This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist. Enjoy!

Question: I have recently seen two properties from Open Door listed for less than what they paid for it. Is that common for them or are these outliers?

Answer:

What is Algorithm-based Real Estate?

Algorithm-based buying and selling, also known as iBuying (2019 article here for more details), is when large companies/investors use algorithms (e.g. Zestimates) to assess a home’s value, purchase it (cash), and then resell it for a (hopeful) profit. These are arms-length transactions using corporate-level strategies rather than local ones.

The idea is that there are enough homeowners who value the ease and flexibility offered by iBuyers (cash, quick closings, no showings, etc) over getting a higher price that there’s billions in business for these companies (Open Door is currently valued over $3B). The acquisition and resale values of homes are determined by algorithms that these companies believe give them a clear picture of local markets across the country and competitive advantage at scale.

Zillow lost about $1B over 3.5 years using their pricing algorithms and shut down their iBuying business last year (article here for more details). After Zillow shuttered their iBuying business, it left Open Door as the biggest player in the industry. What makes them different than Zillow is that iBuying is their core business; for Zillow it was a supplemental revenue stream that risked hurting their core business.

I think the business in fundamentally flawed for many reasons, one of them being the massive disadvantages iBuyers are at during shifting market conditions. In strong markets, sellers can achieve the same or similar terms from everyday buyers and iBuyers are competing with everyday buyers on a house they haven’t seen, in a market they don’t know. In a weakening market (like we’re in now), properties they bought months earlier may be worth the same or less than they are when they’re being resold, so profits are smaller and losses much more common.

The greater D.C. Metro area is a relatively small, unattractive market for iBuying for multiple reasons, one being our diverse housing stock makes it difficult to value/project using algorithms; areas with large scale tract housing tend to much more popular with iBuyers (and corporate buy and hold investors) because it’s much easier to calculate market values.

How It’s Going…

As noted earlier, Zillow exited the iBuying business after ~$1B in losses over 3.5 years, leaving Open Door (market cap $3B+) as the main players in this category. I was curious how Open Door’s business is performing in Northern Virginia so I dug into their data from this year.

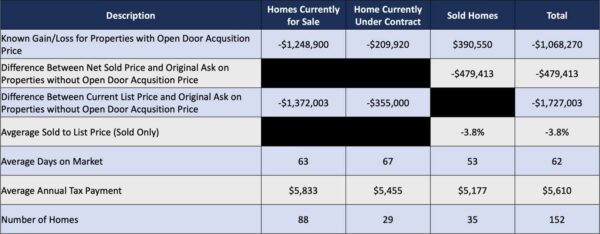

I looked at all of Open Door’s currently active (88), currently under contract (29), and sold (35) properties in 2022 and found 152 properties. I was able to find Open Door’s purchase price on 112 of those properties via public records.

Of the 112 homes I found Open Door’s purchase price on, the total acquisition price for these properties was $63,464,400, for an average of $566,646 per property, ranging from $207,100 to $1,031,800. If we assume their average purchase price held for the 40 properties I couldn’t find an acquisition price for, we can estimate their total acquisition price for all 152 properties in this data set (Northern Virginia sold in 2022 or currently under contract or listed for sale) to be $86,130,257.

Based on the analysis below, I think they may end up losing $5M-$6M+ on these investments.

Known Losses on Closed, Under Contract, and Listed Homes

First, let’s take a look at the gains/losses I can calculate (Known Gains/Losses) based on the known data which is:

- How much Open Door paid for 112 properties

- How much settled properties sold for (including closing cost credits to the buyer)

- How much under contract and active properties are listed for

- That Open Door pays 2% of the sale price to buyer agents (note: in 2021 over 96% of sellers offered at least 2.5% to buyer agents, see analysis here).

I do not know what their other direct costs are including closing costs (on purchase and resale), carrying costs (taxes, HOA fees, utilities), improvements/repairs, marketing, etc but I will address those later in this article.

Here are some highlights on the Known Gains/Losses:

- Known Gains on sold properties are just over $390,000.

- Known Losses on properties under contract or actively for sale are over -$1,458,000 if you assume the property sells for what it is currently listed at (unlikely, more on this later).

- For the 40 properties I do not have the Open Door acquisition price for, I can confirm that they sold five properties for $479,413 less than they originally listed them for (including the 2% commission) and for the 35 homes currently for sale or under contract that I don’t have the Open Door acquisition price for, they’re listed for $1,727,003 less than the original asking prices.

- Of the 35 homes sold, they spent an average of 53 days on market and accepted a price on average 3.8% below the asking price. Only three sold over ask and another three sold for asking. These metrics fall well short of what sellers experienced earlier this year (the average home sold much faster and for at or above the list price).

- The average property tax liability on these 152 homes is estimated to be roughly $71,000 per month.

Projected Losses on Under Contract and Listed Homes

In the section above, I calculated “Known Losses” on properties currently under contract and currently listed for sale by using the most recent list price as the projected sale price, but the reality is that most, if not all, will sell for less.

Of the 35 properties sold in 2022, Open Door accepted an average of 3.8% below their most recent list price with only three selling for over ask and just three more selling for asking price. This was during one of the hottest real estate markets ever, when the large majority of homes were selling for at or above the asking price.

If we assume that all properties currently under contract or for sale will sell for an average of 3.8% below the current list price (that’s probably too optimistic for Open Door), the projected Known Losses on the remaining homes is nearly $3,252,000!

Furthermore, this only accounts for losses on the 82 homes under contract or for sale that I know the Open Door acquisition price of, there are an additional 35 homes that are under contract or for sale that I do not have the acquisition price on so those homes could easily account for another $1M-$1.5M in projected Known Losses.

Additional Unknown Costs

There are plenty of additional direct and indirect costs that we know exist, but would be difficult or impossible for me to calculate including direct costs like their closing costs (e.g. transfer taxes) on the acquisition and resale, months of carrying costs like property taxes, Condo/HOA fees, and utilities, and any improvements/repairs prior to resale (it doesn’t appear they do much). There are also plenty of indirect costs of the operation including salaries of staff working on the deals, marketing each property, and more.

It’s likely that Open Door is taking on roughly $1M-$1.5M in additional direct unknown costs for these 152 transactions.

What Can We Conclude?

I think that we can safely assume that Open Door will be taking $5M-$6M+ in direct losses from the 152 homes they currently have for sale, under contract, or sold in 2022 in Northern Virginia.

For a company currently valued over $3B, these losses are meaningless; and Open Door reported nearly $1.5B in gross profit over the past 12 months (but losses on Operating Income), so clearly they’re winning big in other markets, but what conclusions can we draw from Open Door’s experience?

In my opinion, the most concerning data from Open Door’s Northern Virginia activity is not the millions in losses it’ll take on currently for sale and under contract properties, but the poor performance of their closed sales from earlier this year in a historically strong market. When you account for the unknown additional direct costs on those sales, Open Door is likely coming in at roughly break even. Additionally, the days on market and sold price to ask price ratio data (two key measures of resale success) is much worse than the rest of the market.

We can reasonably conclude that they overpaid for their acquisitions because they generated little-to-no profit, despite a rapidly appreciating market and we can conclude that their resale process/strategy (pricing, prep, listing management, negotiations, etc) performs significantly worse than market average.

As I mentioned above, they clearly are not having these problems in all markets because they’ve generated significant gross profits from their transactions (although they’re taking losses in Operating Income). Many markets are much easier to operate in with an arms-length, hands-off approach. Our market is not. I’ll leave you with some thoughts:

- Local markets behave very differently and present vastly different nuances that make a national approach to local real estate difficult to execute.

- The greater D.C. Metro area market is a difficult one for algorithms to figure out because of the diversity in housing stock and nuances of price shifts over small geographic areas.

- The greater D.C. Metro area market will be a difficult market for high volume corporate buyers to profit from without taking a localized approach, which is expensive and complex.

- Our market is overwhelmingly full of smart, educated, and savvy home sellers and buyers relative to other markets which means that we are more likely to exploit flaws in corporate-level buying/selling strategies that are not specifically tuned to our market or markets like ours.

- There are plenty of examples where algorithms and/or arms-length, uninvolved are successful, there’s excessive risk of that approach in our market and it is unlikely to be more profitable than time-tested, human expertise in the long-run or at scale.

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. (703) 390-9460