Last week, a Maryland man was convicted of running a credit card skimming ring that operated in Maryland, Virginia and Pennsylvania from 2010 to 2011.

Last week, a Maryland man was convicted of running a credit card skimming ring that operated in Maryland, Virginia and Pennsylvania from 2010 to 2011.

Authorities say the ring victimized hundreds of people and businesses by stealing credit card numbers, using those numbers to buy gift cards and merchandise, then returning the merchandise for cash. In some cases, the credit card numbers were stolen when restaurant servers, paid by the ring, ran customer credit cards through a “skimming” device that recorded each number.

The case against the now-convicted ringleader, 33-year-old Olubunmi Oladapo Komolafe, began building in Arlington.

According to an affidavit, a co-conspirator of Komolafe was stopped and questioned by police at an Arlington Macy’s store on January 30, 2010. The co-conspirator was attempting to make a purchase at Macy’s using gift cards that had been either re-encoded or purchased using a stolen credit number, according to the affidavit.

Eventually the suspect was let go, but he surrendered several gift cards to officers. From there, ACPD detectives began an investigation that eventually led to a U.S. Secret Service investigation and a federal case against Komolafe and four other men, including the co-conspirator who was initially stopped in Arlington.

Recent Stories

For Immediate Release

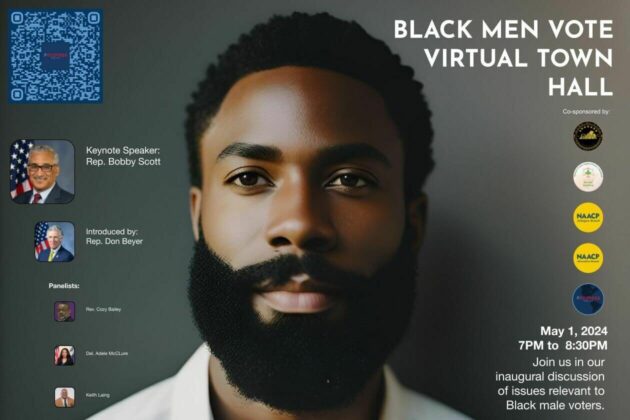

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.