(Updated at noon on 7/10/23) Recently, a family of five with three boys bought a two-bedroom home with a den in Arlington, thanks in part to a little-known county program that helps first-time homebuyers secure a mortgage with small loans.

“They were completely comfortable with that,” says Karen Serfis, a program manager with Latino Economic Development Center, who helped the family work with the county to get the loan. “Not everybody wants to live in a two-bedroom with a den but they wanted to stay in Arlington.”

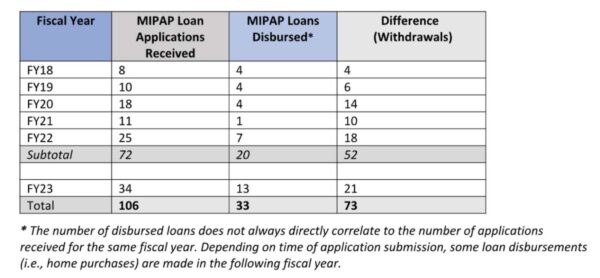

Since 2018, Arlington County has operated the Moderate-Income Purchase Assistance Program (MIPAP), which helps income-eligible people buy homes that cost less than $500,000. Last year, it issued 13 loans to applicants, 65% of whom were single and 25% of whom belonged to two-person households. They were able to buy one-bedroom or small two-bedroom units.

The number of loans issued last year could be a program record for the last decade, according to data provided by Serfis and the county, which is seeing more people interested in accessing the funding.

As interest in the program grows, however, applicants are finding few housing options under $500,000. On top of an income eligibility restriction of 80% of the area median income (AMI), that makes the program difficult for many to effectively utilize.

“There’s been a huge uptick in people trying to use MIPAP in the last year and I don’t know why,” Serfis said. “Is it because it’s so impossible to buy? I don’t know. Is the county doing better outreach? Possibly. Or are people more aware of these programs because they’re on the internet?”

Arlington County says it could be because applicants were confident in post-pandemic economic recovery and could be taking advantage of another county program that uses state funding to lower loan interest rates one percentage point.

Despite the uptick in recent years, MIPAP is just now reaching the numbers of people helped in the late 2000s, when the program was run by a local nonprofit affordable housing developer. In the years before AHC, Inc. ceded it to Arlington County to focus on rentals, the number of loans issued fell to four to six per year throughout the 2010s.

Some say the program’s structure and requirements are getting in the way and it should be revamped. They say Arlington County should raise the $500,000 purchasing price limit as well as the income restrictions, rebrand the program and spread the word.

“MIPAP is an anemic program and represents a significant underinvestment in helping Arlington residents successfully transition to homeownership,” says Kellen MacBeth, a housing policy advocate and member of the Arlington branch of the NAACP. “Homeownership offers unique opportunities to bridge the racial wealth gap and we need to step up county support for residents, especially residents of color, looking to become homeowners.”

The program is funded by the U.S. Dept. of Housing and Urban Development, which stipulates households must earn at or below 80% AMI, or $120,560 for a household of four, and qualify for a conventional first-trust mortgage. Under both these conditions, lenders typically say applicants can qualify for homes priced below $400,000, according to the county.

Last year, the average home purchase price was $350,258, which worked out to a maximum possible loan of about $262,694 and an average MIPAP loan of $87,564, or 25% of the greater loan.

These kinds of parameters make it hard to match eligible families and a wide range of properties. Wanting a bigger place is the biggest reason people drop out of the program after applying, according to the county. Over the last six years, 73 people withdrew after applying for a loan.

“When asked the primary reason for withdrawing their application, 23% of respondents said they hoped to buy a larger-sized unit with more or larger bedrooms and/or additional square footage,” said Elise Cleva, with the Arlington County Dept. of Community Planning, Housing and Development (CPHD). “Those respondents were surprised to learn the monthly costs associated with the larger units.”

A budget of $500,000 could get a buyer a condo but a manageable price tag belies potentially eyebrow-raising condo fees — either because the building is old and needs repairs or because it is new and has lots of amenities.

“One of the easiest ways to get into homeownership is a condo,” says Alice Hogan, a housing consultant for local nonprofit Alliance for Housing Solutions. “The problem is that you may find a more reasonably priced condo in an aging building, but if the condo fee is not high yet it’s going to slowly become high, because maintenance on older building is extensive.”

That is why some want to see the price tag increased. Arlington County last increased the price in 2018 from $362,790 to $500,000.

Arlington County found another 21% withdrew because, even with a county potential loan, they would have debt-to-income ratios that would make homeownership financially challenging, largely due to student loans. Some 19% purchased outside of Arlington and another 19% ended up earning too much money to qualify.

“We’re helping fewer people,” says Hogan. “In the past, houses didn’t cost as much and county subsidies went further.”

Serfis, Hogan and Nicole Merlene, who is currently involved in a county-led review of its home-buying programs, all say the county should raise its income eligibility. They suggest matching the 120% AMI limit set by Virginia Housing, the state’s self-sufficient nonprofit that helps Virginians attain affordable housing. That could make Arlington’s program ineligible for federal funding, however.

“It seems that people that are qualifying for MIPAP are also qualifying for rental assistance meaning that our income restrictions and purchasing prices are too low for the average home buyer that a moderate income assistance program hypothetically could and should be targeting,” Merlene said.

For Hogan, restructuring income and housing cost restrictions raises open questions about whether and how much the government should step in.

“At what point do we say, ‘We offer this much assistance but that’s it?'” she said. “Certainly, as the market gets more inflated, that question will be before us more and more. We can’t leave the purchase price at $500,000 when the average home price is $1 million.”

Arlington County’s Housing Division is mulling how to change MIPAP this year as part of a broad review of current county programs for prospective homebuyers and existing homeowners.

“The study, which is expected to conclude by the end of 2023, will offer an overarching vision for the County’s homeownership programs, goals to support that vision, and program recommendations,” Cleva said. “These recommendations may include changes to the existing MIPAP model, as well as new program types, to support the need among aspiring purchasers with moderate incomes.”

People can share their thoughts on homeownership opportunities on Saturday, July 22, from 10 a.m. to 1 p.m. at Walter Reed Community Center (2909 16th Street S). There will be food and children’s activities offered. RSVP is encouraged, though not required.

Hogan says this study is headed in right direction.

“Homeownership is a big goal in the county, and there are people of goodwill within the county and practitioners outside the county trying… [to] come up with other ideas for how to support homeownership in this very difficult market that we’re in,” she said.