Sponsored by Monday Properties and written by ARLnow.com, Startup Monday is a weekly column that profiles Arlington-based startups and their founders, plus other local technology happenings. The Ground Floor, Monday’s office space for young companies in Rosslyn, is now open. The Metro-accessible space features a 5,000-square-foot common area that includes a kitchen, lounge area, collaborative meeting spaces, and a stage for formal presentations.

Rize has come a long way, literally and physically. The online savings website was first picked up in 2014 as part of the Silicon Valley-based venture fund 500 Startups. Once enough money was invested, it moved across the country to a permanent home in MakeOffices in Clarendon.

Rize works as an online savings account, designed to make automatic transfers from a user’s main bank account with a higher interest rate than any other national bank. Money saved in Rize is insured up to $250,000 and there are no required monthly fees.

It went live in April after a beta testing period.

Online money management isn’t new. PayPal popularized online payments in the late 90s. Payment app Venmo was created in 2009 and has become a oft-used tool when splitting a bill with friends. Almost every major bank has their own app complete with its own budgeting options.

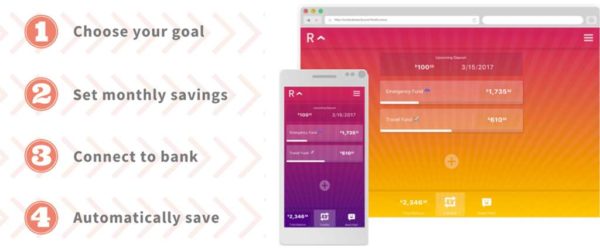

Rize differentiates itself from the crowd on a personal level — the startup says it truly cares about the user’s money and experience. When setting a savings goal, users can choose from the traditional, such as “Emergency Fund,” or “Vacation,” or they can create their own custom goal.

Rize’s savings interest rate is 15 times higher than the national average. While this would seem like a big cost for the startup, Amatori said a higher interest rate should be the norm across the country.

“Banks have the option to give you an interest rate larger than 1 percent, but they choose not to,” said Erica Amatori, marketing lead for Rize. “We give our customers back the money they deserve.”

Rize also appeals to customers on a personal level by giving them the option to choose whether or not they pay a monthly fee. Not only that, users can choose how much they would want to pay. It’s a win-win scenario, because it’s also how the startup earns a profit.

“We make money from our pay-as-you-want model, so at the end of the sign-up process you can pay $1, $2, $3 or nothing a month to use our product,” said Amatori. “Most of our customers do pay us something a month, usually around $2.50.”

In addition to having no maintenance fees, unlike some major banks, Rize users can make unlimited transfers and withdrawals. Most major banks limit the number of transfers users can make before they must pay a fee.

“It’s a really exciting time for us because banks are screwing up a lot, so to be on the verge of this revolution where tech is such a big thing and we know we can make it better,” said Amatori. “Banks are blindsided by it.”

So far, Rize is only available via the web, but Amatori said that a smartphone app is coming soon.