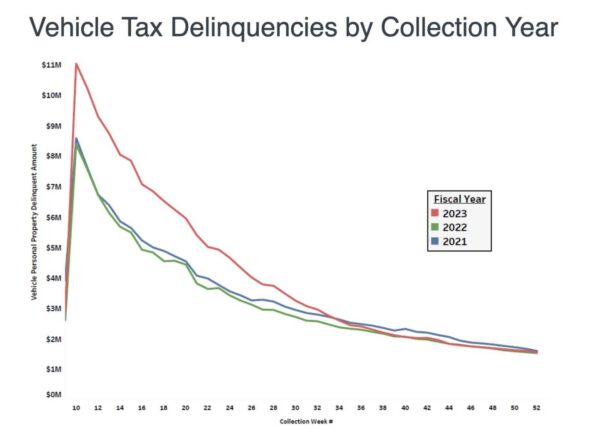

The average Arlington homeowner will see a significant tax increase as part of the new, $1.65 billion county budget.

The Arlington County Board on Saturday approved the FY 2025 budget, which includes a 2 cent tax rate increase. Paired with a 3.3% increase in home values, it will raise property taxes for the average homeowner $430 annually — a 5.3% increase.