This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Eli Residential channel. Enjoy!

Question: What impact will the new Toll Brothers community have on the Arlington housing market?

Answer: If you have enjoyed my real estate columns over the years, I would greatly appreciate your vote for Arlington Magazine’s Best Of Arlington, Real Estate Agent (in the Home section) and encourage you to support all of your favorite Arlington businesses with a meaningful vote!

Toll Brothers will open sales of 40 new single-family homes at The Grove at Dominion Hills very soon (projected by this fall) starting in the $1.9Ms (really $2M) and I suspect most of the homes will have a final price tag of $2.1M-$2.3M.

All 40 homes will not be available at once, rather they’ll be released in phases based on the pace of sales, but the addition of these homes to the market will have a significant impact on the supply of new construction homes in Arlington and I expect will put downward pressure on the price of new builds under ~$2.6M.

The Grove Will Be a Big Percentage of New Construction Supply

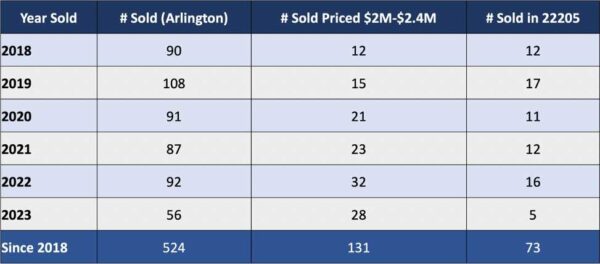

Arlington has averaged just over 95 new homes sold per year since 2018 (per MLS, which includes most but not all new homes sold) so even if it takes two years for Toll Brothers to release all 40 home sites, those homes will represent a significant percent increase in the supply of new homes in Arlington.

If you look at the sales of comparably priced homes ($2M-$2.4M), The Grove will bring an increase of 60-70% more new builds to market over the next 18-24 months (assuming that’s the timeframe they release all 40 home sites within).

Most new homes in Arlington are located in the 22207 zip code, with 52% of new home sales (275 of 524) since 2018. The Grove is in the 22205 zip code and while it’s just 1.5 miles from 22207 and 22205 also commands premium pricing and shares many of the same characteristics as the 22207 zip code, there’s no data to support whether or not the 22205 market is prepared to absorb 40 new homes at this price point. Of the 73 new homes sold in 22205 since 2018, just seven have closed at or above $2.1M — one more is under contract and three are for sale.

And New Homes Are Already in a Softer Sub-Market

Adding that kind of supply to any market is bound to put downward pressure on prices, but I have no doubt that the market would happily gobble up dozens of 2,500-4,000 SqFt homes in the $1M-$1.5M+ range. However when you get into the 5,000+ SqFt market (I imagine most of the 40 homes will finish with 4,500-5,000+ SqFt) and in the $2M-$2.5M range, you enter into that is already pretty well balance between buyers and sellers, softer than the rest of the housing market, without the inventory from The Grove.

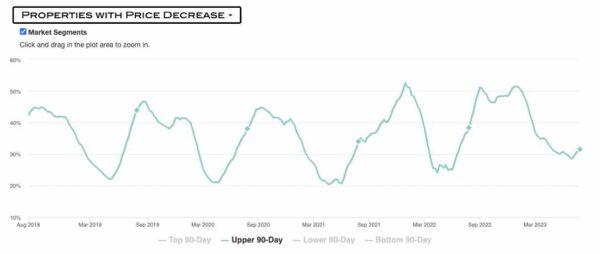

The first chart, courtesy of Altos Research, shows the percentage of homes with a price reduction in the “upper” price range of the Arlington single-family home market, which The Grove community will fall within. Notice the upward trend of price reductions this year highlighted by ~30% of homes reducing price this spring compared to previous spring markets with just 20-25% of homes with a price reduction.

I have seen this play out anecdotally as well with more new builds reducing the asking price or accepting larger discounts from ask than in years past. I would expect this trend to continue as the market adjusts to the Toll Brothers inventory rolling in later this year and in 2024-25.

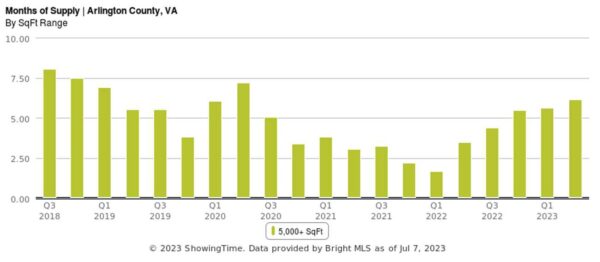

The Months of Supply (MoS) chart below, a good measure of supply and demand where higher MoS suggests a market more favorable for buyers, shows us that the market for homes with 5,000+ SqFt is very much in balance between buyers and sellers, with about six Months of Supply. Most housing economists say that six MoS is a balanced market, below six favors sellers, and above six favors buyers. For comparison, the overall Arlington market measured 1.4 MoS in Q2 2023.

So this chart tells us that unless demand picks up sharply for large homes, the extra supply added by Toll Brothers will likely push this sub-market (~5,000+ SqFt) into a buyer’s market.

Local/Smaller Builders Will Bear the Burden

Most likely, none of this will matter to Toll Brothers and it will be a problem for their competition (everybody else building in Arlington) to bear. Toll Brothers can afford to wait for premium buyers longer than smaller builders can, Toll Brothers has an exceptionally efficient and proficient sales machine including full-time sales staff, model homes, and a nationally recognized brand, and Toll Brothers can offer incentives smaller builders can’t compete with, most notably through the Toll Brothers mortgage company.

If I was a builder in Arlington, I would be careful over the next couple of years on projects in the $2M-$2.5M range with tight margins.

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Eli Residential channel.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C A