This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Rosslyn resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: What were the real estate related changes in the new tax plan and how will those changes impact our local real estate market?

Answer: Spending an hour every week working on my taxes in QuickBooks doesn’t qualify me as a tax expert, so before I provide my take, I’d like to introduce local tax expert Molly Sobhani, CPA of Klausner & Company, located in Rosslyn, to break-down the key changes in the new tax plan that will effect how buyers and homeowners make real estate decisions. Following Molly’s explanation, I will provide my personal thoughts and stats, which stand in contrast to most of the opinions I’ve read.

If you would like to follow-up with Molly about the tax bill or any other tax questions, she can be reached directly at [email protected] or (571) 620-0159. Take it away Molly…

After weeks of confusing, convoluted and contradicting proposals introduced by the House and Senate, the Tax Cuts & Jobs Act (TCJA) was signed into law on December 22 by President Donald J. Trump. As the dust continues to settle on TCJA, taxpayers across the country are wading through the tax reform bill and the impact of those changes.

With increases to the standard deduction, changes to the deductibility of mortgage interest and limits on property tax deductions, current homeowners and potential homebuyers have a lot to think about. The housing market will undoubtedly be impacted but how – exactly – is still a big question mark.

Summary of Major Tax Law Changes Impacting Residential Home Ownership

- Interest will only be deductible on mortgage debts used to acquire your principal residence or a second home of up to $750,000 (or $375,000 for a married couples filing separately). The phase-out of deductible interest begins after the loan balance exceeds $750,000. This new debt limit applies to all loans incurred after December 15, 2017.

- Interest on home equity debt (also known as Home Equity Lines of Credit or HELOCs) will no longer be deductible. This is true regardless of when the home equity debt was incurred.

- State and local taxes (also known as SALT deductions) will be limited to $10,000 per year. This category of deductions also includes property taxes paid on homes.

- The Standard Deduction has increased substantially from $12,700 for joint filers ($6,350 for single filers) in 2017 to $24,000 for joint filers ($12,000 for single filers) in 2018.

One provision that did not change is related to the capital gain exclusion of up to $500,000 for joint filers ($250,000 for single filers) on the sale of a primary residence. You still must use the home as your primary residence for at least two of the last five years in order to be eligible for the full exclusion.

So why do these new tax provisions make homeownership a trickier decision? The incentives for being a homeowner have now been substantially diminished by the new laws for many taxpayers.

A Hypothetical Scenario

A married couple earns $150,000/year in wages and is looking to buy a home in Arlington, VA. Their total state income taxes are $8,625 (5.75% of their $150,000 wages.) They have no other deductions to itemize in 2017 so they will take the $12,700 standard deduction.

In January 2018, they buy a condo for $425,000. They put down 20% and borrow $340,000 at 4%. They are under the $750,000 mortgage debt cap so they are eligible to deduct all of the interest they pay on their loan each year. In the first year, their total interest expense totals $13,491. Their property taxes are $4,233 based on Arlington’s 2017 rates for a $425,000 assessment. Our married couple has a brand new home and all these brand new deductions, right?

But wait! After we add the new property tax deduction of $4,233 to the $8,625 they already pay in state income taxes, they are over the $10,000 limit for SALT deductions. In this example, $2,858 of their property taxes are not deductible.

Fine. Let’s look at their total deductions then: they have the maximum $10,000 SALT deductions and $13,491 of mortgage interest, totaling $23,491. Under the old tax laws, they would itemize their deductions and see a reduction in their Federal and state taxes for these additional expenses.

But we’re not working under the old laws anymore, are we? Under TCJA, even after spending all this money on buying a new home, paying the interest on their mortgage and paying their property taxes, they are actually still better off taking the standard deduction of $24,000.

Why Bother?

As you can see from the example above, by increasing the standard deduction to $24,000 for a married couple filing jointly, many taxpayers who otherwise would have itemized may now benefit more from the standard deduction. This essentially takes away the tax benefit of owning a house for some people. And the question that many potential homebuyers may consider is: “Why bother?” More and more, they may delay the decision to buy in favor of renting.

Other Potential Effects on Housing Markets

Home values may be impacted, too, by the change in tax laws. If mortgage interest is limited to $750,000, houses that are listed at prices over $937,500 (assuming a buyer puts 20% down) may not be as appealing to new buyers as lower-priced homes.

Another consideration is how the disparity in state income and state property tax rates may drive homebuyers into lower tax rate states. In high tax states, there could be multiple scenarios in which taxpayers lose 100% of the tax benefit of paying property taxes.

Conclusion

Of course, there are other (wonderful) reasons to buy a home and other (wonderful) reasons to buy a home in certain neighborhoods. The upsides generated from the Tax Cuts & Jobs Act, though, are severely lacking.

Eli’s Closing Stats and Thoughts

According to The Washington Post, Moodys Analytics predicts that home values in Arlington will drop 2.3% as a result of the new tax bill, with drops of 2% in DC, 2.5% in Montgomery County, 2.6% in Loudon County and 4% nationally. Of course, this analysis is limited to the impact of the tax bill and doesn’t take any other growth factors into consideration. In other words, if Arlington continues its growth from 2017 (3.1%), we wouldn’t see actual losses, but stunted growth.

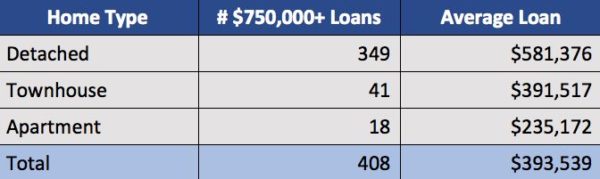

The change in SALT deductions and increase in the Standard Deduction will reduce the benefit of homeownership for many Arlington residents, but let’s take a look at how many homeowners are likely to be impacted by the reduction of the mortgage interest deduction limit to $750,000. Of the 3,100+ homes sold in Arlington in 2017, just over 400 were bought with loans exceeding $750,000. Approximately 30% of detached homes in Arlington (350 of 1,150 sales) had a loan exceeding the new limit. Keep in mind, however, that homeowners with loans over $750,000 will still be able to deduct interest on the first $750,000.

I Don’t Believe The Market Will Suffer

While these stats and Moodys’ analysis are great, they fail to capture how homebuyers actually make decisions in the real world. The majority of buyers decide to purchase a home because of a major life event (marriage, kids, job change, etc) and once they’ve decided to purchase a home, their budget is based on how much they have saved for a down payment and how much they can afford each month in housing costs.

Their monthly budget is primarily based on income and the sum of mortgage payments, property taxes, any HOA fees, insurance and maintenance. SALT and mortgage interest deductions don’t factor into any of the core considerations for most homebuyers.

Let’s Be Realistic

Let’s be honest, for most people, taxes are a once-a-year afterthought and tax planning is mostly crossing their fingers, hoping for a few dollars back. For those who do pay close attention to their tax exposure and who stand to lose out on the benefits of the mortgage interest and SALT deductions, I question how much it actually matters.

Previously, the mortgage interest was capped at $1M and there were just 163 (5%) homes purchased in 2017 with a loan of $1M or more who will be “fully” effected by the change to a $750,000 cap. In the first year, the interest paid on that difference of $250,000 is about $10,000 (drops each year), so for somebody with an effective tax rate of 30%, that’s a $3,000 change to their bottom line from last year.

Adding the change in SALT deduction increases that for many people and $3,000+ is nothing to sneeze at, but we’re talking about the wealthiest homebuyers with incomes exceeding $250,000/year. I’d bet that for those who are conscious of the net effect on their bottom line, they’re more likely to find ways to save this money somewhere else than their home purchase.

Plus, the tax plan provides substantial benefits to wealthy Americans and may very well have a net positive effect on their bottom line anyway. Also, does anybody really think that somebody negotiating on a $1.5M+ home they plan to live in for 15+ years will pay $5,000 less because that’s the calculated net impact from mortgage interest and SALT on their 2019 taxes under the new tax bill? No way.

Let’s be realistic about the psychology of home buying and what determines buying power because that’s what impacts home prices, not expensive studies funded by special interest groups (yes, I’m kind of calling out the National Association of REALTORS for fear mongering).

If you’d like a question answered in my weekly column, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at (703) 539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with Real Living At Home, 2420 Wilson Blvd #101 Arlington, VA 22201, (202) 518-8781.