This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. My wife and I dream about purchasing a home in Arlington. Unfortunately, the prices are above our reach. So we put a plan in place to save for a hefty down payment after five years of savings. We pay about $1500 in rent for an apartment. I noticed condos in South Arlington going around $200,000-215,000, which would equal about $1,700 mortgage including a $400 condo fee.

Is it wiser to buy or continue renting? What should I consider beside the mortgage? My thinking strays me to think a condo would be a wise investment given that rent and mortgage payments are about the same and we could build equity with maybe 2-3 percent growth over five years. Also we live in highly populated area/city and five minutes from Washington, D.C. So I’m also thinking about renting instead of selling the condo.

A. I think that 2-3 percent growth over 5 years is very conservative, but that could be a whole other article in itself. I will go ahead and use your projection for our analysis.

I’m assuming that your down payment is 3.5 percent and let’s use a purchase price of $200,000.

- Estimated principal and interest payment based on a 3.5% interest rate = $867

- Estimated annual property taxes = $2432 ($202/monthly) *

- Estimated monthly condo fee = $354*

- Estimated PMI = $136

- Total monthly = $1,559

* Based on sample property currently for sale, for $199,000

This is $59 per month higher than the current rent you are paying of $1500.

If the home appreciates by 3 percent over the next five years to $206,000, that is an increase of $6,000. You’ll also pay down about $20,247 towards your loan balance. Deduct the $60 premium you are paying each month above your current rent, which will cost you $3600 during those five years. The net gain over renting is $22,647.

You’ll want to compare that gain to a scenario where you invest your $7,000 down-payment elsewhere. If your $7,000 can make more being invested elsewhere then you may want to consider a different direction if this is purely a financial decision.

Please note that this is a very simple analysis. There are much more intricate applications you can use online that will take into account maintenance costs, inflations, tax savings, etc.

I like your idea of holding on to the condo as a rental once you are ready to move out. If you can afford to do that, I think it will make a nice addition to your investment portfolio. The longer you have the mortgage, the more rapid your payoff of the loan balance will become.

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. When a house is for sale and has a finished attic that didn’t apply for a permit from the county, how should you proceed with the sale?

A. It sounds like you are the purchaser. What I don’t know is how far along you are with the transaction. If you have not written an offer yet, then you will have to evaluate whether you want to purchase a house with major modifications that do not have permits.

It’s risky from the standpoint that Arlington County could require this work to be permitted at a later date. You may also want to consider the possibility of safety risks considering that the work was never reviewed by a third party.

During your value analysis you should not include the attic space as living area. You may also want to deduct some value due to the risks mentioned above.

If this is something you discovered during the home inspection and you have a full home inspection contingency in place, you have three primary options.

- You can move forward with the home in its current condition,

- You can cancel the contract and request a refund of your earnest money deposit,

- Or, you can request that the sellers apply for and complete permitting prior to closing.

You are going to have a tough time with option number three especially if you are planning to settle within the next month.

If you no longer have a home inspection contingency in place, then I don’t think the standard NVAR contract provides you with any leverage in this situation. I would recommend consulting an attorney to explore your options.

Please send your questions to [email protected].

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. I live in a small condo complex in the Ballston area, less than 15 units. Our small lot has one spot per unit, and two guest spots. Recently it was proposed that we eliminate the guest spots because people from neighboring complexes have been monopolizing them instead of our residents.

Many residents were fine with getting rid of them, but someone said eliminating the guest spots would lower our property values. Does that seem right? I’m sure eliminating resident spots would lower values, but it seems weird that guest spots would affect our prices.

A. I’ve never seen an appraisal or home value analysis that placed a dollar value on the availability of guest parking spaces. That said, I think your condo building will be more appealing to potential buyers if it offers guest parking than if it does not.

Ballston can be a challenging place to find parking at certain hours of the day. A savvy homebuyer is going to recognize this and may be turned off if guest parking or ample street parking is not available. If buyers go elsewhere because guest parking isn’t available then it is having an effect on your home values.

I recommend keeping the guest parking spaces even if you have to work with one of the local towing companies to set an example when the spaces are not used by legitimate guests.

Please keep the questions coming to [email protected].

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. We are brand new to the area and looking for a house in Arlington. Coming from the Bay Area in California we have been spoiled by walkability. I don’t think we can afford a house on the Metro line. Can you please recommend some other neighborhoods in Arlington that are somewhat walkable to parks, restaurants and necessities?

A. Arlington does such a nice job providing parks that it’s more difficult to think of areas in Arlington that do not have parks within walking distance. You can click here for a full list of parks… searchable by name, community or address.

Below is a list of the top six neighborhoods that come to mind, but I am hoping the commenters can fill in the blanks with additional neighborhoods that they have experienced as walkable.

- Cherrydale — restaurants, grocery store, wine shops, bakery, hardware store, cafes, etc. It’s a quaint and convenient part of town.

- Columbia Pike Corridor — Columbia Pike has grocery stores, restaurants, a movie theater, odds-and-ends shops and a farmers market. It’s a long stretch of road, though, so where you live along Columbia Pike is going to greatly determine what you have walkable access to.

- Harrison/Lee Highway area — The shopping center at the intersection of Harrison Street and Lee Highwy is so packed with dining and shopping options that it is hard to find parking. A nearby park called Chestnut Hills is wonderful for kids.

- Shirlington — The dining options at Shirlington provide a ton of variety. It is also well equipped with a Harris Teeter, library, movie theater and dog park.

- East Falls Church area — You will be within walking distance of the Orange Line Metro, some nice little restaurants and few conveniences. You also have easy access to the W&OD trail. You’ll have to get in the car or on the metro for most of your shopping needs though.

- Westover — like Cherrydale, this is another quaint area of Arlington. You have a small hardware store, market (with the best beer selection in town), restaurants, ice cream shop and cafe.

I know you mentioned not being interested in homes along the Metro line, but there are a number of neighborhoods within reasonable walking distance of the parks, restaurants and shopping that surround the metro stations (i.e. Lyon Park, Ashton Heights and Bluemont) that you may want to consider.

We are happy to spend some time with you or anyone else who is new to the area and would like a personal tour to become more familiar with the various neighborhoods before buying. Please just send me an email: [email protected].

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. It’s been a while since we purchased our home so we are a little rusty. Can you provide me with some questions we should be asking the sellers of homes we are considering?

A. You’ll want to tailor a list of standard questions to your specific concerns, but here are a few good questions to get you started.

Why are they moving? I usually ask this out of curiosity if nothing else. Sometimes it gives me insight about limitations of the home (i.e. the house was not big enough for children). Sometimes it tells me a little bit about how motivated they might be (i.e. they have already purchased a new home they are moving into).

Have they had any issues with water infiltration? This is something they should disclose to you, especially if you ask directly. You’ll want to know about any flooding or major leaks, even if they have been fixed. If nothing else, it will help your home inspector look for issues.

Have they had any other issues with the house? They are required to disclose any latent defects with the house, but by simply asking the question you may learn a whole lot more about things they have dealt with in the past.

Do they have approved permits from Arlington County for any work performed on the house? Don’t make assumptions just because the home looks nice. Ask the question and verify documentation.

Can they provide utility bills for the past 12 months? Utility usage is going to vary from household to household, but this will give you some idea of what to expect.

Have they received any other offers? If an active offer exists, you will need to find out when they plan to make a decision and if there is still time for you to submit an offer. If an offer was received previously and did not ratify, I like to find out as much about that other offer as possible. It may give you some clues about the seller’s threshold for negotiating certain terms.

Please keep the questions coming to [email protected]

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. I live in South Arlington. Will the construction of new affordable housing next door affect the value of my building and condo?

A. When you hear the words “affordable housing,” you may be picturing something out of a scene from the TV show The Wire. The reality is that there are affordable housing neighborhoods all over (north and south) Arlington that fit right into the community.

I’m not sure which new development you are describing, but if it is new like you mentioned, it is likely to be very nice inside and out. Many of the the newer affordable housing buildings rival the accommodations that demand thousands of dollars per month in rent on the open market.

Off the top of my head, I can think of million-dollar-plus condo buildings, townhomes and single family homes that exist within a block or two of affordable housing in Arlington. I’ve helped people buy and sell homes in each of these communities and it has never been a major concern. I do not see any evidence that it has affected home values in the slightest.

Please send questions to me at [email protected].

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. Maybe I’m worrying too much, but we recently put our home on the market and I am afraid that the snow is slowing down interest. The online listing already shows that it has been on the market for over two weeks, but a few of those days were awful out.

A. Let’s look at the bright side first: If someone has a day off of work because of snow, they are more likely to spend time on the computer looking for listings they would like to see.

The downside is that most homebuyers do not want to be driving around looking at homes when the weather is bad. I usually take inclement weather predictions into consideration when choosing which day to go live with a new listing.

Once you go live, you could place the home in temporary off status. In my opinion, the benefit of saving days-on-market is outweighed by the possibility of buyers not finding your home online during those days. I think it is better to ride out the bad weather. Most of the snow days around here only last for a day or two, so they won’t drastically affect your days-on-market.

If you are planning an open house I would pay attention to the weather report. It is worth delaying your open house by a week if it provides the potential for better weather.

Tip: put up a sign asking visitors to remove their shoes when showing your home and/or provide shoe covers. You don’t want people tracking snow or salty water through your house.

Please keep the questions coming. You can send them to [email protected].

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. I can’t seem to find a real definition of a bedroom for Arlington County. I purchased a condo in Clarendon a few years ago that was marketed as a 2 bedroom/1.5 bathroom. Arlington property records and the original floor plan call it a den. Upon refinancing my mortgage, the appraiser told me it can’t be considered a two-bedroom unit. Luckily, the appraisal still came back where I expected, but it was still quite a surprise. A Google search gave me some general guidelines of which my unit meets all (mainly number of entrances, methods of egress, minimum square footage, HVAC), but each noted that the definition varies by local jurisdiction. What are the rules in Arlington?

A. Before getting out my tape measure and calculator, the things I normally look for to initially determine if a room is a bedroom are the following: an egress large enough for a fireman to exit the home with all of his/her equipment, heating, ventilation and a reasonable size.

For a more technical overview of how a bedroom is defined in Arlington, you can consult the 2012 Virginia State Building Code. This is the standard that Arlington has followed since July 14, 2014. I’ll paraphrase some of the pertinent items that apply, below.

Egress — Every sleeping room shall have at least one operable emergency escape and rescue opening. The emergency escape shall have a sill height of not more than 44 inches measured from the finished floor to the bottom of the clear opening. The minimum horizontal area of the window well shall be 9 square feet with a minimum horizontal projection and width of 36 inches. Emergency escape and rescue openings shall open directly into a public way, or to a yard or court that opens to a public way. Window wells with a vertical depth greater than 44 inches shall be equipped with a permanently affixed ladder or steps.

Bedroom size — Habitable rooms shall not be less than 7 feet in any horizontal dimension with a ceiling height of not less than 7 feet.

Heating and ventilation — All habitable rooms shall have an aggregate glazing area (windows) of not less than 8 percent of the floor area of such rooms. Natural ventilation shall be through operable windows, doors, louvers or other approved openings to the outdoor air. Every dwelling unit shall be provided with heating facilities capable of maintaining a minimum room temperature of 68 degrees. Portable space heaters do not qualify.

Closets — Despite popular belief, closets are not required by the building code when defining a bedroom.

If you are still not sure whether you have a bedroom or not, you may want to consult an Arlington County code official.

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. Do you see an increase in the number and proportion of original homes (mostly ramblers) in North Arlington that go on the market and are bought by families to occupy with modest improvements rather than by developers to tear down and replace with new, much larger homes?

The reason I ask: New and recently new resales of McMansions appear to be selling ever more slowly, and the prices of new McMansions appear to be decreasing. In this context, the financial viability of developers buying and tearing down the original (mostly ramblers) homes for replacement with McMansions would seem to be getting weak.

This suggests to me the possibility of a meaningful decrease in developer demand for and in the developer driven prices for original homes for replacement, thereby creating an opening for families to buy the original homes, perhaps at somewhat lower prices, for them to occupy. And maybe some developers will give more emphasis to renovations and expansions of the original ramblers at modest cost for new family owners.

A. It’s hard to quantify the proportion of builders that are still buying lots because a number of the homes purchased for tear down are bought before they go in the MLS. I also don’t have a way of organizing the data to tell me whether the purchaser was a builder, renovator or primary resident. Using the information we do have available, I searched single family homes priced under $700,000 that have sold in Arlington within the last two years. Knowing that many builders pay with cash, I divided the sales into two categories: 1) cash buyers 2) conventional, VA and FHA home loan buyers. The numbers were almost identical in 2013 and 2014. See below:

- 2013 – 76 cash buyers and 352 home loan buyers

- 2014 – 74 cash buyers and 311 home loan buyers

Though there is not a significant change between 2013 and 2014, some of these cash buyers maybe be planning to renovate rather than tear down and rebuild. I wish I had a way to quantify their intentions for you.

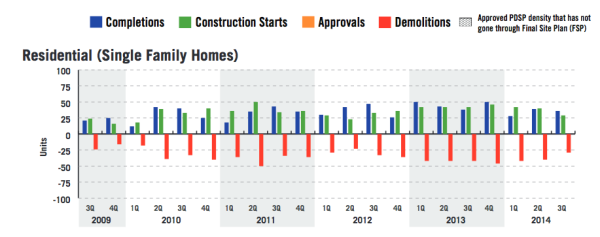

According to the following chart that I pulled from Arlington County’s website, it looks like demolitions and construction starts slowed down in 2014, which seems support the idea that new builds are trending down a little bit.

We can keep an eye on whether that trend continues so feel free to check back with me later this year.

I would like to see more renovations and fixer uppers available on the market. We certainly work with a good number of homebuyers who would love to stay in Arlington if they could find the right home within their budget. Even for the family who may want to build a new home for their primary residence, it has become very challenging to compete for prime lots.

Please send your questions to [email protected].

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. I would love to shorten the length of my 30-year mortgage. I’ve heard that bi-weekly payments can shorten the loan to almost 20 years. Is that true? If so, how does it work?

A. Whenever we get mortgage questions, I like to bring in a mortgage expert. I shared your question with Paul Nagel at First Home Mortgage to gain his insight and advice.

A decade or two ago, a way of making mortgage payments, called the “Bi-Weekly Payment Program” was introduced, and gained popularity. For an annual administrative charge, the program would automatically take half of your monthly mortgage payment from your bank account every two weeks. By doing so, you would pay off a 30 year mortgage in 23-24 years, notably reducing interest paid to the bank.

Before going any further, it’s important to know that this is not a bad program — it does as it advertises and saves money. That said, there’s a much easier way to reduce the term of your mortgage 6-7 years, save approximately the same interest, and skip the $100 – $300 yearly administration fee for the bi-weekly program.

By way of background, a Bi Weekly plan actually makes one extra payment every year due to some simple math:

- A typical mortgage makes one payment per month, or 12 payments a year

- The Bi Weekly Payment Plans make one half-payment every two weeks;

- With 52 weeks in a year, that makes 26 half-payments during the year

- 26 half-payments equals 13 full payments, or one extra payment every year than making one’s mortgage payment every month

The fact that one extra payment is made each year accounts for well over 90 percent of the benefit (i.e. shortening the life of the mortgage). Said differently, if one, on their own, makes one extra payment per year, they would obtain almost the identical benefits of the Bi Weekly Program, but save the $100-$300 administration fee.

All this feeds into a bigger question: specifically whether it’s good or not to make extra payments to your mortgage. The technical answer to this question is relative to what returns you money could earn invested elsewhere. For example, if your interest rate was currently 4 percent, and you could invest in your uncle’s oil well and earn 20 percent annually, it would not make much sense to save 4 percent in interest but skip the opportunity to earn 20 percent with your Uncle. Conversely, if you were earning 1 percent in a Certificate of Deposit, making extra payments to your mortgage could make sense.

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. I saw the article about the rising home prices in Arlington. However, prices in South Arlington (22206) seem to be either stagnant or decreasing. Do you know why?

A. The demand for homes was lower throughout the entire region for a good portion of 2014, which created a fairly well balanced market.

My theory is that there wasn’t a great sense of urgency among homebuyers. Interest rates have been low for so long that consumers are numb to the idea that they may go up significantly at some point. In fact, I think a spike in rates would actually spur activity.

Rents went down, which helps to lower the urgency to buy among renters. Home prices weren’t rising quickly enough to scare anyone or lowering enough to excite anyone. All of these factors combined for an unexciting year for local real estate.

I really don’t think there is anything to worry about. From what I’m seeing in your ZIP code, prices are holding steady for the most part. I expect them to show gradual improvement this year.

The only thing that concerns me a little is the loss of the streetcar. Development along the Columbia Pike corridor was basically stagnant from the late 1970s when the Orange Line Metro began service until recently when the potential for a streetcar began to grow.

The streetcar gave the county a tool to attract new retail, restaurants and development. It is something that often came up when talking with homebuyers looking in South Arlington. I really don’t know how much effect (if any) the loss of the streetcar is going to have on home prices. It is more likely to affect the 22204 ZIP code, but it may have some carryover to the 22206 as well.

It’s just something to keep an eye on. Personally, I think home prices in the area will perform well if Arlington can continue to find ways to attract businesses to the Columbia Pike corridor and Shirlington.

Please keep the questions coming to [email protected]!

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.