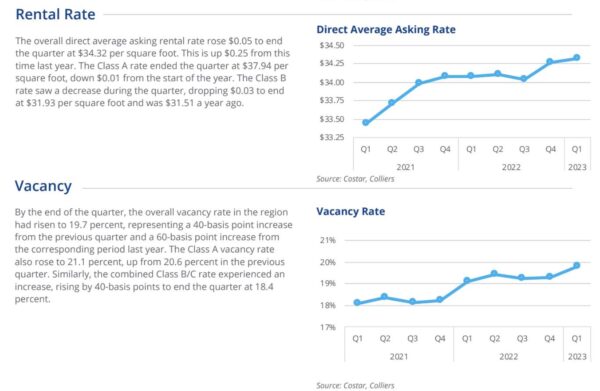

(Updated at 2 p.m.) The newest trend in office leasing may be painful for Arlington County’s office vacancy rate in the short term — but it could be beneficial in the long run.

As companies try to coax employees enjoying remote work back to the office at least part of the time, some are trading spacious leases for smaller agreements with more amenities. Landlords are responding with more investments in renovations.

“We are right-sizing from the pandemic,” said Chaise Schmidt, a senior vice president of and broker with real estate company Colliers. “It’s truly a transition period.”

Arlington County’s office vacancy rate is continuing to climb, reaching 23.7% in the first quarter of 2023. That is up from 20.8% in the summer of 2022, up from 16.6% at the beginning of 2020 and 18.7% at the beginning of 2021.

Meanwhile, a Washington Post poll published on Friday found that “two-thirds of D.C. area remote-capable workers want to work from home ‘most’ or ‘all’ of the time.” Only 3% wanted to work from home “rarely” or “never.”

Much of Arlington’s local tax base comes from commercial property with tenants in it, so a high vacancy rate can mean more pressure on residential property owners to make up the difference in their taxes — if they want the forthcoming budget to pay for the level of services currently offered.

But the news is not all bad. Organizations are still seeking to lease — they are just reducing the size of their office floor plans by 20-50% and, instead, paying more for higher-quality amenities, Colliers found. Schmidt said this has been christened the “flight-to-quality trend.”

“Business leaders are realizing you cannot build a company culture and innovation in an old, dark office space,” she said. “You need a beautiful, comfortable space, with lots of natural light, outfitted with a variety of meeting rooms of all different sizes.”

That will mean a higher vacancy in the short term but, she predicts, that rate will even out.

Some companies are moving out of older, less technologically equipped offices in lower-demand areas, dubbed “Class B and C buildings,” into more marquee “Class A and trophy class” buildings in Arlington, particularly in Rosslyn and Ballston.

“People want to be in Arlington,” Schmidt said. “Ballston and Rosslyn are getting a lot of attention.”

Two buildings in Ballston are set to come online soon: 3901 N. Fairfax Drive at the end of this year and George Mason’s FUSE at Mason Square next year.

Above-grade construction started in the fourth quarter of 2022 on 3901 Fairfax Drive, consisting of 178,131 square feet of office space, 16,185 square feet of retail and 7,311 square feet of “other space,” per a development tracking report from the Arlington County Dept. of Community Planning, Housing and Development.

The FUSE building, meanwhile, consists of 345,000 square feet for laboratories, classrooms, offices, startup incubators, co-working facilities and other uses.

“They are both true speculative buildings,” she said. “That’s showing us the confidence landlords have. They’re doubling down on Ballston.”

As for existing buildings, landlords are upgrading their leasable spaces and sweetening the deal with allowances for moving costs and for making improvements.

Common upgrades for business include establishing a tenant lounge and creating conference centers. But there are more distinctive changes.

“We’re seeing really fun amenities as well, like golf simulators,” she said. “It’s business but it’s fun, too. You want to pull people to your building.”

Have you ever showed up to a date and realized you had been stood up?

The Arlington County Board nearly did yesterday (Thursday) during a hearing on the proposed property tax rate.

The county proposes a rate of $1.013 per $100 in assessed value. While flat over last year, the average Arlington homeowner would still see taxes go up $454, owing to rising residential property assessments and other fees.

“Madame Clerk, do we have any speakers this evening?” asked Board Chair Christian Dorsey.

“We do. We have one speaker,” said the clerk.

“Terrific,” he rejoined.

That speaker was Hamilton Humes, the commissioner of the Youth Ultimate League of Arlington, an ultimate frisbee league. Addressing the board in gear suggesting he had just been out slinging a disc — or would be soon — he expressed his thanks for the County Board’s work and approval for the fees levied to maintain local playing fields.

“We appreciate all the effort to provide playing fields,” said Humes. “I speak for all the youth athletic organizations to say that… The only issue, which is not in your purview, is the scheduling between Arlington Public Schools and the Dept. of Parks and Recreation, but you all know that.”

There was no mention of the property tax rate.

The Board took a break to wait for more speakers. Eventually, a man called in to ask why the real estate assessment on a church property he recently purchased along Route 50 had increased by more than 17% — compared to increases of 3.5.-5.5% in previous years.

He prefaced his brief comments by apologizing for possibly bringing this up in the wrong avenue, saying he had never done anything like this before. After he finished speaking he was informed that it was, in fact, the wrong venue for challenging property assessments.

“We have a no wrong door policy,” Dorsey assured him. “We’ll be sure to communicate with you via email about the exact route for [appealing the tax assessment]. We’re happy you joined us however you come to us.”

Last night’s meeting is a far cry from Missing Middle hearings last week, which saw north of 200 speakers, as well as yesteryear’s tax rate hearings. A hearing in 2010 drew 26 speakers, the most of any meeting dating back to 2008 with minutes available on the county website.

In these meetings, people often requested higher taxes to cover school spending or affordable housing, while others have advocated for lower tax rates or holding the current tax rate steady to provide relief to people on fixed incomes and small business owners. Those opposed to tax hikes would often also speak in favor of reducing county spending.

The number of speakers has since declined to seven, four and six speakers in 2020, 2021 and 2022, respectively — years that coincided with introspection and concern about the county’s pathways for citizen engagement, called the “Arlington Way.”

Meeting minutes showed about a half-dozen people who used to speak reliably against increases: In first place, with at least eight appearances, is former independent Congressional candidate Jim Hurysz; in second is former independent County Board candidate Audrey Clement, with at least seven.

While lacking in speakers passionate about taxes and county finances, the meeting had one memorable moment.

Arlington’s youngest-ever Sergeant-At-Arms — County Board member Katie Cristol’s son — banged the gavel to start the hearing at 7 p.m. As he continued banging the gavel, Cristol intervened.

“Okay, you don’t have to keep doing it,” she said.

He happily sat on Cristol’s lap, sipping juice until his father took him home. Board members continued chatting among themselves between the speakers and the adjournment at 8 p.m. sharp.

(Updated at 4 p.m.) There seems to be bipartisan agreement among state lawmakers about at least one issue: something must be done about the popping and roaring of noisy mufflers.

On Saturday (Feb. 25), the Virginia General Assembly adjourned its 2023 winter legislative session, which some say has been too short to get vital work done. These bills will now head to Gov. Glenn Youngkin to review before March 27.

With Republicans controlling the House of Delegates and Democrats the Senate, Arlington’s all-Democratic representation introduced a laundry list of bills that failed. These ranged from one permitting same-sex marriage to increasing gun control and leveling the playing field for online news outlets like ARLnow.

Those seeking relief from cars with loud exhausts fell short of a total victory, but both the Virginia House of Delegates and the State Senate passed a version of Sen. Adam Ebbin’s bill, SB 1085, that would study the issue.

His original bill would have prohibited the sale and use of aftermarket mufflers. Now, the legislature is directing the Department of Transportation to “convene a workgroup of specified stakeholders to examine the issue of vehicle noise in the Commonwealth and to report its findings and recommendations” to the chairs of each chamber’s transportation committee by Nov. 1.

His bill follows up on last year’s reversal of a 2021 law that prevented police from pulling over drivers just for having an excessively loud exhaust system. The original law was intended to reduce pretextual traffic stops and racial disparities but might have contributed to an uptick in noise complaints.

Of all the bills filed by local legislators that ARLnow highlighted at the start of the 2023 legislative session, this was the only one to pass.

However, a slew of bills from other lawmakers did make it through, including a few notable ones listed below.

Crime

- HB 1583 (Del. “Rip” Sullivan) makes it illegal to use drones to spy on someone, regardless of where that device is located.

- HB 1590 (Sullivan) modernizes a harassing phone call statute that used to apply only to telephones and pagers. Now, it would be a misdemeanor to annoy or delay emergency personnel trying to do their job by causing any device to ring or signal an alert repeatedly.

- SB 887 (Sen. Barbara Favola) requires out-of-cell programs and congregant activities for four hours a day for people in solitary confinement at the state prison, unless there is a lockdown. People in solitary confinement must receive physical and mental health evaluations and there has to be a publicly available process for restoring people to the general prison population.

Consumer protection

- HB 1857 (Del. Elizabeth Bennett-Parker) is intended to prevent resellers from misleading ticket buyers by prohibiting them from making their website look similar to a ticket operator’s website. It also prohibits the display of trademarked or copyrighted information from an operator or a primary ticket provider without their consent.

- SB 871 (Favola) would make it illegal for car manufacturers, factories and distributors to threaten to take away incentives from buyers or the right to participate in incentive programs.

(Updated at 4:20 p.m.) Arlington’s property tax rate will not be going up in the new county budget, but it looks unlikely to come down, either.

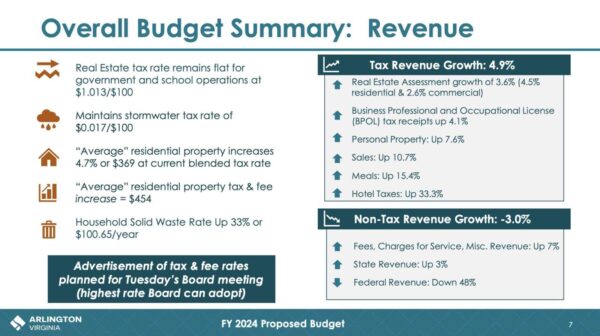

The County Board voted unanimously last night (Tuesday) to advertise a property tax rate of $1.013 per $100 in assessed value. That sets a cap on the real estate tax rate, locking in the county to a rate that’s flat or lower than last year.

But homeowners would still see their taxes go up significantly even with the rate unchanged, owing to a 4.5% rise in residential property assessments. Between taxes and fees, the average Arlington homeowner would be paying $454 more to the county compared to the previous year, a 4% increase.

That includes a $100 hike in the annual trash collection fee paid by homeowners — from $308 to $409 — which county officials attributed to a “significant increase to contractual costs due to driver shortages, current labor costs, and equipment pricing.”

Arlington County Manager Mark Schwartz’s budget proposes keeping the current $1.013 real estate tax rate, despite a better-than-expected revenue outlook.

“The facts have changed since November and December,” Schwartz said, referencing what was then predicted to be a $35 million budget gap. “We’ve seen higher than anticipated real estate assessment growth. I think a number of people saw that when they received their residential real estate assessments in January.”

“On the commercial side, we had anticipated a drop in overall assessments, and there was a very small drop in the commercial assessments, but when you factor in the new commercial buildings the numbers were actually up,” the County Manager continued. “And also, our other taxes… are doing quite well.”

The county is seeing a 10.7%, 15.4% and 33.3% rise in sales, meals and hotel tax revenue, respectively, according to Schwartz’s presentation to the Board on Saturday. After a brutal couple of years for Arlington’s hospitality industry, hotel taxes are now about back to pre-pandemic levels, he noted.

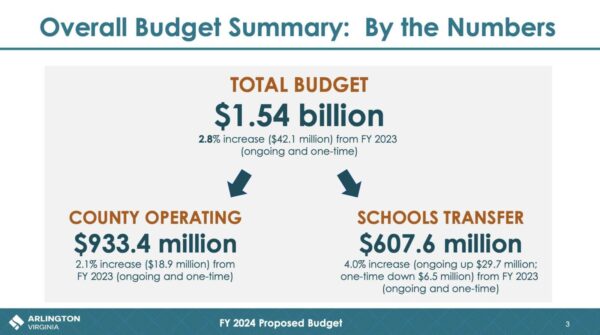

Schwartz’s $1.54 billion budget — up 2.8% over last year’s adopted budget — also includes a number of proposed cuts,

Just over 20 vacant positions would be eliminated, including an auditor position in the County Board office, and other savings would be found from initiatives like paperless billing of property and business taxes. In all, the cuts would save $5.6 million.

While the county is no longer benefiting from the firehose of Covid relief funds from the federal government, it will save $2.6 million thanks to energy credits stemming from its 2020 solar power agreement with Amazon.

In the expense side of the budget, however, the picture is less rosy.

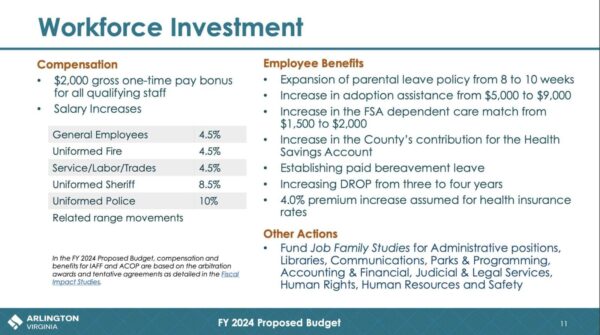

Schwartz said the county is still facing a “very competitive environment in terms of workforce,” making it hard to hire for certain positions and driving up wages. The budget proposal includes a $2,000 bonus for qualified county staffers and 4.5-10% salary increases, including:

- General Employees — 4.5%

- Uniformed Fire — 4.5%

- Service/Labor/Trades — 4.5%

- Uniformed Sheriff — 8.5%

- Uniformed Police — 10%

“We are still having challenges in hiring vacancies,” Schwartz said.

Other initiatives in the budget include purchasing 22 electric vehicles for the county fleet, part of an ongoing transition, and a community engagement effort focused on libraries. The latter will “review the operating model (locations, hours) considering where we’ve seen growth in the County and how that overlaps with service demands.”

However unlikely, there could be flexibility for a slight decrease in the property tax rate. Schwartz left $4.5 million in his budget unallocated, for consideration by the Board.

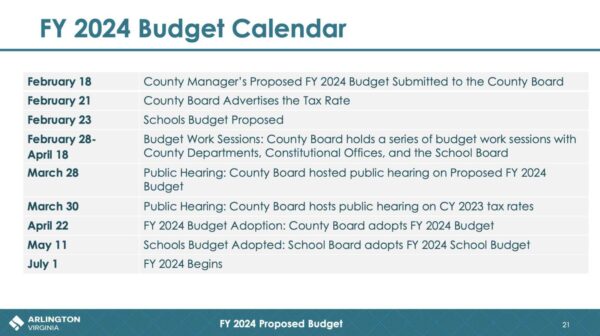

Starting next week the county will start a series of in-depth work sessions focused on individual departments and offices, followed by public hearings at the end of March and a County Board vote on the final Fiscal Year 2024 budget on April 22.

More from an Arlington County press release, below.

(Updated at 3:50 p.m.) When Arlington Economic Development tried to help a local tech business take advantage of a county tax incentive program some 2.5 years ago, it hit a snag.

The Commissioner of Revenue denied the company’s application to be recognized as a “qualified technology business,” per a county report. Under this designation, as part of the county’s “Technology Zone” program, it would have paid half the rate normal rate for the Business, Professional, Occupational License (BPOL) tax.

“Technology Zone” allows qualifying companies in Arlington’s “high-technology business corridors” to pay $0.18 per $100 of gross receipts for 10 years, as opposed to the $0.36 that many companies pay for a business license.

AED says the program is one of its “most effective tools” to recruit and retain tech companies, and a spokeswoman for the division tells ARLnow that 105 businesses have been approved for this designation since its inception in 2014.

After talking with the tax assessor’s office, AED learned the business was denied because it used a third-party organization, known as a Professional Employer Organization, to manage company payroll. It also learned “several” other businesses had been turned away for the same reason.

To qualify for the tax break, businesses must show, and the Virginia Employment Commission must verify, they increased their full-time employees by at least 25% within the 12 months before applying for the program.

“PEOs report a company’s employees and wages to the VEC under the PEO’s federal employer identification number, and the reports indicate that the employees are affiliated with the PEO rather than with the company,” said the staff report to the Arlington County Board. “This leaves the company unable to demonstrate employment growth to the County via its own VEC filing and therefore unable to meet the Technology Zone program’s criteria.”

This affects between four and six companies interested in applying for the program every year, AED spokeswoman Cara O’Donnell said.

Now, AED and the Commissioner of Revenue are asking the County Board to allow businesses that use these services to be eligible. The Board is set to review the request during its meeting on Saturday.

“The language does not align with current business processes and trends in the technology industry, specifically the increasing usage of third-party organizations to manage and process company payroll,” the staff report says, asserting that this is “inconsistent with the original intent” of the ordinance.

The proposed changes would also update the definition of “qualified technology business,” which the county says is “vague and outdated.”

County code currently says that a “qualified technology business” has a “primary function in the creation, design, and/or research and development of technology hardware or software.”

It adds that using computers, telecommunications services or the internet “shall not, in itself, be sufficient to qualify as a qualified technology business.”

But AED says this “does not capture many new business models” and recommend emphasizing proprietary technology instead.

Lastly, businesses would have 24 months, rather than 18, to apply to be “qualified technology businesses” after setting up a business in Arlington.

“The proposed amendments are minor technical changes to the ordinance language, not expansive policy changes,” the staff report says. “Together, these changes would enhance the effectiveness of the Technology Zone incentive as a business attraction and retention tool.”

Two bills that would have given online-only local news publications like ARLnow some of the same privileges afforded legacy media outlets failed in Richmond over the past few weeks.

In the House of Delegates, HB 1920 would have included online local news publications that employ at least one full time journalist in an exemption from local Business, Professional, and Occupational License (BPOL) taxes.

Current statute exempts radio stations, television stations, newspapers, magazines, newsletters and “other publication[s] issued daily or regularly at average intervals not exceeding three months.” Online publications are not considered an “other publication” in Virginia, in part because the state exemption was originally passed in the late 1980s, before the advent of the modern commercial internet.

ARLnow’s parent company, which is based in Arlington and pays a mid-four-figure BPOL tax annually — nearly 10% of the company’s net income for 2022 — appealed the exclusion from the media outlet BPOL exemption to the Arlington Office of the Commissioner of Revenue in the fall. The office rejected the appeal, citing a 2020 Virginia Tax Commissioner ruling against a food blog that was also seeking the exemption.

Introduced by Del. Patrick Hope (D-Arlington), the bill garnered support from other Virginia online-only local news publishers but Arlington County officials expressed concern about a loss of tax revenue. Several other online publications, including Axios, are also based in Arlington.

HB 1920 was ultimately “laid on the table” by a House finance subcommittee, with committee members expressing both interest in studying the bill’s financial impact and surprise that legacy media outlets are excluded from BPOL.

Also considered this year was SB 1237, proposed by state Sen. Mark Obenshain (R-Harrisonburg), which would have given local governments and businesses the option of placing legal notice ads in qualifying online local news publications. Currently, such notices must be placed in printed newspapers to satisfy legal requirements.

Obenshain argued that numerous online-only local news publications have as many or more readers than their print counterparts, while citing the continued closure of print newspapers across the country, including the Richmond-area Chesterfield Observer earlier this month.

Here in Arlington, residents and County Board members have at times expressed frustration with the county placing its legal notices in the relatively lightly-circulated Washington Times newspaper. Board members, however, said that doing so is the most cost-effective way to meet state notice requirements and placing notices in the Washington Post, for instance, would be considerably more expensive.

Arlington County spent more than $37,000 with the Washington Times, an unabashedly conservative daily paper owned by an offshoot of the Unification Church, between fiscal years 2018 and 2019, according to a Freedom of Information Act response to a resident’s query in 2020.

The owners of ARLnow, Page Valley News and the MadRapp Recorder were among those to testify in favor of the bill last week. It was opposed by the Virginia Press Association and the publisher of InsideNoVa on the grounds that newspapers provide a permanent physical record of such notices and Virginia newspapers publishers already post notices online.

The state Senate’s judiciary committee ultimately voted 6-9 against the bill, after expressing concerns about which publications would qualify under SB 1237 and whether notices would be lost if online publications closed.

The vote was largely along party lines, with six GOP members voting in favor. Among those voting against it were members of the Democratic delegation from Fairfax County: Sen. Jennifer Boysko, Sen. Chap Petersen, Sen. Dick Saslaw and Sen. Scott Surovell. Previous attempts to pass a similar bill on the House side by Del. Hope have also failed in committee.

Online-only local news publishers who supported the bill — there are currently more than a dozen such local sites throughout the Commonwealth — have vowed to try again to gain bipartisan support for a modified version of this year’s bill during next year’s General Assembly session.

Separately, a bill from Del. Alfonso Lopez (D-Arlington) to provide tax credits that would benefit both print and online local news publishers, also failed in a House finance subcommittee. The bill, HB 2061, had the support of the Virginia Press Association.

Local Boy Scouts of America and Girls Scouts troops in Virginia may get some tax relief — if a local lawmakers succeeds in modifying the state constitution.

Inspired by the testimony of one Arlington Boy Scout, Del. Patrick Hope (D-Arlington) has introduced legislation that would exempt property owned and used by the organization “solely for the purpose of supporting” troops from personal property taxes.

The organizations would join other nonprofits that also enjoy this status, including museums, churches, the YMCA and similar religious groups.

Last September, Boy Scout Troop 167 member Griffin Crouch told the Arlington County Board that his troop was saddled with $3,000 in personal property taxes on its vans.

He asked them to see if there was a way to get the troop out of this obligation, as it eats up a chunk of the $21,000 budget.

Hope says he read ARLnow’s coverage and decided to try and help.

“I know many Scout troops rely on vehicles for camping trips and backpacking adventures across the state and the country,” Hope said. “Many troops, however, cannot afford other means of transportation to these excursions and owning your own van(s) is an economical way to afford these life-changing experiences.”

Up until last year, Mount Olivet United Methodist Church (1500 N. Glebe Road), near Ballston, officially sponsored Troop 167.

But last summer, the United Methodist Church, the largest supporter of scouting troops, told local churches to stop officially sponsoring local troops. Troops can still use their facilities, however.

Troop 167 decided to incorporate a nonprofit to sponsor the troop, but getting 501(c)(3) status and federal tax-exempt status did not protect it from state tax code or Arlington’s personal property tax.

So far, Hope says he’s only aware of Troop 167 facing this dilemma but he filed the resolution expecting other troops will also lose their sponsorship and face similar circumstances.

“More and more troops are going to lose their once enjoyed tax-exempt status and, while localities have the statutory authority to grant narrow exceptions to non-profits, there will be many that will refuse to open that door and, therefore, a state solution through amending the Virginia Constitution is the only available remedy,” he said.

Urban farms and breweries could be coming to a vacant office near you.

Over the weekend, the Arlington County Board approved a series of zoning changes aimed at tackling the stubborn office vacancy rate. They would allow the following tenants to move into offices by right:

- animal boarding facilities, provided animals are under 24-hour supervision

- urban farms

- urban colleges and universities

- breweries, distilleries and facilities making other craft beverages, such as kombucha and seltzer

- artisan workshops for small-scale makers working in media such as wood or metal, laser cutters, 3D printers, electronics and sewing machines

Colleges and universities or urban farms previously needed to seek out a site plan amendment, which requires Arlington County Board approval, to operate in spaces previously approved for office or retail use.

The code requires all animal boarding, farming and artisan product-making activities to occur inside the building.

A county report describes this existing process as “overly cumbersome” for entrepreneurs trying to prove their business concept as well as for landlords, “who may be averse to take a risk on a new type of use that may require significant building improvements.”

The changes require farms, craft beverage facilities and artisan workshops to maintain a storefront where they can sell goods made on-site to walk-in customers, which the report says could reinvigorate dead commercial zones.

“Artisan beverage uses can bring new life to vacant buildings, boost leasing demand and, when located in a walkable neighborhood, can attract both existing and potential residents, while creating active third places for the community to gather,” the report said. “By fostering space for small-scale makers, artisans, and the like, a creative economy can grow, and people who may not have the space for such activities in their urban apartments may see this as an attractive neighborhood amenity.”

Some of these uses were allowed along Columbia Pike in the fall of 2021 to encourage greater economic revitalization. At the same time, D.C.-based animal boarding company District Dogs was appealing zoning ordinances curtailing the number of dogs it could board overnight in Clarendon, prompting discussions about expanding the uses approved for the Pike throughout the county.

The next spring, County Manager Mark Schwartz developed a “commercial market resilience strategy” aimed at bringing down the county’s high office vacancy rate, fueled by persistent remote work trends catalyzed by the pandemic. The tool, which includes an expedited public review process, was first used last fall to allow micro-fulfillment centers to operate by-right in vacant office spaces.

In a letter to the County Board, Arlington Chamber of Commerce CEO Kate Bates said the rapid approval of these commercial activities is critical for attracting new and emerging businesses.

“The Chamber believes that the Zoning Ordinance needs reform, and that unnecessary restrictions on commercial use should be removed to help the economy of the County grow,” Bates wrote. “In the wake of record high commercial vacancy, timely change is needed. It is imperative that the County focuses on long-term solutions for new business models, both through increased adaptability for new uses and expedited timeframes for approval of these new uses.” Read More

America’s oldest continuous law-making body, the Virginia General Assembly, is now in session, and local lawmakers have introduced a slew of new legislation.

With split control of the General Assembly, Republicans of the House of Delegates and Democrats of the Senate, it’s unclear how many bills introduced by Arlington’s all-Democratic representation will pass.

Still, some priorities appear to have a measure of bipartisan support, including SB 1096 (from Sen. Adam Ebbin) permitting marriage between two people regardless of sex while protecting the right of religious clergy to decline presiding over same-sex marriages.

Here are some of the bills that were pre-filed ahead of this session.

Arlingtonians could get relief from noisy cars and predatory towing.

- SB 1085 (Ebbin): Prohibits the sale and use of aftermarket mufflers. This follows up on a change in law last year reversing a 2021 law that prevented officers from pulling over drivers just for having an excessively loud exhaust system. The original law was intended to reduce pretextual traffic stops and racial disparities but might have contributed to an uptick in noise complaints those living along highways and busy roads.

- HB 2062 (Del. Alfonso Lopez) and SB 790 (Sen. Barbara Favola): Reprises a failed 2022 bill that would make violations of existing towing law subject to the Virginia Consumer Protection Act. Under this act, predatory towing could receive heftier civil penalties than the $150 fine currently codified. Tackling predatory towing was a 2023 Arlington County Board legislative priority.

In addition to Ebbin’s same-sex marriage bill, a few others pertain to family life, health and privacy.

- SB 1324 (Ebbin): Gives parents who make less than $100,000 a $500 child tax credit for 2023-2027.

- SB 852 (Favola): Protects menstrual data stored on computers, computer networks or other devices — like phone period tracking applications — from being subject to search warrants. This likely responds to a Republican bill to outlaw abortion after 15 weeks except in the case of rape or incest or if the pregnancy endangers the life or “major bodily functions” of the mother.

- HB 1879 (Del. Elizabeth Bennett-Parker): Requires each managed care health insurance plan licensee to provide a sufficient number and mix of services, specialists and practice sites to meet mental health care needs 24/7.

A number of gun control bills would curtail who can own a gun and who can assume possession of those owned by people who have committed a crime, while tackling the proliferation of “ghost guns.”

- HB 1729 (Bennett-Parker) and SB 909 (Favola): Requires people to be at least 21 years old and to live under a different roof in order to accept guns from someone legally required to surrender them for being convicted of assaulting a family member or being under a protective order.

- HB 1579 (Del. Rip Sullivan): Prevents people from buying or transporting firearms if they have two convictions in five years for operating a car or boat while drunk.

- SB 1181 (Ebbin): Makes it a misdemeanor for anyone who is not a federal firearms importer, manufacturer or dealer to knowingly sell, offer to sell, transfer or purchase unfinished firearms that do not have serial numbers. These can be purchased online and used to build untraceable firearms, known as “ghost guns.”

- SB 1192 (Ebbin): Prohibits certain semi-automatic guns — loaded or not — in any public right-of-way or publicly accessible natural area.

The U.S. real estate market is facing significant headwinds, but Arlington property assessments are continuing their march upward.

Arlington County announced today that overall assessments of residential and commercial properties rose 3.6% for 2023, compared to 3.5% for 2022. Residential values are up 4.5% while commercial values are up 2.6%.

“The increase in property values continues to show that Arlington remains a place people want to live and work,” County Manager Mark Schwartz said in a statement. “And it’s the revenue generated from these real estate taxes that help to fund the County’s high-quality services and public services for residents, visitors, businesses and workers.”

The average single-family home in Arlington is now assessed at $798,500, compared to $762,700 last year. The rise comes despite the local real estate market experiencing many of the challenges also seen in the national market, precipitated by rising interest rates.

The rate of property value increase, however, has slowed compared to the previous two years. Residential values were up 5.8% in 2022 and 5.6% in 2021. In 2020, residential values rose 4.3% and were outpaced by a 4.9% rise in commercial values, prior to the pandemic causing the office vacancy rate to spike and values to in turn go down.

Arlington has for years relied on a balanced residential and commercial tax base, which allows it to grow its budget and embark on large projects while keeping real estate tax rates at levels slightly below many of its Northern Virginia neighbors.

The weakness in office assessments, while offset by rises in other commercial property like hotels and apartment buildings — and bolstered by new construction — is a contributing factor what is currently projected to be a nearly $35 million budget gap.

Arlington County Manager Mark Schwartz is scheduled to present his proposed FY 2023-2024 budget to the County Board next month.

Local homeowners, meanwhile, will be able to view their new assessments online after 11 p.m. tonight (Friday), the county said. There is an appeal process for those who disagree with their assessments.

More on the newly-released assessments, below, from the county press release.

In another bid to tackle the soaring office vacancy rate, Arlington County is mulling whether to fill vacant offices with unconventional tenants such as breweries and hydroponic farms.

The county is looking at allowing urban farms, artisan workshops, and craft beverage-making and dog boarding facilities to operate by-right in commercial, mixed-use districts throughout Arlington County. Some of these uses are already allowed along Columbia Pike.

Now above 21%, the office vacancy rate in Arlington spells lower tax revenue and belt-tightening for the under-development county budget. It ticked up during the pandemic and remained high even as buildings reopened, mask mandates were lifted and people returned to the office.

As the trend persisted, Arlington County Manager Mark Schwartz and his staff launched a “commercial market resilience strategy” to get new types of tenants moved in quickly. The strategy focuses on zoning changes with a limited impact on neighbors that can be approved with through a new, less involved public engagement process. The strategy was first used last fall to approve micro-fulfillment centers.

Last night (Wednesday), a majority of the Arlington County Planning Commission approved a request to authorize public hearings on this proposal.

“We do need to be thinking creatively,” said Planning Commission Vice-Chair Sara Steinberger. “I’m appreciative that the county came forward with a streamlined approach so we can start fast-tracking some things. The community feedback and involvement is essential and is a cornerstone of the Arlington Way and how we comport ourselves within this community. That said, it’s never fun to be bogged down in bureaucracy either, so when there is an opportunity to move more quickly on certain things in a limited field, I think it’s appropriate to do so.”

The proposal also would let colleges and universities, which can currently operate in offices only after obtaining a more burdensome site plan amendment, move in by right.

“They tend to be our strongest source of demand in office buildings at a time when we aren’t seeing much demand,” Marc McCauley, the director of real estate for Arlington Economic Development, told the Planning Commission.

Commissioners Stephen Hughes and James Schroll abstained from the final vote, reprising concerns they raised last year about the impact of these new uses on neighbors. While voting for the proposal, Commissioner Tenley Peterson questioned county staff about potential noise, smell and parking nuisances.

“I can see the good reasons for doing this,” Schroll said. “My reticicene is not necessarily what you’re doing on the zoning side, it’s more the outreach. There are some things that I feel like aren’t fully thought through… We’re pursuing these without fully understanding what use standards we need to put in place.”

Citing “incessant barking” from nearby dog-boarding facilities that can be heard from Jennie Dean Park, Hughes said he wants the community to understand that these changes would leave nuisance mitigation up to the condition of the building and county noise ordinances.

“There is no place in the entire county where your actions do not impact another person,” Hughes said, pushing staff to instead draft a document listing “externalities we can all agree to as a community that we will not do.”