(Updated at 3 p.m.) Arlington County is facing a possible budget gap in the tens of millions dollars during the current fiscal year, as a result of the pandemic.

That’s the message from county staff, who raised the alarm during Tuesday’s County Board meeting.

“We had hoped that the recovery that we had anticipated at the time in March and April would be further along, and that’s simply not the case,” said County Manager Mark Schwartz.

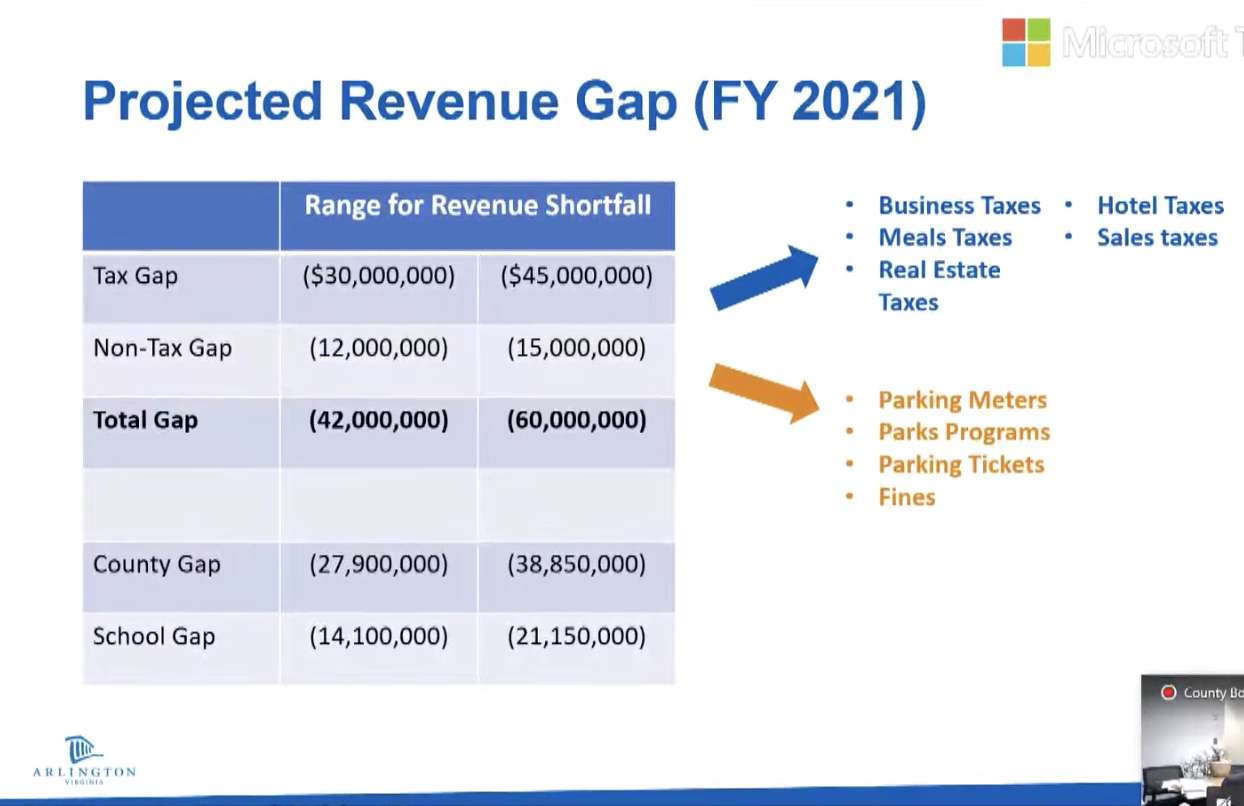

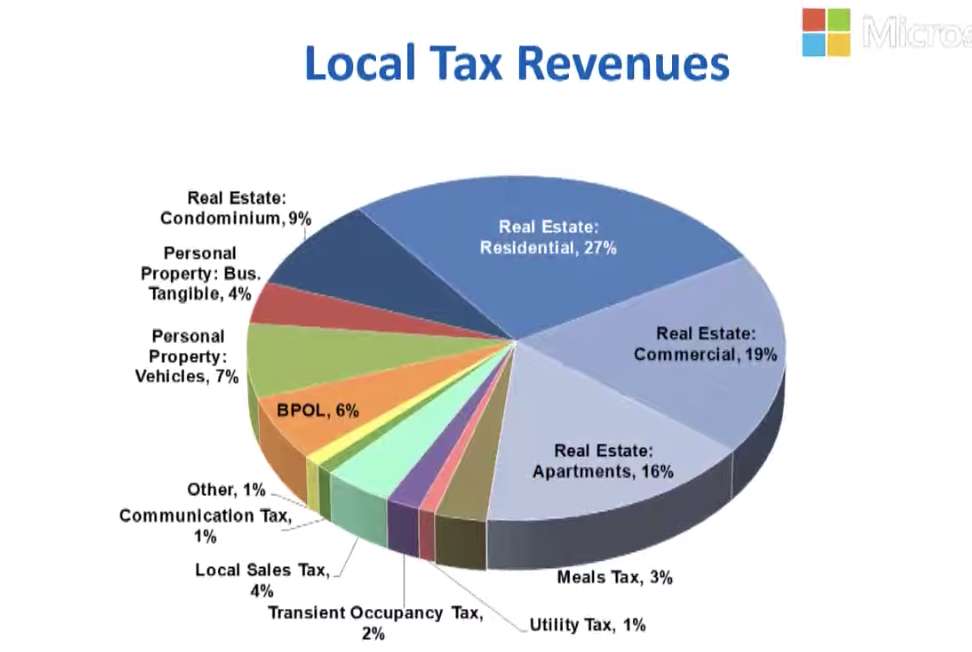

As a result, tax and fee revenue is coming in significantly lower than expected, and Arlington is now facing an estimated budget gap between $42-60 million for the fiscal year that started on July 1. On the high end, that comes out to a gap of about $39 million for the county government and $21 million for Arlington Public Schools.

The County Board adopted a scaled-down, $1.35 billion budget in the spring — $820.8 million for the county, $524.6 million for schools — assuming lower revenue due to COVID-19. But as the pandemic and its effects drag on, the impacts are becoming bigger than first estimated.

“Clearly this is taking longer than we had anticipated, in terms of both the health and economic recovery,” said Budget Director Richard Stephenson.

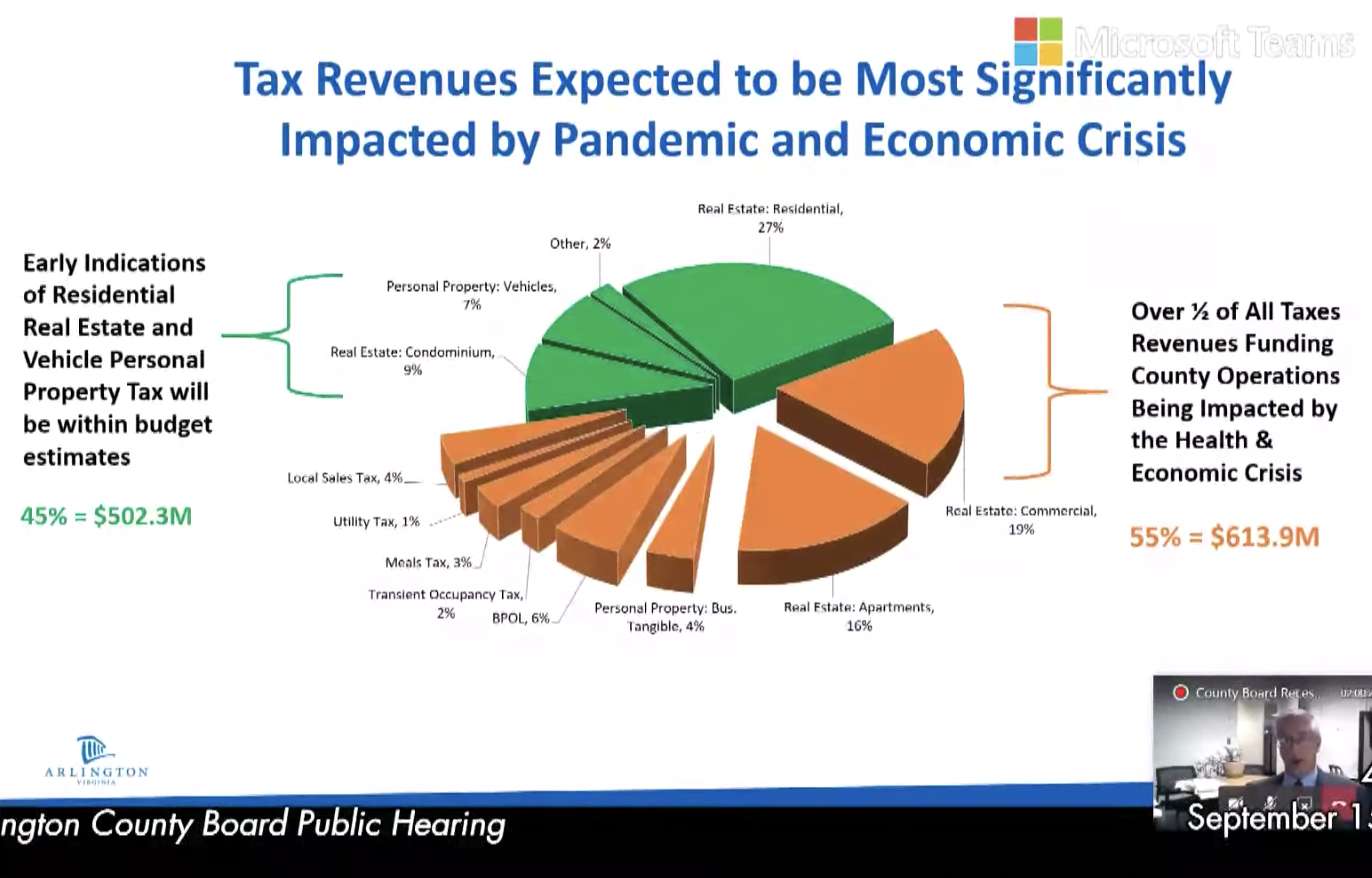

Restaurant, sales, car rental and hotel taxes are still down — way down, in the case of hotel taxes. Stephenson showed a slide that compared the county’s expectations for those taxes to reality; rather than a V-shaped recovery, with the tax revenue getting back to near-normal this fall, actual revenues have been much lower and county budget staffers now do not expect to return to near-normal until mid-2021.

Parking meter fees, parking tickets, parks and rec program revenue, and transit revenue are all also coming in lower than expected, Stephenson said. Residential real estate taxes and vehicle property taxes are closer to projections, but the county is worried about potential tax delinquencies from residents facing economic hardship.

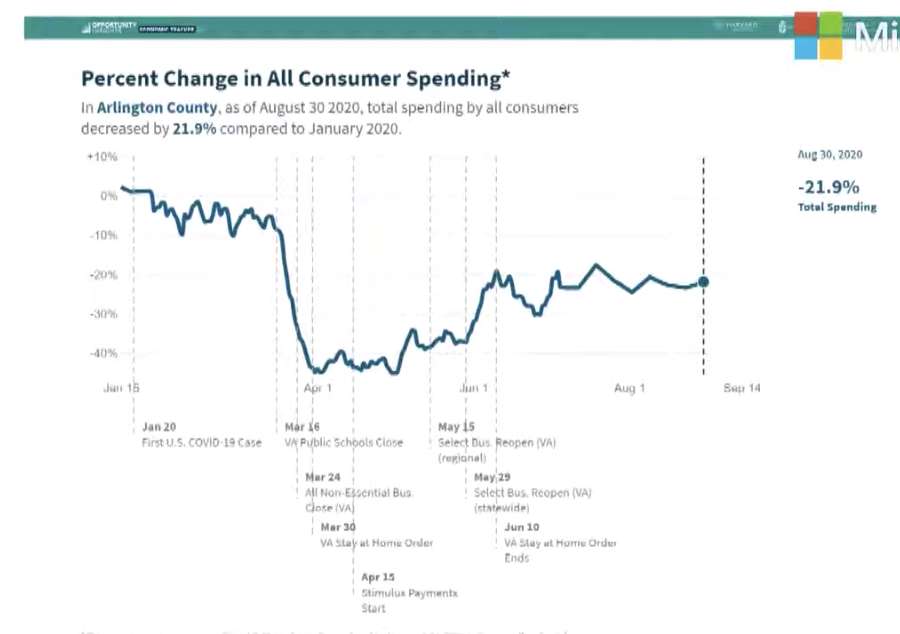

Another slide showed overall consumer spending in Arlington still down 22% compared to earlier in the year, when the first U.S. coronavirus case was reported.

Commercial property taxes, business license taxes and business property taxes may also take a hit from delinquencies, Stephenson said. The county is not projecting any growth in property assessments next year, something that has boosted the past couple of budgets without raising tax rates.

Stephenson presented a number of options for dealing with the budget shortfall, for the County Board to consider, including slowing some spending, using leftover funds from last year’s budget, using unallocated funds from Arlington’s share of the federal CARES Act, and using the county’s general budget reserves.

The County Board will learn how much is left over from last year’s budget in October, before deciding what to do with those funds in November, when it will receive further budget guidance.