This regularly-scheduled sponsored Q&A column is written by Adam Gallegos, Arlington-based real estate broker, voted one of Arlington Magazine’s Best Realtors of 2013 & 2014. Please submit your questions via email.

Q. Do you see an increase in the number and proportion of original homes (mostly ramblers) in North Arlington that go on the market and are bought by families to occupy with modest improvements rather than by developers to tear down and replace with new, much larger homes?

The reason I ask: New and recently new resales of McMansions appear to be selling ever more slowly, and the prices of new McMansions appear to be decreasing. In this context, the financial viability of developers buying and tearing down the original (mostly ramblers) homes for replacement with McMansions would seem to be getting weak.

This suggests to me the possibility of a meaningful decrease in developer demand for and in the developer driven prices for original homes for replacement, thereby creating an opening for families to buy the original homes, perhaps at somewhat lower prices, for them to occupy. And maybe some developers will give more emphasis to renovations and expansions of the original ramblers at modest cost for new family owners.

A. It’s hard to quantify the proportion of builders that are still buying lots because a number of the homes purchased for tear down are bought before they go in the MLS. I also don’t have a way of organizing the data to tell me whether the purchaser was a builder, renovator or primary resident. Using the information we do have available, I searched single family homes priced under $700,000 that have sold in Arlington within the last two years. Knowing that many builders pay with cash, I divided the sales into two categories: 1) cash buyers 2) conventional, VA and FHA home loan buyers. The numbers were almost identical in 2013 and 2014. See below:

- 2013 – 76 cash buyers and 352 home loan buyers

- 2014 – 74 cash buyers and 311 home loan buyers

Though there is not a significant change between 2013 and 2014, some of these cash buyers maybe be planning to renovate rather than tear down and rebuild. I wish I had a way to quantify their intentions for you.

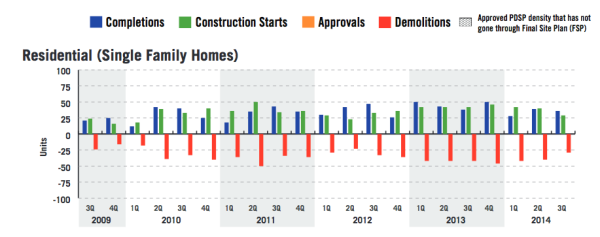

According to the following chart that I pulled from Arlington County’s website, it looks like demolitions and construction starts slowed down in 2014, which seems support the idea that new builds are trending down a little bit.

We can keep an eye on whether that trend continues so feel free to check back with me later this year.

I would like to see more renovations and fixer uppers available on the market. We certainly work with a good number of homebuyers who would love to stay in Arlington if they could find the right home within their budget. Even for the family who may want to build a new home for their primary residence, it has become very challenging to compete for prime lots.

Please send your questions to [email protected].

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.