This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Rosslyn resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: Does the amount of money I put down have an impact on how much I can negotiate the purchase price?

Answer: In a multiple offer situation, the amount of your down payment may be the difference in whether or not your offer is accepted, but in non-competitive negotiations, the data shows that it only really matters if you’re putting 0% down or paying 100% cash.

From 1% down to 99% down, there isn’t a strong correlation between the amount of a down payment and a buyer’s bargaining power.

Data Set

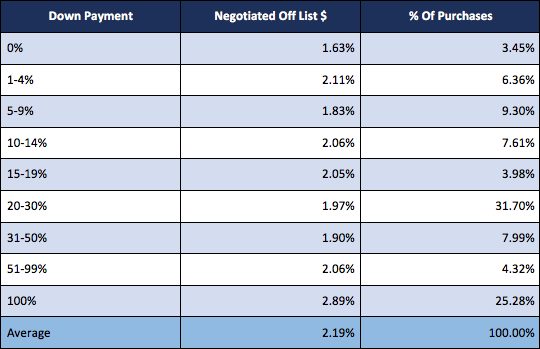

Below is a data table of 3,192 home sales in Arlington since 2017, inclusive of any closing cost credit paid by the seller, excluding new construction and any sales with a purchase price above the list price.

Note: loan data is manually entered into the MLS by the seller’s agent and is not quality checked so there is some level of human error, but with nearly 3,200 data points the sample size mostly off-sets incorrect entries. I also cleaned up a handful of data points that were clearly wrong.

Key Findings & Notes

- Buyers putting 0% down are clearly at a disadvantage in negotiations and buyers paying all cash (thus no financing or appraisal contingencies) negotiate nearly 1% more off the list price (avg 2.89% off) than all other buyers (avg 1.96% off)

- The most surprising data point is that buyers putting 1-4% down negotiate more off the list price than every other range except all-cash. I believe this is due these buyers also putting a high priority on negotiating seller-paid closing costs in the deal, thus many buyers will only purchase homes that sellers are willing to negotiate on. Only 20% of these buyers paid full price.

- The second most surprising data point is that 25% of Arlington buyers paid all-cash. Reader and frequent ARLnow commenter, Dave Schutz, noted this from the numbers in last week’s column on VA loans. Cash buyers tend to purchase less expensive homes, with the majority of cash purchases being condos, below the average market price (likely many investors). Also, many of the single-family homes purchases for cash are developers.

- 0% down loans are almost exclusively VA (Veteran Affairs) loans and 100% down refers to all-cash purchases

Why Put More Down?

If you don’t gain any leverage negotiating your purchase price by putting more money down, why should you?

Mortgage insurance is a big reason, which can add hundreds of dollars per month to loans with less than 20% down.

This is where having a great financial team can be helpful. Not only does that mean a lender who will take the time to advise you on your loan options, but I also suggest involving your financial advisor and/or accountant in this decision to determine the impact of different loan structures on your personal finances.

Bottom Line

It may come as a surprise to many that buyers with less money to put down (seemingly less qualified) have similar bargaining power as buyers putting 50% or more down, but the bottom line is that sellers are focused on the probability that a buyer will be able to close the deal they’re offering on time.

A buyer putting 3% down with a strong pre-approval from a reputable lender has a higher probability to close, and close on-time, than somebody putting 50% down with a weak pre-approval from a big bank or online lender.

If you’d like a question answered in my weekly column, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at (703) 539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with Real Living At Home, 2420 Wilson Blvd #101 Arlington, VA 22201, (202) 518-8781.

Recent Stories

Still planning for summer camps? Check out the great variety of art projects and fun teachers at Art House 7 in Arlington. We have morning, midday, and afternoon weekly camps for ages 5-13. Among our themes: Clay Creations; Animals Around the World; Arts & Crafts; Draw, Paint & Sculpt Faces & Animals; Drawing & Printmaking. We’ve recently added PaperPalooza (paper making and bookmaking) and Jewelry camps. You can see all our listings on our website.

Art House 7 has been a haven for artists of all ages since 2015, offering classes, camps, and workshops. We’re located on Langston Blvd. near the Lee Harrison Shopping Center. We have an ample 2-story studio, and plenty of free parking.

Weekly camps at Art House 7

– June 17-Aug. 9

– Camp times: 9-11am, 11am-2pm, 2:30-4:30pm

– Ages 5-13

5537 Langston Blvd., Arlington VA 22207

Sarah Moore, LPC, is a therapy practice specializing in women’s mental health across various life stages.

We work with women, couples and teens in Virginia and Washington, DC. online and at our office at 1530 Wilson Blvd. in Arlington.

Our specialties include Cognitive Behavioral Therapy (CBT), the Gottman Method for couples and the Path to Wellness for pregnancy and postpartum.

Many of our clients are experiencing major transitions in their lives, either personally or professionally — or at school. A good portion are athletes. And many are caretakers.

Fascination

Goth-Dark Wave Dance Party with Belly Dancing and Drag King Show.

Part of OurAlternative Thursdays for Alternave People with Alternative Lifestyles

Performances By

Belladonna and the Nightshades

Ya Meena

Drag King - Ken Vegas

DJ Michelle Guided

National Chamber Ensemble – Concerto Celebration

We invite you to join us for an extraordinary evening of music at our Season Finale, “Concerto Celebration”! Enjoy several masterworks as NCE performs two famous concertos in an intimate chamber music setting, opening with a delightful work by Chevalier