This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Rosslyn resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: Does the winter impact all housing types equally or do certain types of homes fare worse during the cold season?

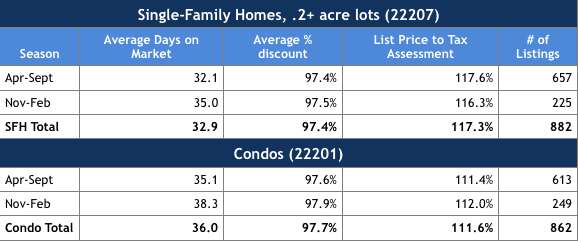

Answer: I have always held the theory that suburban homes with yards, trees, and plant life are impacted more when leaves/plants die in November than homes without any private/nearby trees and plant life (e.g. condos). This week, I decided to test my hypothesis by comparing sales statistics between single family homes in the 22207 zip code, the area of Arlington with the most tree/plant growth, with the sales statistics for condos in the 22201 zip code, where tree canopy and plant growth isn’t a major factor for buyers.

For my hypothesis to hold true, we would see the usual increase in days on market and discounts from asking price during the colder months across both sets of data, but a higher variation from the mean for the single family homes.

Summary of the data set:

- The data is broken down by properties listed in November – February and April – September because I wanted to target properties listed during leafy/bare months (note, I removed properties listed in March and October)

- Single family sales in 22207 date back to 2010 to arrive at 882 data points

- Condo sales in 22201 dates back to 2014 to arrive at 862 data points

- I removed extremes including properties that took 200+ days to sell and properties that sold at a discount of 15% or more because these would suggest their difficulty selling had nothing to do with seasonality

- I didn’t include new construction in the single family data

- Single family lot size had to be at least two tenths of an acre

Split Findings

Using the two main data points of days on market and percent discount of sold price from original list price, the data suggests that my hypothesis is incorrect and all types of property are impacted similarly by seasonality, regardless of how much tree/plant growth there is on and near the property.

However, I also attempted to measure how sellers were pricing their homes during each time of year by calculating the percent difference between the original list price and previous year’s tax assessment. I figure that this is the most accurate way to gauge asking price relative to market price across a large set of data. Under this assumption, I drew a different conclusion that the only thing keeping seasonal sales of single-family homes with tree/plant growth consistent with condos is that sellers underpriced their homes from Nov-Feb (or overpriced Apr-Sept) whereas condo pricing remains slightly more consistent through out the year. In other words, if homes sold Nov-Feb, featuring tree/plant growth, were priced the same as they are during leafy months, there would be a sharper increase in days on market and larger discounts, proving my hypothesis correct.

Another factor in drawing any conclusions from these numbers is how much the housing supply varies by season. With substantially fewer homes listed during the colder months, homes on the market at that time face much less competition, thereby helping to offset the negative impact of bare trees/plants, colder temperatures, and less daylight. However, this also seems to impact all housing types equally.

Using Real Estate Data

Data like this can help buyers and sellers make more informed decisions, but you should be cautious of how much influence you allow it to have. Unlike other data-heavy industries like the stock market and marketing, localized real estate data is full of anomalies, missing data, and misrepresented data making it challenging to draw reliable conclusions and necessary for the person analyzing the data to understand the local market as well as the strengths/weaknesses of certain data elements. I’m clearly a proponent for incorporating customized data into real estate decisions when applicable, but for those of you in data-dependent industries, keep in mind that your weighting factor for real estate data should be less than you’re used to.

If you’d like a question answered in my weekly column, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at http://www.RealtyDCMetro.com.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with Real Living At Home, 2420 Wilson Blvd #101 Arlington, VA 22201, (202) 518-8781.