This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. My wife and I dream about purchasing a home in Arlington. Unfortunately, the prices are above our reach. So we put a plan in place to save for a hefty down payment after five years of savings. We pay about $1500 in rent for an apartment. I noticed condos in South Arlington going around $200,000-215,000, which would equal about $1,700 mortgage including a $400 condo fee.

Is it wiser to buy or continue renting? What should I consider beside the mortgage? My thinking strays me to think a condo would be a wise investment given that rent and mortgage payments are about the same and we could build equity with maybe 2-3 percent growth over five years. Also we live in highly populated area/city and five minutes from Washington, D.C. So I’m also thinking about renting instead of selling the condo.

A. I think that 2-3 percent growth over 5 years is very conservative, but that could be a whole other article in itself. I will go ahead and use your projection for our analysis.

I’m assuming that your down payment is 3.5 percent and let’s use a purchase price of $200,000.

- Estimated principal and interest payment based on a 3.5% interest rate = $867

- Estimated annual property taxes = $2432 ($202/monthly) *

- Estimated monthly condo fee = $354*

- Estimated PMI = $136

- Total monthly = $1,559

* Based on sample property currently for sale, for $199,000

This is $59 per month higher than the current rent you are paying of $1500.

If the home appreciates by 3 percent over the next five years to $206,000, that is an increase of $6,000. You’ll also pay down about $20,247 towards your loan balance. Deduct the $60 premium you are paying each month above your current rent, which will cost you $3600 during those five years. The net gain over renting is $22,647.

You’ll want to compare that gain to a scenario where you invest your $7,000 down-payment elsewhere. If your $7,000 can make more being invested elsewhere then you may want to consider a different direction if this is purely a financial decision.

Please note that this is a very simple analysis. There are much more intricate applications you can use online that will take into account maintenance costs, inflations, tax savings, etc.

I like your idea of holding on to the condo as a rental once you are ready to move out. If you can afford to do that, I think it will make a nice addition to your investment portfolio. The longer you have the mortgage, the more rapid your payoff of the loan balance will become.

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

Recent Stories

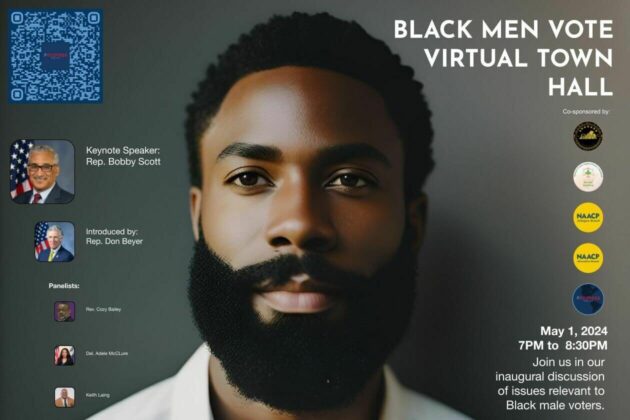

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.