This regularly-scheduled sponsored Q&A column is written by Will Wiard, an Arlington-based real estate broker. Please submit your questions via email.

Q. Do you have any tips on working with a real estate agent in a longer-term house hunt? I don’t need to buy immediately, and want to take the time to find the perfect place. I would like to find an agent who can recommend and show me properties that meet my criteria as they come on the market, as well as offer advice not biased by his or her personal interests.

A: It’s never too early to consult with a Realtor. And as with any major investment, you’ll want to be sure you don’t rush through this process and take the time to select the property that best meets your criteria. Here are a few things to keep in mind:

1. Discuss your goals and expectations upfront.

It’s important to be honest and disclose your goals, expectations and timeline with the agent from the beginning. Whether you are in a rental lease for the next six months, still saving for a down payment or generally just not in a hurry to buy – these are all key things to tell your agent to ensure they properly represent your interests throughout the process.

2. Find a local realtor.

In any house hunt you will want to find a realtor that is an expert in the location you are looking to buy. This will make it much easier to stay apprised of the homes coming on the market and effectively navigate the negotiation process when the time comes to make an offer. Selecting someone nearby also makes it more convenient to arrange meetings and showing times.

3. Set communications preferences.

Are you more easily reached by phone, email or text message? How frequently do you prefer that your agent contact you – weekly, bi-weekly or monthly? Discussing communications preferences with your agent will help him or her better meet your expectations.

4. Get pre-approved for a loan.

If you are among the majority homebuyers that plan to secure a loan to purchase the home be sure to secure a pre-approval letter from a lender you trust who is familiar with the market before seeing property. Even if you don’t plan to buy something for the next few months, or even year, getting pre-approved can help you avoid any financing challenges down the road.

Don’t have a lender? No problem. An experienced agent can recommend someone they have worked with and trust. Keep in mind that pre-approval does not bind you into working with the financial institution that gives you loan pre-approval, but will help you and your agent understand the price range you can comfortably afford. Most agents also require pre-approval before showing property. Even if you’re not ready to see property, talking with a lender to explore financing options can give you a better understanding of the loan programs that may be the best fit for you.

5. Select your home criteria.

Are you looking for a condo, a town house or freestanding house? How many rooms and bathrooms do you need? Is there a city, or even neighborhood, you prefer? These, and many other criteria, are important for narrowing your housing search. Even if you aren’t yet ready to start seeing property, your agent can set you up with an electronic listing alert where you can peruse for-sale homes and get a better idea of your options and related pricing.

As you continue your house hunt, your criteria may change, as it often does for buyers. It’s important to keep your agent updated on all of your criteria and let him or her know if something changes, so he or she can refine your search.

6. Protect your interests by entering into an agreement.

Once you’ve found an agent who you feel comfortable working with for your home search you should enter into a signed agreement with that agent and company. Created in July 2012, Virginia law requires a buyer and an agent who have agreed to work together in an agency relationship to define the terms of the agreement in writing. This helps protect the interests of both parties, and helps to ensure that the agent is representing your interests first to the best of his or her ability.

In many cases this will be an exclusive right to represent buyer’s agreement, but the terms of the agreement are often negotiable. Your agent should work with you to finalize this agreement before showing you property.

I’m hoping readers can share any additional advice in the comment section below.

Thank you for this week’s question. Please keep them coming to [email protected]. This is also a great place to reach me for anyone looking to buy or sell a home in the Arlington area.

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.

Recent Stories

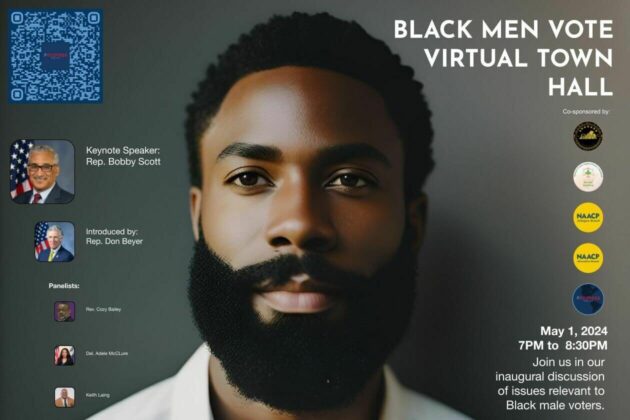

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.