Peter’s Take is a weekly opinion column. The views and opinions expressed in this column are those of the author and do not necessarily reflect the views of ARLnow.com.

Peter’s Take is a weekly opinion column. The views and opinions expressed in this column are those of the author and do not necessarily reflect the views of ARLnow.com.

In September, I explained why county government should temporarily defer until the following spring allocating any annual close-out surplus.

Here’s that column’s most up-voted comment (24 up votes):

Spend a $17.8M surplus one year, then raise taxes the next year by $11.1M. I don’t care who you are…this single fact should make smoke spurt out of your ears.

Today, I pose a related question: does County government commit or earmark too much surplus revenue for spending rather than beefing up reserves or offsetting tax or fee increases? (The final 2017 close out report was not available when this column was submitted.)

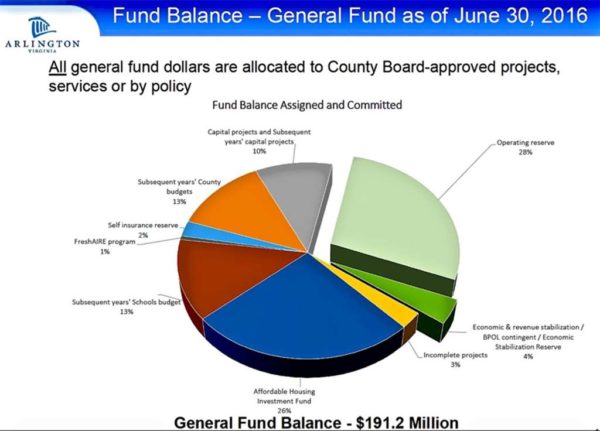

An October 3 Arlington County Civic Federation report (drafted by former Deputy Arlington County Treasurer John Tuohy) analyzes the County’s FY 2016 General Fund (GF) Fund Balance, an account that receives surplus close-out funds (collected revenues minus budgeted expenditures) at the end of the June 30 fiscal year.

Below, you can see how money in the GF Fund Balance is allocated:

What Portion of the Fund Balance Is Reserves?

Of this $191,243,859 in the GF Fund Balance, the County Board sets aside a “no-touch” operating reserve of $59,885,262 — or about 5.16% of budgeted revenues — for the County AND Arlington Public Schools. Board policy restricts use of these reserves to unforeseen emergencies (e.g., natural disasters, economic emergencies).

There is an additional $5 million self-insurance reserve and a small, separate “economic stabilization” contingency reserve within the GF Fund Balance.

Experts, including bond rating agencies, set 5 percent as the minimum operating reserve, but many recommend reserve levels as high as 10 percent of operating expenses. (Even when the percentage remains constant, the bigger the budget, the more you must set aside for reserves.)

Committed Vs. Assigned

By County Board action or policy, the rest — $131,358,597 — is committed or assigned (earmarked) for spending. Committed funds (approved by Board action) cannot be reallocated without a new Board action. Assigned funds (earmarked by the County Manager based on Board policy) can be reallocated.

Allocating Unallocated Close-Out Funds

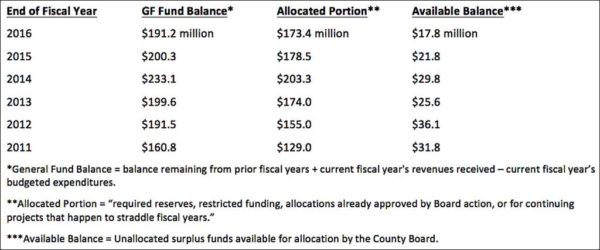

During the close-out process, the Manager has historically identified a modest amount of surplus funds that are not yet allocated for spending or reserves:

Using County Board policy guidelines, the County Manager recommends how these unallocated surplus funds could be allocated.

Conclusion

By policy and practice, the County Manager does not recommend allocating a portion of the unallocated close-out surplus to offset increases in taxes or fees for the coming fiscal year. (Each 1-cent increase in the real estate tax rate currently generates roughly $7.4 million in ongoing revenue.)

Should the County Board take a different approach next month? Should the county allocate less for spending and more for reserves or to offset tax/fee increases?

I will discuss these questions further in next week’s column.