This biweekly sponsored column is written by the experts at Gordon James Realty, a local property management firm that specializes in residential real estate, commercial real estate and homeowner associations. Please submit any questions in the comments section or via email.

Mortgage rates. Sound boring, right? They’re actually pretty fascinating — especially if you are in the market for a new home. Even if you don’t think so, you better get used to them because it’s something that will come up a lot in the journey to home buying — and even sometimes renting.

First of all, if you are trying to educate yourself on mortgage rates, you may be having a hard time just Googling “mortgage rates.” Typically, the results yielded will be from different lenders claiming they have the best rates. If you haven’t figured it out already, there are a lot of ads for mortgages on the web. You’ve probably seen a ton of different rates from a ton of different lenders. But if you’re not actually looking into that right now and just want to learn more about mortgage rates in general, we are here to help.

Wonder how mortgage lenders and banks even come up with interest rates in the first place? Wonder why a lot of mortgage rates are so different? Well, to better understand all of that, you need to fully understand how mortgage rates are determined.

One of the most important aspects to successfully obtaining a mortgage is securing a low interest rate. After all, the lower the rate, the lower the payment each month. The smallest even quarter of a percent of a change could mean thousands of dollars in savings or costs annually. And even more over the entire term of the loan. Keep in mind — mortgage terms often last a very long time.

When you are offered a rate, it will either be a whole number, such as 2 percent, or 2.125 percent, 2.25 percent, 2.375 percent, etc. The next stop after that is 6 percent, then it repeats itself. Get it? For all you math minds, this should not be too tricky to you.

So, how are mortgage rates set? There are many different factors. If you just want to determine whether rates are going to rise or fall, they say that the best indicator is the movement of the 10-year Treasury bond yield. Most mortgages are sold as lasting for 30 years. But the average mortgage is paid off or refinanced within 10. Treasuries are backed by the “full faith and credit” of the United States, so you can feel confident in their determinations.

Mortgage rates can change a lot. They are different all throughout the U.S. Some states have high mortgage rates and some have low ones. In fact, they can even vary by county. For example, in Washington, D.C., mortgage rates may be higher than in Arlington.

This is not because the mortgage lenders are out to get you in D.C. No, it’s because lenders want to increase their business in a certain part of the country, and thus they’ll offer better pricing for lower rates in, for example, Arlington. Or maybe in Seattle or areas of Dallas, Texas.

It can really be a toss up. And for that reason, this is why you must shop around. Don’t go with the first rate or lender you see, unless you think it’s the best deal. You can easily compare mortgage rates online. Then, you can also easily check mortgage rates with your bank and/or credit union.

It all depends on economic activity, unemployment rates, the stock market, home sales, consumer confidence, home loans, loan criteria and much more. To prove this, we are going to take a couple of states from the north, east, south and west and compare mortgage rates. Let’s compare some 30-year and 15-year fixed loans from state to state. Here we go! (Keep in mind, these are always subject to change – and they do!)

- New York: A 30-year fixed loan rate is 4.07 percent and a 15-year fixed loan rate is 3.26 percent.

- California: A 30-year fixed loan rate is 4 percent and a 15-year fixed loan rate is 3.18 percent.

- Florida: A 30-year fixed loan rate is 3.96 percent and a 15-year fixed loan rate is 3.13 percent.

- Texas: A 30-year fixed loan rate is 3.97 percent and a 15-year fixed loan rate is 3.14 percent.

- Virginia: A 30-year fixed loan rate is 4.02 percent and a 15-year fixed loan rate is 3.17 percent.

- New Mexico: A 30-year fixed loan rate is 4.06 percent and a 15-year fixed loan rate is 3.24 percent.

- South Dakota: A 30-year fixed loan rate is 4.04 percent and a 15-year fixed loan rate is 3.22 percent.

- Alabama: A 30-year fixed loan rate is 4.10 percent and a 15-year fixed loan rate is 3.26 percent.

- Oregon: A 30-year fixed loan rate is 4.05 percent and a 15-year fixed loan rate is 3.23 percent.

Want more great blogs on everything property and mortgage-related in the DC and Arlington area? Visit GJR.

Gordon James delivers full-service residential property management for single-family homes, multi-family homes and condo units in Washington, D.C. and Northern Virginia.

Recent Stories

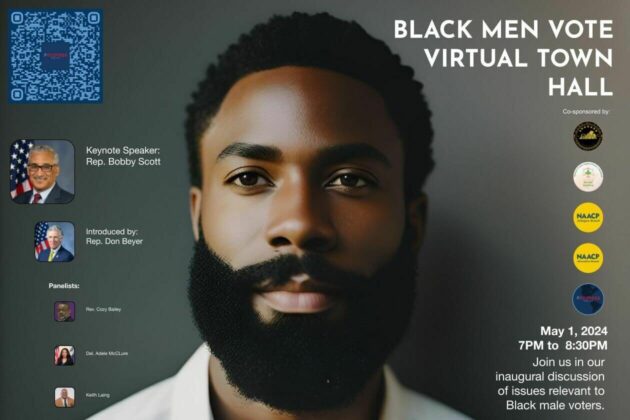

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.