The value of residential properties is up in Arlington, but the torrid growth of past years has slowed.

Arlington County announced today that residential property assessments are up 3.2% for 2024. The overall property assessment growth was 2.5%, with commercial properties up 1.6%. New construction contributed significantly to the overall growth.

The announcement comes as the county starts to mail assessment notices to property owners today. Assessments will also be available online starting at 6 p.m.

Single-family home values rose more than $25,000, on average, according to the county.

“The average single-family property value increased from $798,500 to $824,700,” Arlington County said in a press release. “For 2024, approximately 70 percent of residential property owners saw their assessed value increase while the rest remained unchanged or declined.”

The 3.2% residential assessment growth this year is lower than the 4.5% reported last year, 5.8% in 2022, 5.6% in 2021 and 4.3% in 2020. Inflation last year, meanwhile, just clocked in at 3.4%.

The full press release is below.

The U.S. real estate market is facing significant headwinds, but Arlington property assessments are continuing their march upward.

Arlington County announced today that overall assessments of residential and commercial properties rose 3.6% for 2023, compared to 3.5% for 2022. Residential values are up 4.5% while commercial values are up 2.6%.

“The increase in property values continues to show that Arlington remains a place people want to live and work,” County Manager Mark Schwartz said in a statement. “And it’s the revenue generated from these real estate taxes that help to fund the County’s high-quality services and public services for residents, visitors, businesses and workers.”

The average single-family home in Arlington is now assessed at $798,500, compared to $762,700 last year. The rise comes despite the local real estate market experiencing many of the challenges also seen in the national market, precipitated by rising interest rates.

The rate of property value increase, however, has slowed compared to the previous two years. Residential values were up 5.8% in 2022 and 5.6% in 2021. In 2020, residential values rose 4.3% and were outpaced by a 4.9% rise in commercial values, prior to the pandemic causing the office vacancy rate to spike and values to in turn go down.

Arlington has for years relied on a balanced residential and commercial tax base, which allows it to grow its budget and embark on large projects while keeping real estate tax rates at levels slightly below many of its Northern Virginia neighbors.

The weakness in office assessments, while offset by rises in other commercial property like hotels and apartment buildings — and bolstered by new construction — is a contributing factor what is currently projected to be a nearly $35 million budget gap.

Arlington County Manager Mark Schwartz is scheduled to present his proposed FY 2023-2024 budget to the County Board next month.

Local homeowners, meanwhile, will be able to view their new assessments online after 11 p.m. tonight (Friday), the county said. There is an appeal process for those who disagree with their assessments.

More on the newly-released assessments, below, from the county press release.

Arlington is seeing another big jump in residential property assessments this year, something that should bolster the county’s finances but hit the pocketbooks of local homeowners.

While a county press release, below, described “modest” growth in Arlington’s property tax base, it was a tale of two types of property.

On one hand, commercial property like office buildings and hotels, struggling with vacancy during the pandemic, is up only 0.6%. It’s an improvement from last year, when commercial property dipped 1.4%.

In line with the rise in local home prices, on the other hand, residential real estate assessments are up 5.8%, the county announced. That’s above the 5.6% rise in residential assessments last year and the 4.3% increase the year before that.

“The increase in property values for this year shows the attractiveness of our Arlington community, even as our community continues to face challenges brought by the ongoing COVID-19 pandemic,” County Manager Mark Schwartz said in a statement. The county’s press release notes that new construction “contributed 1 percent of the 3.4 percent overall tax base growth.”

The overall 3.4% rise in property values will mean a corresponding rise in property taxes, the county’s biggest single source of revenue.

Rising property taxes should help bolster the county’s finances as budget season gets underway. In its press release, however, the county said that rising workforce costs, Covid challenges and other pressures “will continue to be a challenge in balancing the FY 2023 Budget.”

Schwartz is set to present his recommended budget to the County Board next month.

The full press release is below.

Arlington’s overall property tax base grew modestly from 2021 due to continued residential growth, while commercial values were relatively flat.

Measured growth in residential property values buoyed the tax base, but the County continues to face challenges in balancing the FY 2023 budget due to the lingering effects of the COVID-19 pandemic.

Overall, the total assessed value of all residential and commercial property in Arlington increased 3.4 percent, compared to the 2.4 percent growth in 2021. Residential property values increased 5.8 percent overall, while commercial property values increased by 0.6 percent. Overall, new construction in the County contributed 1 percent of the 3.4 percent overall tax base growth.

“The increase in property values for this year shows the attractiveness of our Arlington community, even as our community continues to face challenges brought by the ongoing COVID-19 pandemic,” said County Manager Mark Schwartz.

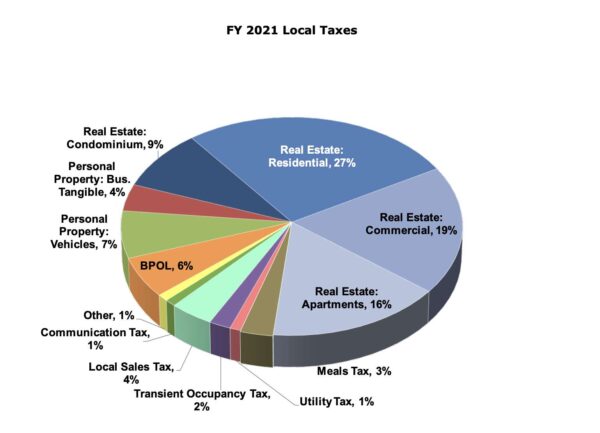

Real estate taxes provide almost 60 percent of total County revenues. The County’s real estate tax base is spilt roughly equally between residential (54%) and commercial (46%) property assessments.

The slight increase in commercial property assessments demonstrates some growth in our business market and a rebound closer to pre-pandemic levels. After experiencing double-digit decreases in 2021, hotel property values increased by 5.6 percent as occupancy and room rates gradually recover from the initial impacts of the pandemic.

Apartment property values also saw an improvement, growing 5.3 percent from the previous year. Just under half of the growth was due to new construction, reflecting continued demand for residential development.

General commercial property (malls, retail stores, gas stations, commercial condos) values decreased, reflecting continued impacts of the COVID-19 pandemic on retail stores and restaurants. Office property values also decreased due to rising vacancy rates and changing demand for office space.

The 5.8 percent increase in residential property values increased the average single-family property from $724,400 to $762,700. For CY 2022, approximately 73 percent of residential property owners saw their assessed value increase while the rest remained unchanged or declined. Residential properties include condominiums, townhouses and detached homes.

Notice of Assessments will be mailed to Arlington property owners beginning January 14. Assessment information will be available online Friday, Jan. 14, after 11 p.m.

The value of homes in Arlington County has soared during the pandemic.

Residential property values in Arlington are up 5.6%, while commercial property values slumped 1.4% from last year, according to newly-released stats. Arlington County is starting the process of mailing the new assessments out to homeowners and commercial property owners.

“Arlington’s overall property tax base grew modestly from last year due to continued residential growth despite a slowdown in some commercial sectors due to the impacts of the COVID-19 pandemic,” the county is saying in a letter to property owners. “Property values increased 2.2% overall in Calendar Year (CY) 2021 compared to 4.6% growth in CY 2020. New construction contributed to 1% of the 2.2 % overall property assessment growth.”

The sharp rise in residential property assessments shows “the continued attractiveness of our Arlington community, even as our businesses and residents face the burdens and challenges brought by the COVID-19 pandemic,” said County Manager Mark Schwartz. The average value of existing residential properties is now $724,400, up from $658,600 two years ago.

The average value of hotels, meanwhile, plummeted amid the pandemic, while apartment and office buildings increased in value — with the latter propped up by the arrival of Amazon.

“Overall commercial property assessments decreased by 1.4% over the previous year, mainly driven by a double-digit decrease in the hotel sector where operations have been significantly impacted by the COVID-19 pandemic,” the county said. “Apartment and general commercial (malls, retail stores, gas stations, commercial condos, etc.) property values saw small decreases offset by new construction. After strong growth in CY 2020, apartment property assessments increased by 0.8% overall in CY 2021. General commercial property assessments increased by 0.1% overall.”

“While many office property assessments decreased due to increases in vacancy rates and changing demand for office space, total office property values increased by 0.8% over last year,” the county added. “The overall office market tax base increased, in part, due to the increased presence of Amazon and the related development activity.”

Last year, assessments rose 4.6% on average — 4.9% for commercial properties and 4.3% for residential properties. The big rise in 2021 residential assessments will likely result in another effective tax hike for homeowners.

Last year, Arlington’s property tax rate — $1.026 per $100 in assessed value — was held steady despite the higher property values. This year, budget pressures brought on by the pandemic have prompted the county to warn of the likelihood of both budget cuts and tax rate hikes.

The height of Arlington’s budget season is set to kick off on Feb. 20, with the release of the County Manager’s proposed Fiscal Year 2022 budget. The final budget is expected to be adopted on April 17. The county’s new fiscal year begins July 1.

“The County continues to feel the economic impacts on local revenues, including the slowdown in sales, meals and hotel taxes, as well as cost increases and additional costs related to the pandemic,” the county said in a press release today. “The projected budget shortfall remains at more than $40 million, excluding the needs of the Arlington Public Schools (APS).”

The Arlington County Board voted yesterday to advertise a maximum tax rate that will, at most, keep the current rate steady.

The action comes amid rising property assessments that will buoy county coffers and help support County Manager Mark Schwartz’s proposed 2.9% increase in spending without a rate hike.

Arlington’s rosier financial picture, with the ongoing arrival of Amazon’s HQ2, was enough to have Schwartz smiling during a recent budget presentation, touting “a good budget year.” And it might be enough to even support a tax cut.

Arlington County Board Chair Libby Garvey pointedly floated the idea of bringing down the current $1.013 per $100 rate in her remarks yesterday.

“This year’s higher assessments mean that even without an increase in the tax rate, most homeowners still would see the biggest jump in their real estate taxes since 2016,” said Garvey, who’s facing a primary challenge this year. “Facing that reality, we will certainly be looking for ways to adopt a lower rate than what we have advertised today when we finalize the budget in April.”

The rise in assessments — 4.3% for residential properties and 4.9% for commercial properties — means more tax revenue, but also a higher tax burden on property owners.

“With no increase in the property tax rate, the County expects $51.1 million in additional ongoing revenue,” a county press release noted. “Should the Board adopt the current tax rate and other proposed fee increases, the average Arlington homeowner would see their fees and taxes increase by $376 from what they paid in FY 2020, based on a home value of $686,300.”

Last year, amid budget pressures, the County Board voted for a 2 cent tax rate increase.

Among neighboring jurisdictions in Northern Virginia, Alexandria and Prince William have both proposed 2 cent property tax rate increases this year, Loudoun has proposed a 1 cent reduction, and Fairfax County just proposed a 3 cent hike. Arlington’s rate is currently the lowest of the group.

Despite Fairfax’s proposed 3 cent hike, the increase in taxes on the average homeowner would actually be lower than that in Arlington with no tax rate change here — $376 vs. $346. Residential property assessments in Fairfax rose an average of 2.65% this year.

(1/5) Proposed budget highlights:

3-cent real estate tax increase to $1.18 per $100 of assessed value; average increase of $346/year.— Fairfax County Government (@fairfaxcounty) February 25, 2020

As part of the annual budget process, the Arlington County Board will now hold a series of work sessions and public hearings, before a final vote on the FY 2021 budget on Saturday, April 18.

More on the Board’s tax rate advertisement vote, via the county press release, below after the jump.

The rise in property values in Arlington is accelerating post-HQ2.

Late last week Arlington County announced that its assessments for 2020 had risen 4.6% on average — 4.9% for commercial properties and 4.3% for residential properties. That compares to an average property assessment increase of 3.5% last year.

The rise in property values will almost certainly mean a rise in property taxes for Arlington residents. The county, in its announcement, seemingly discounted the idea that tax rates — currently $1.026 for every $100 in assessed value — would come down to offset the rising assessments.

“Although the growth will result in additional revenue, the County faces continued funding choices in the coming fiscal year,” the county’s press release says in the first paragraph. In November the County Board directed County Manager Mark Schwartz to propose a budget that either keeps the tax rate steady or slightly lowers it; his budget proposal will be released in February.

The county says Amazon’s arrival is at least partially responsible for rising property values, though apartment buildings accounted for much of the commercial assessment increases.

Commercial property values were driven by a decline in the office vacancy rate, continued new construction, demand for rental properties, and Amazon-related leasing activity. Apartment property values increased by 8.9 percent, office values increased by 2.5 percent, and general commercial property (malls, retail stores, gas stations, etc.) grew by 1.8 percent.

“Arlington continues to be a place where people want to live and work,” Schwartz said in a statement Friday. “The investment we make in our community through real estate tax revenue helps us maintain the high-quality amenities and public services that make Arlington so attractive.”

The full press release is below, after the jump.

Residential and commercial property values in Arlington ticked up last year, sending more revenue into the county’s coffers, but officials warn the increase won’t be enough to avoid the painful budget gaps facing county leaders this year.

The good news, the county says, is that the total assessed value of all Arlington property increased by 3.5 percent this year, compared to a 2.2 percent bump last year. Today (Friday), county mailed out property assessments, which determine the size of homeowners’ tax burdens. It plans to make all that information available online by tonight at 6 p.m.

The county said in a news release that three out of every four homes saw an increase in assessed value, for an overall bump in residential property values of about 2.9 percent. The average home’s value is now $658,600, up from $640,900 last year.

Commercial property also saw a 4.1 percent increase in value, and the county says the construction of new apartments was “responsible for about a third of the collective increase.” Office properties specifically saw a 4.3 percent bump, a substantial turnaround from the 6.9 percent decrease they recorded last year.

“Rising property values mean Arlington is a place people want to live and work,” County Manager Mark Schwartz said in a statement. “And the revenue we collect from real estate taxes helps us maintain the high-quality amenities and public services that make Arlington so attractive.”

Of course, the county still has its challenges. The release notes that Arlington’s office vacancy rate still sits at about 17.4 percent, and the resulting tax revenue slowdown has led to all sorts of fiscal challenges over the last few years.

Amazon’s arrival in Crystal City and Pentagon City will go a long way toward reversing that trend, but county leaders expect that it will take years for Arlington to start to feel the positive revenue impacts.

In the meantime, Schwartz is warning that the county’s budget deficit could be as large as $78 million in fiscal year 2020, given the gap facing both the county and its school system.

Schwartz expects that the county will need to close a gap of anywhere from $20 million to $35 million all on its own, which is driven by factors including Metro’s increasing expenses, the new raises for public safety workers the Board approved in the FY 2019 budget and new spending associated with the statewide Medicaid expansion.

The county school system could also tack on another $43 million in unmet needs, as it works feverishly to build new schools and keep pace with the county’s influx of students.

The County Board has already directed Schwartz to prepare options for the new budget ranging from tax increases to staff layoffs. He’ll deliver a proposal for a new spending plan next month, as will schools Superintendent Patrick Murphy.

File photo

Puerto Rico Pets Coming to Arlington for Adoption — Dogs and cats from Puerto Rico, which is still recovering from Hurricane Maria, were flown from the island to the D.C. area over the weekend by Arlington-based Lucky Dog Animal Rescue. The pets arrived via van convoy to a hero’s welcome in Shirlington and are now up for adoption. [Washington Post]

Arlington Among ‘Best Places to Live’ — City ranker Livability.com is out with its 2018 “Top 100 Best Places To Live” list and Arlington has placed No. 35, one spot below Pittsburgh and one above Asheville, N.C. Arlington previously ranked No. 3 on the list. [Livability]

Lower Property Value Rise Will Cause Budget Challenges — “The year-over-year increase in real-estate assessments throughout Arlington came in lower than government officials had expected, which may cause problems for County Board members trying to avoid either tax increases or budget cuts.” [InsideNova]

More on Key Bridge Marriott Sale — The new owners of the Key Bridge Marriott in Rosslyn may benefit from the previous owner’s application to the FAA to construct buildings up to 470 feet tall on the property, which overlooks Georgetown and the Potomac River. The FAA application is “an indication it was setting the stage for the site’s redevelopment.” [Washington Business Journal]

Betsy Franz Leaves Leadership Center — Leadership Center for Excellence (formerly Leadership Arlington) founding President and CEO Betsy Frantz is leaving the organization in April to become President of the Virginia Hospital Center Health System Foundation. Liz Nohra, the COO of LCE, will take over as Acting President and CEO. [Leadership Center for Excellence]

Eviction Notice for TechShop in Crystal City — “A Jan. 18 eviction notice from the Arlington County sheriff’s department now hangs in the storefront of the maker space chain’s Crystal City location. The notice comes more than a month after San Jose, California-based TechShop announced it would file for Chapter 7 bankruptcy protection and then, a few weeks later, disclosed in early December it was reaching a deal to be acquired.” [Washington Business Journal]

County to Connect Building Owners and Investors for Sustainability — “All systems are ‘go’ for Arlington’s new ‘C-PACE’ program, a first-in-Virginia public-private partnership to provide affordable, long-term financing to improve energy or water efficiency of commercial buildings.” [Arlington County]

Reminder: Use Salt in Moderation — Prior to this morning’s rain, Arlington’s Dept. of Environmental Services tweeted a reminder to residents to avoid excess application of salt during freezing weather. “Use only as much as needed and no more to melt ice because this will wash into our watershed,” DES said. [Twitter]

Flickr pool photo by Kevin Wolf

(Updated at 5:15 p.m.) Property values in Arlington County rose at a slower rate this year compared to last year, according to the latest tax assessments, and slower than projected by staff.

(Updated at 5:15 p.m.) Property values in Arlington County rose at a slower rate this year compared to last year, according to the latest tax assessments, and slower than projected by staff.

The value of all residential and commercial property rose by 1.9 percent over the past year, compared to 3 percent the previous year. Homes went up in value by 3.9 percent, compared to a rise of 2.5 percent last year.

It means the average home value in Arlington, including condominiums, townhouses and detached homes, is now $640,900, up from $617,200 last year.

“Year after year, we see through our rising residential property values that Arlington is a place people want to live,” said County Manager Mark Schwartz. “At the same time, we’ll have some challenging budget decisions in the months ahead, given that our overall property values did not grow as much as projected.”

While residential real estate continued to rise, the value of office buildings was down significantly.

“Office properties, which represent 17.6 percent of the County’s total property tax base, saw significant declines — down 6.9 percent since last year,” the county said in a press release. “This decrease was driven primarily by office vacancies as well as rent concessions.”

The slower growth overall will mean a budget shortfall for Fiscal Year 2019, with debate on county spending levels to continue this year. Staff initially projected a 3.2 percent increase in the value of all real estate, so with actual growth of 1.9 percent the county will need to find savings to balance the budget.

Schwartz and Arlington Public Schools Superintendent Patrick Murphy will present their respective budget proposal late next month.

The full county press release is after the jump.

Local real estate assessments have ticked up “modestly” over the previous year.

Local real estate assessments have ticked up “modestly” over the previous year.

Arlington County said today that property values rose 2.9 percent over 2016. The increase includes a 2.1 percent rise for existing properties and another 0.8 percent rise for new construction, with both residential and commercial properties seeing gains.

The value of the average Arlington home, defined as existing single-family properties like condominiums, townhomes and detached homes, increased 2.3 percent to $617,200, up from $603,500 last year.

Commercial properties, such as office buildings, apartments, hotels and retail, increased 3.4 percent over last year. The increase “was fueled by 1.6 percent growth from new construction across the commercial sectors and by 14.6 percent growth in existing hotels, reflecting the strength of Arlington’s tourism market,” the county said.

The commercial growth wasn’t totally even, however. While existing office property values remained flat, apartment properties increased in value by 1.9 percent. The two represent 82 percent of the commercial tax base, according to the county.

“It is good to see continued strength in both our residential and commercial properties,” County Manager Mark Schwartz said in a statement. “Arlington remains a desirable community in which to live and do business.”

Real estate assessments are scheduled to be mailed to all Arlington property owners tomorrow, Jan. 14. The 2017 assessments will also be posted online and made available at 11:00 p.m. later tonight.

Last year residential assessments rose 2.8 percent while commercial assessments rose 1.3 percent. In 2015, residential property was up 4.9 percent while commercial properties rose only 0.1 percent.

Read the full press release from Arlington County, after the jump.

Traffic Switch on Columbia Pike — VDOT crews will open a new ramp from Washington Blvd to Columbia Pike tonight. Crews will also activate a new traffic signal on the Pike and remove an old one. The Pike/Washington Blvd bridge replacement project is expected to wrap up this summer. [VDOT]

Rep. Beyer’s First Bill Passes — Rep. Don Beyer’s (D-Va.) Science Prize Competition Act has passed with bipartisan support. The bill “will encourage federal agencies to use prize competitions to incentivize innovative scientific research and development.” It’s Beyer’s first bill to pass the House of Representatives after replacing the retired Rep. Jim Moran. [Twitter, U.S. House of Representatives]

County to Consider Board Reduction — The Arlington County Board will hold a public hearing on a proposed reduction to the Board of Equalization of Real Estate Appeals. The body hears appeals on real estate assessments, which are down by half from their peak in 2009. The proposal would cut the seven member board to five. [InsideNova]

Petition Against Gun Store Created — Residents have created an online petition against a gun store that’s set to open in Cherrydale. Think of the children, the petition creators say. “It is unconscionable, in an era where our children are forced to practice ‘lock down’ drills designed to train them how to protect themselves from armed intruders, to locate a gun shop anywhere in the vicinity of schools,” the petition states. “The fear of armed intruders permeates their education, and placing a shop that sells guns and/or ammunition within immediate distance of schools is confusing to students at best, and sparks fears of access to them at school at worst.” So far, the petition is more than 2/3rds of the way to its 1,000 signature goal. [Change.org]

Flickr pool photo by Erinn Shirley