh chemicals. Instead, we handpick cleaning products rated “safest” by the Environmental Working Group, the leading rating organization regarding product safety.

The reason is threefold.

First, using safe cleaning products ensures toxic chemicals won’t leak into waterways or harm wildlife if disposed of improperly.

Second, it’s better for you and your family. Fragrant chemicals in surface cleaners can expose you to a similar amount of pollutant particles as a busy city road, New Scientist reported.

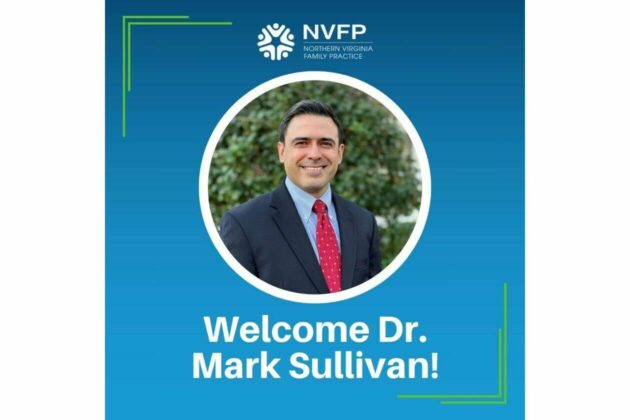

Northern Virginia Family Practice (NVFP), known for its comprehensive concierge healthcare, is thrilled to introduce Mark Sullivan, MD as the newest member of its family medicine team.

Dr. Sullivan brings a wealth of experience in family medicine, underpinned by a passion for delivering personalized, patient-centered care. He has a distinguished background in managing various medical conditions, emphasizing preventive care, health education and chronic disease management. Dr. Sullivan is adept at employing the latest medical research and technologies to enhance patient outcomes.

Beyond his medical expertise, Dr. Sullivan is committed to the well-being of his community, demonstrating this through his active engagement in local health initiatives and educational programs. His approach to medicine is holistic, focusing on integrating physical, mental and emotional health and patient education to achieve optimal patient wellness.

Dr. Sullivan is now accepting new patients at their newly established Arlington office at 2445 Army Navy Drive, Arlington, VA, 22206. The office, known for its patient-friendly amenities and state-of-the-art medical facilities, continues to provide the exceptional, personalized care NVFP is known for in its newly upgraded Arlington location.

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

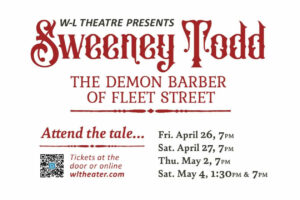

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.