The following article was written by John Nguyen. John is a lifelong Arlingtonian and the Managing Partner of Clarendon Wealth Management, a financial advisory firm focused on comprehensive wealth management for high net worth individuals, medical professionals and small business owners.

The following article was written by John Nguyen. John is a lifelong Arlingtonian and the Managing Partner of Clarendon Wealth Management, a financial advisory firm focused on comprehensive wealth management for high net worth individuals, medical professionals and small business owners.

With the holidays fast approaching, now can be a great opportunity to perform a comprehensive review of your financial situation and plan for next year. Use this year-end financial checklist to focus on where you stand and make any adjustments necessary for the New Year. Spend a little time now and make your holidays brighter knowing you’re on solid financial footing.

Review your spending and fine tune your budget. Take a look at your 2014 spending. Are there areas where you were consistently over budget? Were there unanticipated expenses? Did you meet your savings goals? Use this year’s fresh figures to prioritize your expenditures for next year.

Review your spending and fine tune your budget. Take a look at your 2014 spending. Are there areas where you were consistently over budget? Were there unanticipated expenses? Did you meet your savings goals? Use this year’s fresh figures to prioritize your expenditures for next year.

Determine your net worth. This is a worthwhile yearly exercise to find out where you are — and where you need to go. Simply add up what you own (home, car, savings, business interests, personal property, investments, etc.) and subtract what you owe (mortgage, loans, credit cards, etc.). Your net worth can be used to track your progress each year and incentivize you to save more or reduce debt.

Add more to your 401(k). You can contribute up to $17,500 to your 401(k) for 2014 ($23,000 if you’re over 50). You have until December 31st to reach that limit. The contributions must be made through your employer’s payroll deduction.

Contribute to a 529 college-savings plan before December 31st. The beneficiary of the account (your child, grandchild, etc) can use the money tax-free for college tuition, room and board and fees. In many states, you get a state income tax deduction for your contribution. Many 529 plans require you to make your contributions by December 31st to count for that tax year. For details, see SavingforCollege.com.

Contribute to a 529 college-savings plan before December 31st. The beneficiary of the account (your child, grandchild, etc) can use the money tax-free for college tuition, room and board and fees. In many states, you get a state income tax deduction for your contribution. Many 529 plans require you to make your contributions by December 31st to count for that tax year. For details, see SavingforCollege.com.

Rebalance your portfolio. Market movements may have resulted in portfolio drift altering your targeted asset allocation. Check to see if your portfolio still reflects your goals and risk tolerance. If not, bring it back to your target allocation by reducing your over-weighted asset classes and increase the underweighted classes. If you’re retired, this is a good time to set aside money for next year’s cash needs.

Take your required minimum distributions. If you’re older than 70½, you generally need to take required minimum distributions from traditional IRAs, 401(k)s and other retirement-savings plans by December 31 (except for the year you turn 70½, when you’re given an extension until April 1 to make your first withdrawal; also, you don’t need to take RMDs from your current employer’s 401(k) while you’re still working).

Start tax planning. It’s not too early to think about taxes. If you’re selling stocks to rebalance your portfolio, consider harvesting your losses to get a tax break. Capital losses can be used to offset taxable capital gains, plus up to $3,000 in ordinary income ($1,500 for married couples filing separately). Losses you can’t use this year can be carried over into future tax years.

Start tax planning. It’s not too early to think about taxes. If you’re selling stocks to rebalance your portfolio, consider harvesting your losses to get a tax break. Capital losses can be used to offset taxable capital gains, plus up to $3,000 in ordinary income ($1,500 for married couples filing separately). Losses you can’t use this year can be carried over into future tax years.

Giving money to charity before the end of the year is a great way to boost your deductions if you itemize. You may be able to deduct various kinds of charitable contributions, including cash, appreciated stock and non-cash donations.

Update your estate plan. New baby? Newly married or divorced? Make sure your beneficiary designations are updated to reflect any changes. Don’t have an estate plan? Make that a new year’s resolution!

The preceding article was submitted by an ARLnow.com sponsor. Please consult a tax advisor for all tax-related information.

Securities and advisory services offered through Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Advisor. Fixed insurance products and services offered by Clarendon Wealth Management. 3033 Wilson Blvd. Suite 430, Arlington, VA 22201. Phone: 571-257-3252.

Recent Stories

For Immediate Release

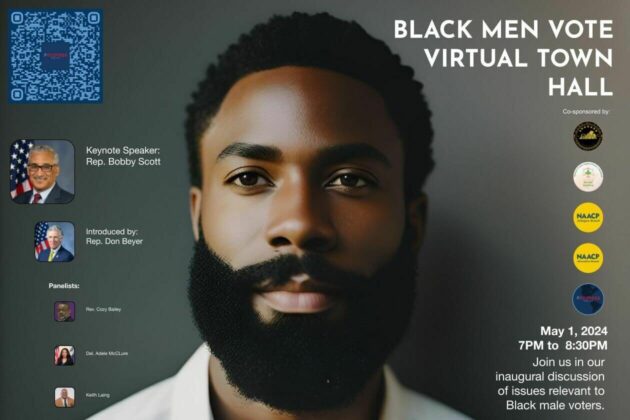

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.