Sponsored by Monday Properties and written by ARLnow, Startup Monday is a weekly column that profiles Arlington-based startups, founders, and other local technology news. Monday Properties is proudly featuring Three Ballston Plaza.

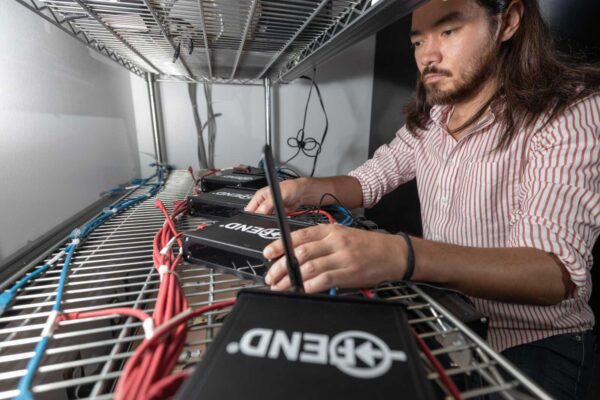

Amid new federal efforts to push for the adoption of electric vehicles, a local software firm is helping truck fleets, property owners and utility companies electrify.