This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Eli Residential channel. Enjoy!

Question: How have rental prices and purchase prices changed in relation to each other over the last few years?

Answer: This is not going to be a column about whether you should rent or buy, there are plenty of those. Rather, I’m offering a data comparison of how rental and purchase prices and demand metrics in Arlington have changed in relation to each other since 2018.

We all know that both have gotten mind-numbingly expensive over the last few years, but there’s not really a third option (aside from crashing with Mom and Dad) so everybody is faced with the same decision of whether it’s a better decision/value proposition for them to rent or buy — hopefully this column helps with that decision.

Note: the rental data used below is limited to what is in the MLS, which is a limited data set of the Arlington rental market but it is more than enough data to allow us to capture an accurate reading of the rental market.

Buy a Condo, Rent a House?

Since 2018, the average price of a single-family home has gone up by significantly more (+28.3%) than the average cost of renting a house (+20.7%) in Arlington (note: this does not take mortgage rates into consideration) whereas the average cost of renting a condo (+12.9%) has gone up much more than the average cost of buying a condo (+8%) during that time.

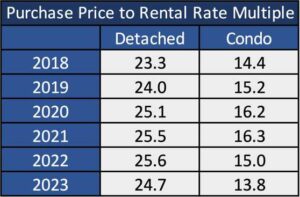

Another way of looking at the price relationship between sale prices and rental rates is to look at the multiple of the average cost to buy compared to the average cost of a 12-month rental. Using the table below, we learn that condo prices are the cheapest they’ve been since 2018 relative to the cost of renting, which may very well be due to high mortgage rates pushing more demand towards renting and away from buying condos.

We can see a modest decrease this year in the cost of buying a house relative to renting, after five straight years of that multiple increasing. This is also likely due to mortgage rates shifting more demand than usual towards renting.

The other key takeaway from the table below is just how much more it costs to buy a single-family home relative to renting one in comparison to buying vs renting a condo.

Renting Ain’t Easy

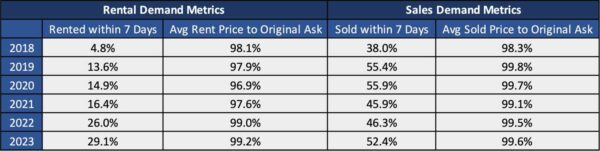

Unfortunately for those fed up with purchase prices, high mortgage rates, and low inventory for purchase, deciding to rent isn’t exactly an easy way out. Not only have rents increased significantly since 2021 — by 10.5% for single-family homes and 15.1% for condos (yes, it’s higher than the increase since 2018 because rents fell in 2020 and 2021) — but the rental market has gotten much more competitive in that time with properties renting more than twice as fast as they did in 2019 and about six times faster than they did in 2018!

The demand metrics below show just how competitive the rental market has gotten over the last two years, because of higher prices and mortgage rates pushing more demand towards rentals. For reference, depending on the season and type of property, about 40-60% of homes for sale go under contract within seven days and usually sell for 99-101% of the original asking price.

How to Use this Data to Decide on Buying vs Renting

The data in the first section suggests that the smart financial decision is to buy a condo and rent a house, right? No, not really. This data isn’t meant to answer your buy vs rent question, rather it can be a helpful input amongst the many other considerations that factor into which decision is right for you/your family.

For example, you may walk away from this column feeling that renting a house is a better financial decision, but the reality of renting a single-family may not actually work for you — it’s harder to find what you want from a rental, you give up a lot of control over the home’s maintenance and condition, you may not be able to live there as long as you’d like, etc.

Condos (and apartments) are a different story though, you have significantly more options from individually owned condos to commercially managed apartment buildings and there a fewer maintenance and condition issues that might negatively affect your day-to-day living and enjoyment of the property.

At the end of the day, the decision to rent or buy should include a wide range of factors and be based on your individual situation, not the opinion of one or two people in the business of making content or who financially benefit from your decision. I do think that a mistake many people make is that once they’ve owned a home, they never consider renting as an option again. I think that for every move you need/want to make, you should give serious consideration to both renting and buying, allowing yourself to revisit assumptions you’ve made, challenge your reasoning, and consider current market conditions.

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Eli Residential channel.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10CA