In March, Arlington County was on-track to set a new record low for tax delinquency rates.

Then, the coronavirus hit.

“As the pandemic unfolded, we got further and further from our goal, which was to be expected,” Treasurer Carla de la Pava told the County Board during its recessed meeting on Tuesday.

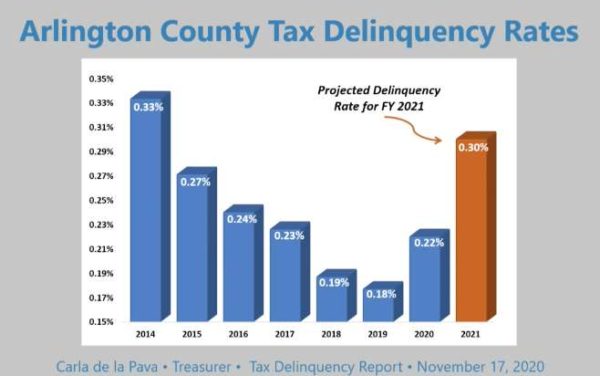

Delinquency rates had decreased by almost half since 2014, but COVID-19 erased two years of record-setting lows. The County is currently out nearly $10 million in uncollected tax revenue, de la Pava said.

For every 10,000 tax-paying residents and business, de la Pava had aimed to have only 17 fall behind, but when the collection year ended on Aug. 14, that proportion increased to 22. She told the County Board that next year, she predicts it will be “difficult, but achievable” to keep the rate under 30 delinquent residents and businesses per 10,000.

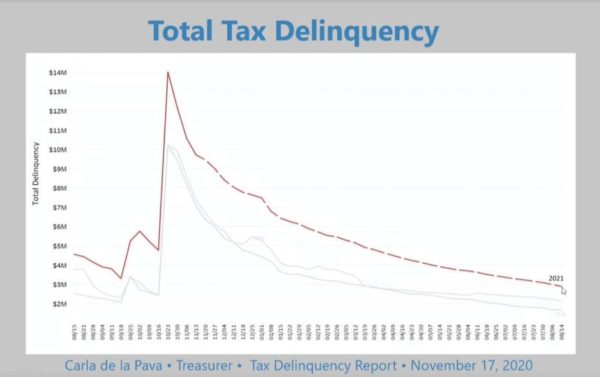

“We have our work cut out for us,” she said. “We started this collection year with the highest rate of delinquencies since I became treasurer,” or about $14 million.

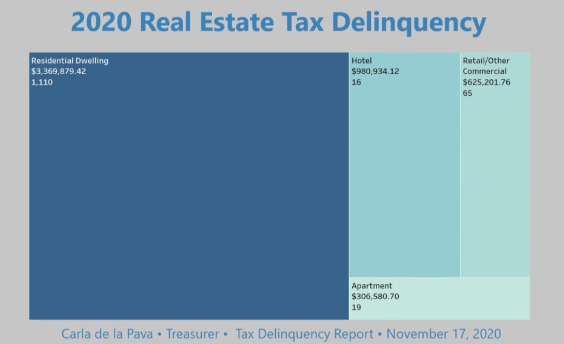

The “elephant in the room” that contributed the most to the spike is delinquent real-estate taxes, which have never been higher in the County’s history, de la Pava said. Overall, the County is missing more than $5 million in property taxes for homes, apartments, hotels and businesses.

The highest percentage of households that have not paid their property taxes are clustered in the 22207 zip code: the northernmost part of North Arlington that includes the Cherrydale, Country Club Hills and Yorktown neighborhoods.

The highest percentage of businesses that have not paid their property taxes are centered in the 22202 zip code (the Crystal City, Pentagon City and Arlington Ridge neighborhoods) and 22206 (the Shirlington, Fairlington and Long Branch Creek neighborhoods).

Taxes on property used for business are also up dramatically, with number of delinquencies concentrated in the 22202 zip code. The amount owed along the Rosslyn-Ballston corridor, however, exceeds all other zip codes combined, de la Pava said.

This June, the treasurer’s office put a number of hotels and big businesses on Taxpayer Assistance Program loans so they could pay their taxes over 10 months, from August 2020 to May 2021. This came after her office offered a two-month deferral this spring that mostly benefited hard-hit restaurants and hotels.

John Marshall Bank, which partners with the county on the short-term loans, lowered its rates to make these repayment plans more affordable, she said.

“We prevented almost $1 million in going delinquent through TAP loans from John Marshall Bank,” de la Pava said.

To encourage safe and timely payments this year, de la Pava said her office added a temporary location this September and encouraged people to pay online, resulting in an 11% increase in online profiles.

The County Treasurer said she found another bright spot in vehicle taxes, which reached the second-lowest delinquency rate in Arlington’s history this year. Outreach, payment plans and automatic billing contributed to the lower delinquency, she said.

The Columbia Pike corridor, or the 22204 zip code, has the highest concentration of vehicle delinquencies, amounting to $1.1 million.

The treasurer’s office drafted 400 payment plans for vehicle taxes, saving $600,000 from going delinquent, de la Pava said.

Images via Arlington County