This is a sponsored column by attorneys John Berry and Kimberly Berry of Berry & Berry, PLLC, an employment and labor law firm located in Northern Virginia that specializes in federal employee, security clearance, retirement and private sector employee matters.

By John V. Berry, Esq.

Financial security concerns are the most common issue resulting the loss of of a security clearance. As a result, it is important that when a security clearance applicant or holder runs into financial issues that they act preemptively to protect their clearance.

In security clearance cases, financial issues are referred to as Guideline F cases. In Guideline F cases, the government’s concern is generally focused on how a person has handled his or her finances and/or his or her vulnerability to financial manipulation given a pattern of overspending or debt. The criteria for evaluating such cases are covered in Security Executive Agent Directive (SEAD 4)

Here are 7 tips for clearance holders or applicants when dealing with financial debts and other issues:

1. Stay Current on Debts and/or Make Arrangements with Debtors.

Most security clearance clients seek our assistance when they have had multiple bills that are past due, delinquent, in collections or have been charged off. In some cases, the debts have been ignored.

In Guideline F cases, the existence of multiple, unpaid debts seems to be the most usual reason for the loss or denial of a security clearance. It is important to gain control of your finances in such situations in order to attempt to keep your security clearance.

2. Pay and File your Taxes.

Individuals in tax trouble or who fail to pay and/or file their taxes take a big risk in losing their security clearance. Tax issues tend to be viewed as more significant for security clearance purposes than regular debts because they are owed to the government.

If outstanding taxes or tax liens are too much for the individual to pay off all at once, it is important to try to work out a resolution plan with the IRS or state tax agency and show good faith towards resolving these debts in order to keep or obtain a security clearance.

3. Keep an Eye on your Credit Report.

Oftentimes, an individual has encountered difficulties in the security clearance process because incorrect information is listed on his or her credit reports.

Errors in credit reports are quite common. As a result, it is important for an individual applying for or holding a security clearance to keep a watchful eye on his or her credit report for errors and potential problems and to dispute debts that do not belong to the person.

4. Work with Creditors.

It can be easy to ignore a creditor, especially where the debt is part of a dispute, but it is always better for a clearance holder or seeker to get ahead of his or her credit problems than to wait until he or she receives notice of a possible denial of a security clearance.

An individual who recognizes a debt problem or allegation early and works towards resolving it early and before a clearance issue is raised tends to be given more credit towards the granting of the clearance as opposed to an individual who starts the process after he or she receives notice of the potential loss of the clearance.

Even if a creditor is non-responsive, it is important to try multiple times to communicate with the creditor in an effort to resolve these issues.

5. Credit Counseling and Classes Can Help:

If an individual falls behind in his or her debts, or taxes it is still important to show how that individual is working (or has worked) to get back on a healthy financial track in order to alleviate concerns about the individual’s ability to hold a security clearance.

Taking meaningful credit classes or engaging in credible credit counseling can help mitigate security concerns in such cases.

6. Report Major Financial Issues to Security Officers:

If and when major financial issues arise, it can be important to report them, in advance, to an individual’s security officer. Doing so in appropriate situations can be used as evidence of mitigation for security concerns. For example, if a bankruptcy arises, that is an important issue that should be raised with a security officer.

7. Demonstrate Financial Stability:

When and if security concerns under Guideline F arise, be prepared to demonstrate that the individual lives within their means, has developed a policy for dealing with spending and debt (e.g. budget planning). The more that an individual can show that they live within a manageable financial lifestyle, the better.

Conclusion

When facing financial consideration security concerns it is important to have the assistance and advice of counsel. If you need assistance with a security clearance issue, please contact our office at 703-668-0070 or at www.berrylegal.com to schedule a consultation. Please also visit and like us on our Facebook page.

Recent Stories

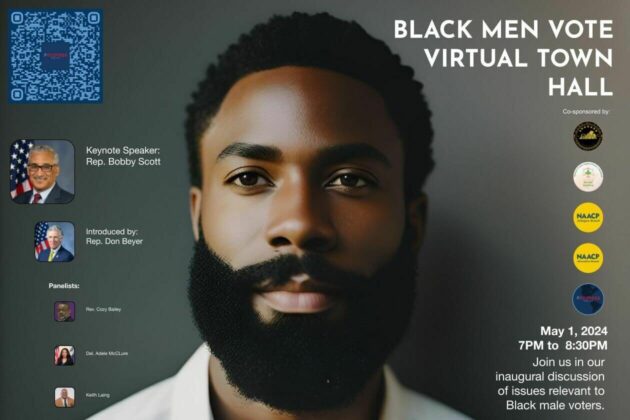

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

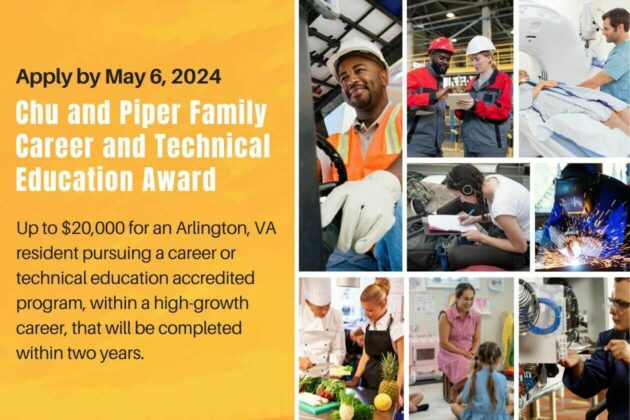

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.