Del. Patrick Hope (D), who represents part of Arlington in the Virginia House of Delegates, has proposed a bill that would raise taxes on tobacco products to fill several gaps in the state’s Medicaid budget.

Del. Patrick Hope (D), who represents part of Arlington in the Virginia House of Delegates, has proposed a bill that would raise taxes on tobacco products to fill several gaps in the state’s Medicaid budget.

The bill would raise the tax on cigarettes from the current $0.015 per cigarette to the national average of $0.0725 per cigarette, or $1.45 per pack. Virginia currently has the lowest cigarette tax in the U.S.

The bill would also raise the tax on snuff and other tobacco products. Cigars would be taxed at 50 percent of the wholesale price, up from 10 percent.

Hope’s legislation would direct 52 percent of the additional tax revenue (estimated at about $250 million) to fund Medicare waivers for intellectual and developmental disabilities. Forty percent of the revenue (about $150 million) would go to Medicaid reimbursement for physicians and hospitals. And 8 percent (about $30 million) would be split among the state tobacco quitline and a youth tobacco prevention program.

“Virginia’s Medicaid budget is on an unsustainable course,” Hope said in a statement. “Cuts to Medicaid only result in higher costs down the road. The sick end up in the hospital and ERs for costly medical procedures and avoidable hospitalizations; and individuals with disabilities wind up in institutions rather than being served in their communities for a fraction of the cost. This proposal will take a significant step in preserving and protecting the Medicaid program for future generations and will fulfill a promise to Virginia’s families.”

What do you think?

Virginia has traditionally been one of the more tobacco-friendly states in the country, making consideration and passage of such a bill an uphill battle. Hope has received public words of encouragement, however, from a number of influential health-related organizations, like the Medical Society of Virginia, the American Cancer Society and the American Heart Association.

See the press release prepared by Hope’s office, after the jump.

RICHMOND – As the General Assembly begins its work for the 2011 legislative session, Del. Patrick Hope announced legislation that will raise the cigarette tax to $1.45 and dedicate the revenue to fill several gaps in Virginia’s Medicaid budget.

“Virginia’s Medicaid budget is on an unsustainable course,” Del. Hope said. “This bill will not only sustain the program but it will put it on a pathway to slow the growth and save taxpayers money.”

Hope’s bill, HB 1815 – Medicaid Preservation and Protection Act will:

- Raise the excise tax on cigarettes by $1.15, from $0.30 to the national average of $1.45

- Raise the excise tax on other tobacco products from 10% of the wholesale price to 50% of the wholesale price

- Direct 52% of the new revenue (approximately $253.8 million) to fund Medicaid waivers for intellectual and developmental disabilities

- Direct 40% of the new revenue (approximately $155.9 million) to Medicaid reimbursement for physicians and hospitals

- Direct 8% (approximately $31.2 million) to fund tobacco cessation and prevention programs in the Commonwealth.

Virginia currently ranks in the bottom ten states (45th) for its spending per capita income towards services for people with developmental disabilities. More than 6,400 people with intellectual and related developmental disabilities are on waiting lists for the Intellectual Disability (ID) and Developmental Disability (IFDDS) Waivers, the funding mechanisms that provide community-based services. The Department of Behavioral Health and Developmental Services has reported that over 50% of the people on the ID Waiver waiting list, 2,946, meet the state’s “urgent need” criteria

“Del. Hope’s bill will help the Commonwealth keep its promise to eliminate the ID and IFDDS Waiver waiting lists,” said Jill Egle, co-executive director of The Arc of Northern Virginia. “In 2009, the General Assembly unanimously passed legislation stating the intent to eliminate the ID and IFDDS Waiver waiting lists by the 2018-2020 Biennium. Unfortunately, the funding necessary to achieve this important goal has not been made available and the waiting list has grown due to inaction.”

Medicaid payment rates for physicians and other healthcare providers are scheduled to be cut by four percent on July 1, 2011. Revenue from HB 1815 would offset that cut.

“It is becoming increasingly difficult for physicians to maintain their practices and continue to care for the growing number of Medicaid enrollees when they are providing services at below cost. In a recent survey over half of the physicians who responded said that the additional cuts scheduled for July 1 will force them to make personnel changes or stop taking new Medicaid patients. It’s an unfortunate and personally difficult dilemma for many of us who chose this profession so that we could help those in need,” said Medical Society of Virginia President Cynthia C. Romero, M.D., FAAFP.

Members of the public health community applauded the proposal to raise the cigarette tax. “The evidence is clear that increasing the price of cigarettes is one of the most effective ways to reduce smoking, especially among children and pregnant women,” said Keenan Caldwell, director of government relations for the American Cancer Society. “Preliminary evidence confirms that every state that has significantly increased its cigarette tax in recent years has enjoyed substantial increases in revenue, even while reducing cigarette sales. Virginia has nothing to lose and everything to gain from raising its cigarette tax.”

The Annual health care expenditures in Virginia directly caused by smoking are $2.08 billion, with $401 million covered by the state Medicaid program.

According to the Campaign for Tobacco-Free Kids, a $1.15 increase in Virginia’s cigarette tax would prevent more than 73,800 Virginia kids alive today from becoming smokers and prompt 45,500 adult smokers to quit, saving 35,600 Virginians from a premature, smoking-caused death.

“A significant tobacco tax increase combined with funding for tobacco prevention and cessation programs will deliver the maximum health and economic benefit for Virginia. These steps will prevent kids from starting to smoke, help smokers quit, save lives, and save taxpayers money by reducing smoking-caused health care costs,” said Cathleen Smith Grzesiek, senior director of government relations for the American Heart Association.

Del. Hope concluded, “We cannot afford doing business as usual. Cuts to Medicaid only result in higher costs down the road. The sick end up in the hospital and ERs for costly medical procedures and avoidable hospitalizations; and individuals with disabilities wind up in institutions rather than being served in their communities for a fraction of the cost. This proposal will take a significant step in preserving and protecting the Medicaid program for future generations and will fulfill a promise to Virginia’s families.”

Patrick A. Hope is a Member of the Virginia General Assembly as the Delegate from the 47th District representing part of Arlington County. He serves on the House Courts of Justice Committee and House Health, Welfare, and Institutions Committee.

Recent Stories

For Immediate Release

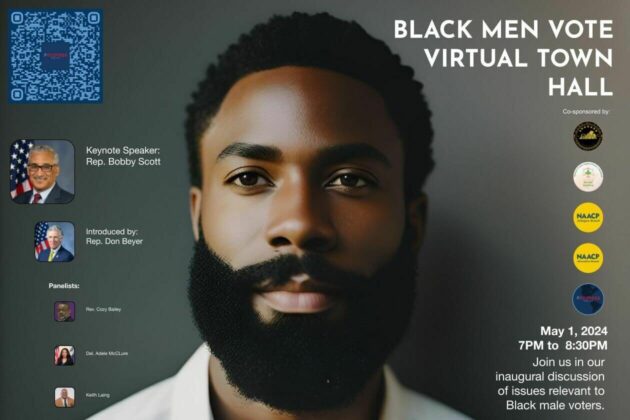

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.