This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Eli Residential channel. Enjoy!

Question: How did Arlington’s condo market perform in 2023?

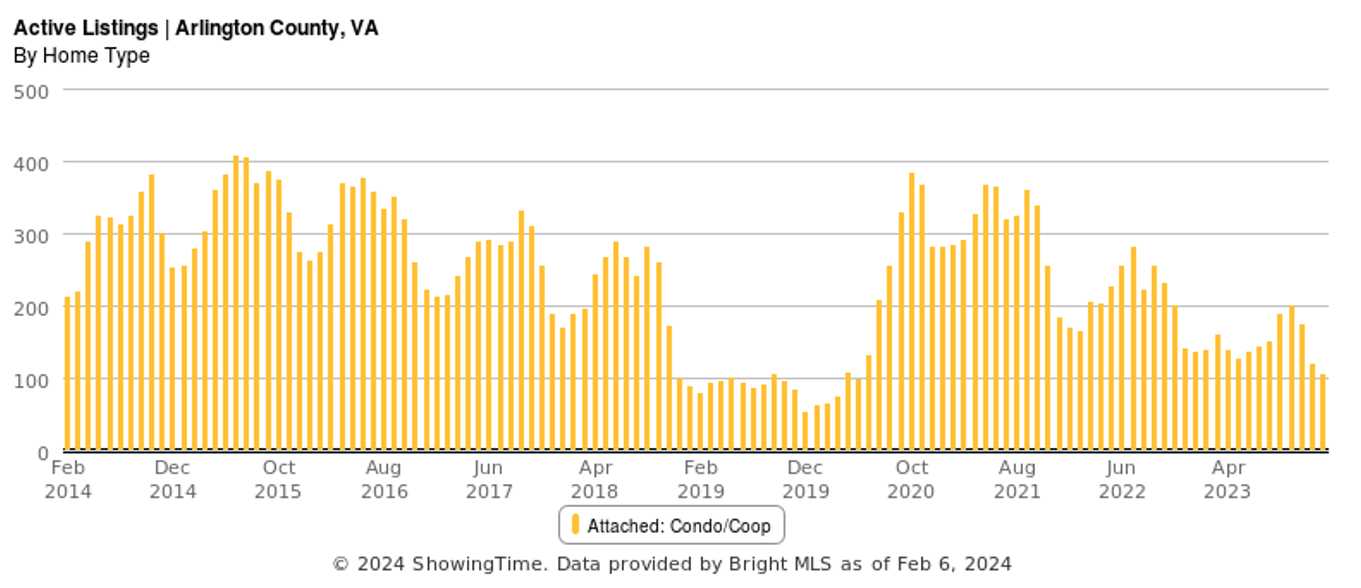

Answer: 2023 was a tough year for condo demand because interest rates for much of the year pushed monthly payments well above the cost of renting a comparable apartment. However, like the single-family market last year, listing volume was so low that it kept prices stable and condo sales moderately competitive despite lower demand. How low was listing volume? We saw about 30% fewer condos listed for sale in 2023 than in 2022 and more than 40% fewer listings last year compared to 2021.

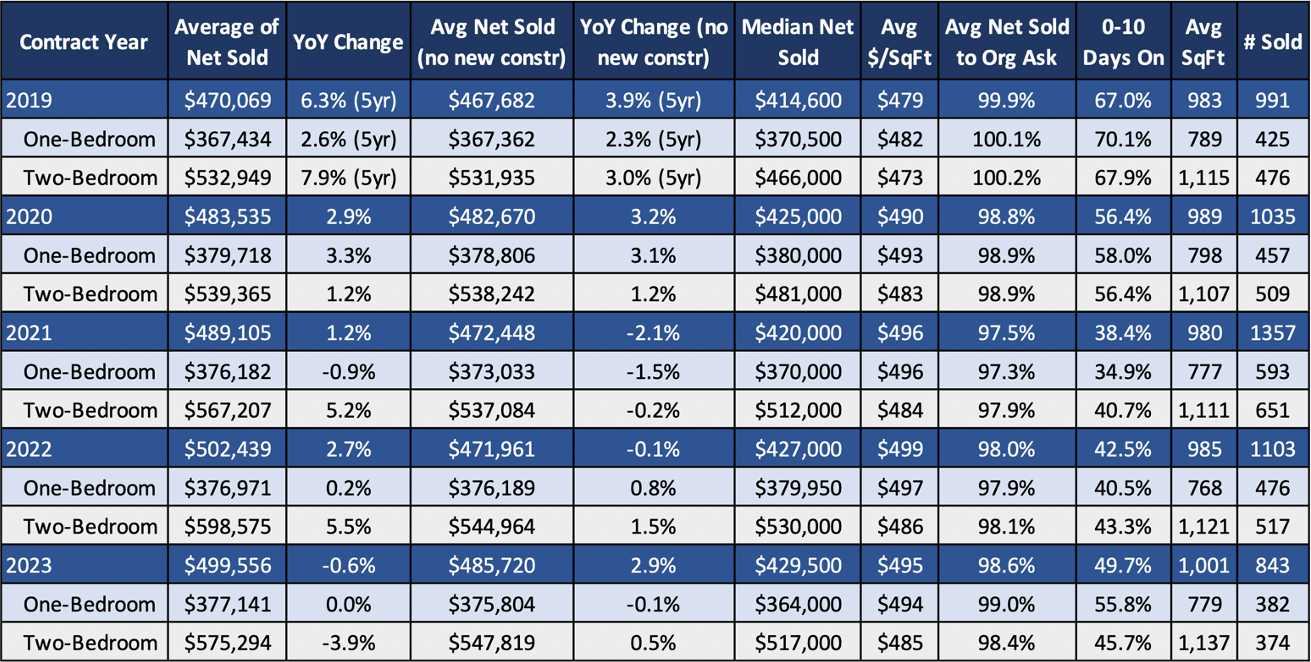

The data below looks at Arlington’s condo market, specifically multi-family condos, last year and the trends over the past five years. Most real estate data sets look at numbers based on the year a home sold/settled, but I prefer to look at data based on when a home went under contract because it gives a more accurate reflection of what was happening in the marketplace at the time the deal was agreed to. For example, many new builds go under contract months to a year or more before they close. I also use “Net Sold” for prices, the sold price less any seller credits, for a more accurate representation of the price paid/received.

Condo Market Steady, Prices Flat

After an up and down few years from 2019-2021 (up from Amazon HQ2 announcement, down from COVID), the Arlington condo market has returned to its natural form — slow and steady. Depending on how you slice the data, the condo market is either up or down slightly in 2023 compared to 2022 so it’s fair to say that condo prices were mostly flat in Arlington last year.

- The average price of a condo in Arlington fell by .6% in 2023, while the average $/SqFt fell .8%, and the median price of a condo increased .5%

- If you remove new construction sales from the data, the average price of a condo increased 2.9% in 2023, but if you drill down into price change by condo size, the average one-bedroom condo dropped .1% and the average two-bedroom condo increased .5%

- Over the past five years, the average condo price is up 6.3% but if you remove new construction from that data, the average condo has gained just 3.9% since 2019

- Competition in the condo market has fallen sharply since the 2019 Amazon HQ2 surge when 67% of condos sold in ten days or less and the average condo sold for full ask. In 2023, just under half of the condos listed for sale were sold in ten days or less and the average condo sold for 1.4% less than its original asking price.

- This was the first time in 5+ years with more one-bedroom condo sales than two-bedroom sales

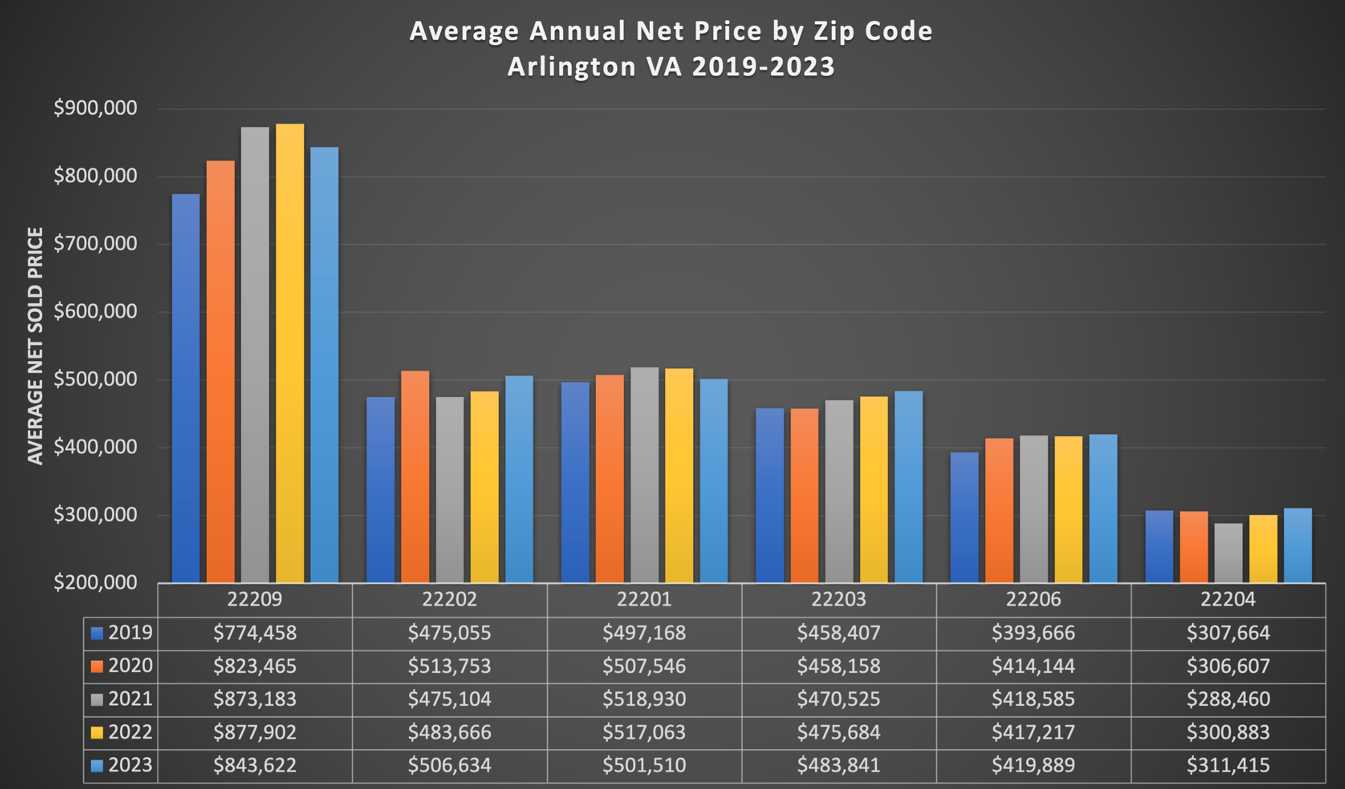

- The most expensive zip code to buy a condo by average price and average $/SqFt is 22209 (Rosslyn area) largely due to being home to some of the region’s most expensive condo buildings including the newly built Pierce condos, Turnberry Tower, and Waterview

- If you remove new construction sales from the data, the zip codes with the strongest five-year average price increase are 22206 (6.7%) and 22202 (6.6%)

Looking Ahead, Upward Price Pressure in 2024

There are strong signs of momentum building in the condo market with a sharp increase in the number of condos sold within ten days on market in 2023 compared to the previous two years, as well as a material decrease in the average amount buyers are negotiating off the original asking price. Combine that with falling inventory levels (charted below), now well below the 10yr historical average, and falling interest rates, I believe we could see some real appreciation in the condo market in 2024; quite possibly in the 3-5% range if rates remain on a downward trajectory.

I also think we will see more condo demand this year than usual due to pent-up demand from buyers who would have normally shifted from rental apartments to condo ownership in 2023, but avoided doing so because rates remained persistently high. I think that as these leases expire in 2024 we will more demand come to market, as long as interest rates remain flat or down.

For All My Condo Board Members and Finance Chairs…

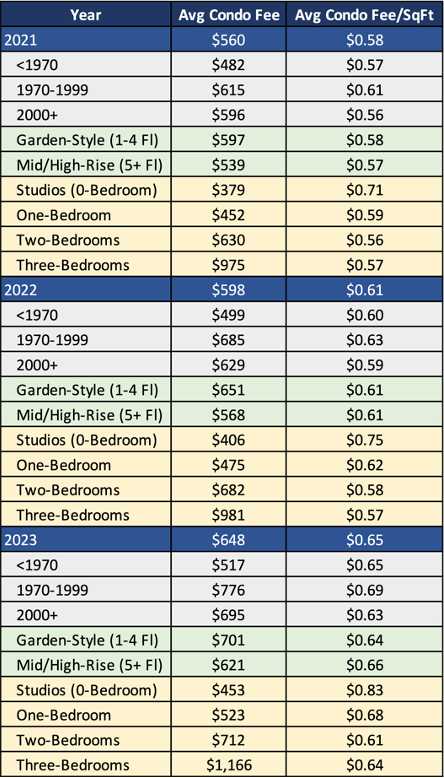

For those of you who have taken the important and thankless job of being on your Condo Board or being part of your Finance Committee (thank you!), I’ve organized condo fee trends across Arlington over the past three years to help you gauge your own fees against the market. In most cases, there is an inverse relationship between condo fees and market values in your building; higher fees result in downward pressure on market values. There are of course exceptions to that, like luxury buildings with high-end amenities and higher staff counts.

Over the past two years, the average condo fee has increase about 16% and the average condo fee/SqFt has increased 12%. Normally, this would be alarmingly high, but it makes sense given the pace of inflation during the period of time. Generally speaking, the goal for communities should be to hold condo fees steady relative to inflation (2-3% annual increases) which makes sense because condo fees are essentially the sum of goods and services used by the Association, divided amongst each unit.

If you would like me to generate some more customized condo fee data sets for your condo, just email me at [email protected].

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Eli Residential channel.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10CA