This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Rosslyn resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: I’ve read a lot of articles that millennials are not buying homes and with Arlington being such a popular destination for millennials, do you see that causing a drop in real estate prices in the future?

Answer: I’m sorry. I can’t stand the constant millennial click-bait analysis either. I really didn’t want to write a column about millennials (born early 80’s through the 90’s), but here we are. Having been asked the same version of this question four times this month during meetings with homeowners, I figured it was worth addressing.

While accusing millennials of killing home buying isn’t as bad as accusing millennials of killing Mayonnaise, it’s just as misguided. Millennials are and will continue to seek home ownership like generations before them. Here’s why the “Millennials Don’t Buy” theory is wrong:

Most Millennials Are Not Old Enough

It makes sense to study the entire generation for things like media consumption, something that people do at all ages, but not home-buying. Currently, the youngest millennials are just heading to college and the oldest are in their mid-to-late 30’s.

Historically, the average first-time homebuyer has been in their early 30’s, so we’ve only seen about one-third of the generation reach average home-buying age. Let’s wait for more of the generation to reach their early 30s before we make broad assumptions about their home ownership preferences.

I’m confident that 5 years from now, home ownership trends amongst millennials in the DC Metro will be as strong or stronger than previous generations. The 20-somes I meet with are eager to stop renting and start building equity.

The Great Recession

For those that point to millennials waiting longer to buy their first or second home, historical perspective is important. The oldest third of millennials (those in their 30’s) were in the early stages of their careers during the Great Recession so the generation got off to a slow start saving up for a down payment and building an income to support a mortgage.

Tighter Lending Practices

The Great Recession also led to tighter lending practices (rightly so) requiring higher savings, higher incomes and more restrictions than before. Couple that with the difficulty building a savings and income, as noted above, and even those highly motivated to buy were forced to rent a bit longer.

Not Rushing to Major Milestones

Home buying is often aligned with other major life milestones like marriage and having children. As reported by ARLnow last week, the NY Times just released a study showing that Northern Va has three of the top ten counties with the highest average age for first-time mothers.

I believe this is tied to us having the most educated population in the US, thus people are spending their 20’s focused on education and careers, not thinking about marriage, children and buying a home until later in life. This does not mean millennials don’t believe in home ownership, as many news articles have led you to believe, they’re just not rushing to get there.

Whether you are a millennial navigating your first home purchase, a Boomer or Silent Generation homeowner looking to “right-size,” or anywhere in between, the Eli Residential Group is here to help.

Call (703-539-2529) or email me any time to talk or schedule a meeting.

If you’d like a question answered in my weekly column, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at (703) 539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with Real Living At Home, 2420 Wilson Blvd #101 Arlington, VA 22201, (202) 518-8781.

Recent Stories

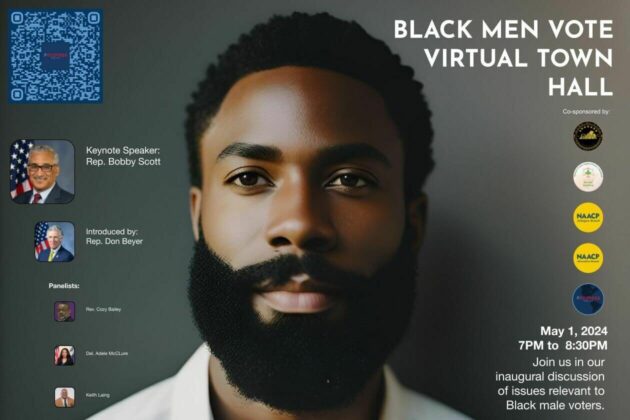

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.