(Updated at 1:55 p.m.) Arlington County has collected some $11.5 million in property tax deposits for future years, according to Treasurer Carla de la Pava, but it’s unclear whether taxpayers will be able to deduct those prepayments from their 2017 federal taxes.

Following a ruling by the IRS yesterday, limiting deductions to property taxes assessed in 2017, the county issued a statement Thursday afternoon that made it clear that Arlington is unable to assess 2018 property taxes until the County Board sets the tax rate in April.

The Arlington County Treasurer’s Office and Arlington County have received multiple inquiries based on the statement issued by the Internal Revenue Service on December 27, 2017, concerning deductibility of the property taxes. Neither the Treasurer nor the County staff will be offering individuals advice on tax issues and suggest people consult with a tax professional for any IRS related questions.

Arlington County, through the Department of Real Estate Assessment issues real property tax assessments each year in mid-January. The assessments for Calendar Year 2018 will be completed in mid-January and mailed to residents at that time.

Bills for taxes owed for calendar year 2018 are generated by the Treasurer after a tax rate is set by the County Board in April.

Those bills are due and payable in two installments – by June 15 for the first portion, and October 5 for the second portion.

De la Pava says the tax office has been inundated with tax deposits this week, but the activity has slowed considerably since the IRS ruling.

Taxpayers hoping to save on their taxes before the $10,000 cap on state and local tax (SALT) deductions goes into effect next year have jammed the phone lines and the payment queues of the treasurer’s office. So far, $11.5 million in deposits have been made across more than 1,500 tax accounts, de la Pava said.

That includes some $4.5 million collected over a six hour span Wednesday, before the ruling, but it also includes $1.8 million collected today following the IRS determination.

De la Pava said that her office, which is roughly two-thirds staffed because of the holidays, handled 1,500 phone calls yesterday, while keeping wait times to around 30 minutes.

“It was crazy,” she told ARLnow.com. “They did the best they could.”

De la Pava and other county officials are being careful not to give federal tax advice to residents given the ongoing uncertainty.

“The only thing I can say is that the real estate assessments have not been made and will not be made in 2017,” she said.

Bobby Grohs of RLG Tax Advisors, an Arlington-based CPA firm, told ARLnow.com that the letter of the law suggests that deposits for Arlington property taxes will not be deductible.

“A prepayment of anticipated real property taxes that have not been assessed prior to 2018 is not deductible in 2017,” he said. “Since Arlington does their 2018 assessment in January, prepaying these taxes in 2017 will not permit you to take a deduction on your 2017 tax filings.”

But that has not stopped the tax deposits, which are continuing to flow in, though at a reduced rate. Some taxpayers believe that there will be lawsuits that may end up reversing the IRS ruling, we’re told.

Other D.C. area jurisdictions, meanwhile, are collecting prepayments that should be deductible under the IRS rules. Among them are the City of Falls Church and the District of Columbia, which have already assessed next year’s property taxes.

Recent Stories

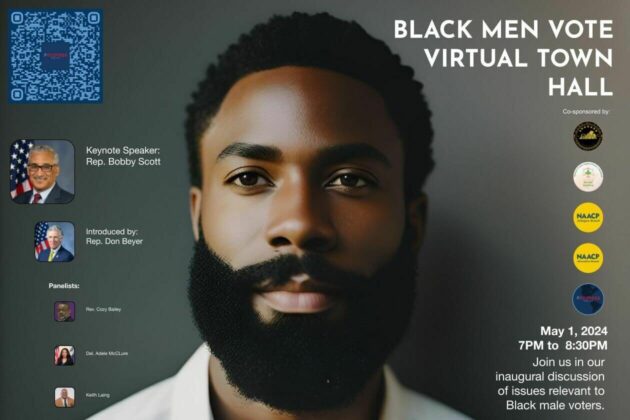

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.