(Updated on 9/11/19) The D.C. area needs 374,000 new homes in the region to keep up with population growth and prevent a Bay Area-like increase in housing prices, according to a new report.

Local leaders will vote on a resolution expanding their housing goals at the next Metropolitan Washington Council of Governments (MWCOG) meeting in D.C. on Wednesday, September 11. The vote comes after the Urban Institute’s 130-page report on the region’s housing needs, which predicts 220,000 families could be at risk of displacement if the goals are not met.

Senior Research Associate Leah Hendey, one of the report’s authors, said there exists a “window of opportunity available right now” for leaders to fix the housing unit shortage before it displaces more residents and makes business difficult.

In Arlington, the study noted 20,000 households may be at risk of displacement. Rising housing prices in the wake of Amazon’s arrival combined with the county’s dwindling stock has long worried advocates that lower-income residents could be pushed out.

“The arrival of new businesses, jobs, and residents could intensify today’s housing challenges unless the region’s leaders come together to address them,” noted the report.

“Overall 29% of Arlington residents are cost-burdened,” Hendey told ARLnow today (Friday). “So they’re paying more than 30% of income.”

However, the report also found that many renters could afford higher rents, but chose to live in lower-rent housing units — which likely further exacerbated the affordable housing squeeze for those at lower income levels.

“That didn’t really surprise us,” said Hendey. “People want to minimize their housing costs so they have money for other things.”

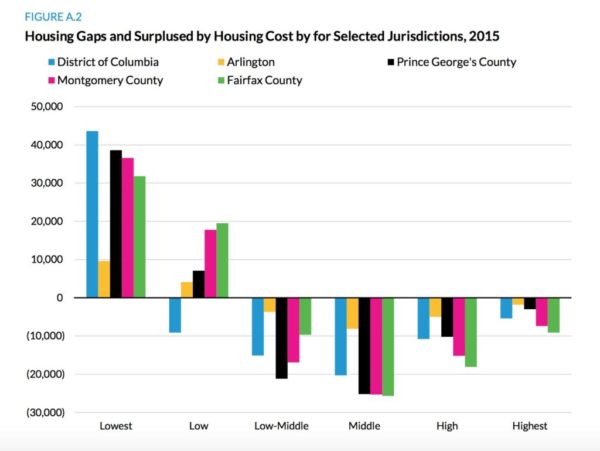

The Urban Institute’s data indicates that Arlington would need 9,700 more housing units renting at under $800 a month, and 4,100 units under $1,300 a month, to meet its needs. On the other hand, the report pointed to a surplus in higher-end units: 18,600 more units than needed in the units in the range of $1,300-$3,500 or more a month.

Henley summarized the report’s recommendations for meeting affordable housing needs as a “three-prong framework” to focuses on preserving existing stock, producing more of the right kind, and protecting renter and buyers from displacement.

The authors recommend not just ramping up construction of additional housing stock, but also finding ways to streamline permitting processes and make use of public land and vacant lots.

The report also recommends allowing more multi-family projects on properties zoned for single-family housing, through the use of accessory dwelling units. It found that 73% of Arlington’s residential space is zoned for single-family houses, which is lower than D.C.’s 80%, and Fairfax County’s 95%.

The report itself was funded with grants from the Greater Washington Partnership and JPMorgan Chase.

Earlier this month, Loudoun County Board of Supervisors Chair at Large Phyllis Randall remarked that area residents needed to start understanding affordable housing as meaning suitable housing for the elderly, people with disabilities, and debt-ridden college graduates.

“I want them in the area,” Randall said of her children seeking housing they could afford. “Not in my basement.”

“I think that people view the word affordable housing as only for poor people, or of people with extremely low incomes, but I think that everyone need housing that is suitable for them.” Henley said. “We need the housing market to work for everyone.”

Graph via Urban Institute