By New York family and matrimonial attorney Mario D. Cometti, a partner with Tully Rinckey PLLC.

The Tax Cuts and Jobs Act (TCJA), which was passed at the end of 2017 and went into effect for the 2018 tax year, has a multitude of new provisions that will have both positive and negative impacts on millions of individuals, including those paying and receiving alimony.

Under previous tax laws, alimony payments under a divorce settlement or decree were deductible for the party making the payments and taxable income for the receiving party. This effectually shifted the tax burden to the lower-earning individual and reduced the taxes owed on that alimony payment, thereby opening a bigger pool of money to pay alimony from.

“Under the TCJA, alimony payments are no longer deductible for the paying party, nor or they considered taxable income for the recipient party in any divorce entered after December 31, 2018,” said Albany matrimonial attorney Mario D. Cometti with the law firm Tully Rinckey, PLLC.

Although this may seem like a win for the recipient and an increase in tax receipts for the government, the actual effect may be less positive.

Alimony payments were an “above the line” deduction, meaning they reduced the taxable income of the individual making the payment. This could provide recipients with leverage in negotiating amounts by showing the tax savings associated with the payments. The result was that an individual could make alimony payments without feeling the full impact of those payments on their net income.

With the new law, the recipient no longer must show alimony as taxable income, but the actual result puts the leverage into the hands of the paying party. The paying party will now be able to argue there is a smaller pool to make payments from because of the lost deduction, while also being able to argue the recipient should be able to do more with a smaller amount because it is tax-free.

If you have questions about this shift in tax law, or alimony and divorce in New York, contact a knowledgeable attorney with Tully Rinckey, PLLC today to schedule your initial consultation.

Recent Stories

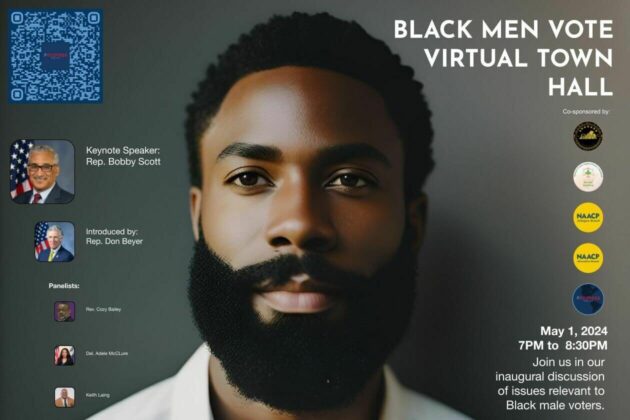

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.