This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist. Enjoy!

Question: How has Arlington’s condo market performed in the first half of 2021?

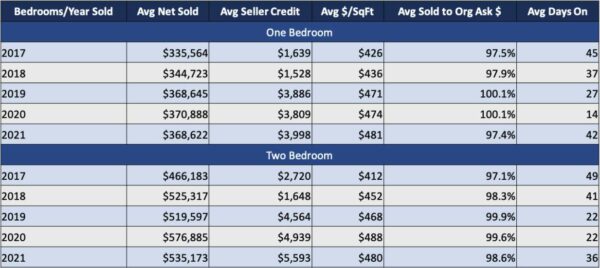

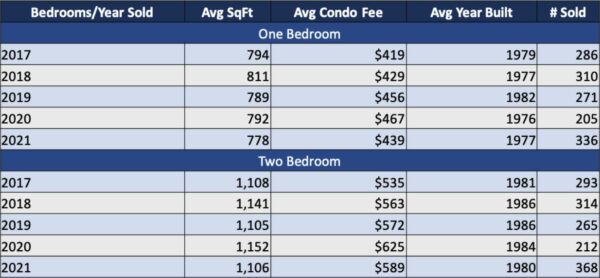

Answer: Given the tremendous appreciation we’ve seen locally and nationally on prices for single-family homes and townhouses, the mostly unchanged values of condos in Arlington highlights how much the condo market has struggled compared to the rest of the housing market. We did experience some periods of value loss in the last quarter of 2020 and early in 2021, but the first half data (and my experience in the market) suggests that prices have recovered and leveled out to about the same values we saw in 2019.

The biggest question I have is whether we will sustain these prices or see a slow decline as people adjust to new work arrangements and housing preferences in the wake of COVID. While it’s possible that we could see a delayed price surge due to sustained low interest rates and returns to offices, I think that scenario is unlikely.

This week, we will take a look at Arlington’s condo market in the first half of 2021. Note that the data does not include cooperatives (e.g. River Place) or age-restricted housing (e.g. The Jefferson).

Prices Relatively Flat, Listing Volume and Inventory Up

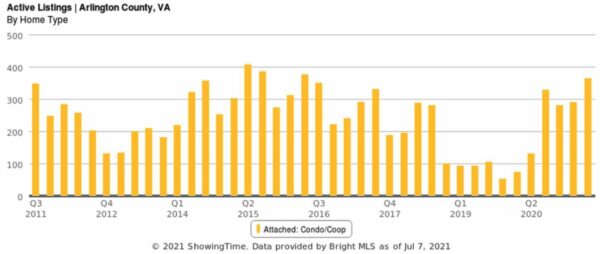

I think the biggest story in the condo market for Arlington and the D.C. metro area is the historically high number of condos being listed for sale since Q3 2020. There is clearly a flight out of condos by homeowners and investors, and the demand is not high enough to absorb the extra supply, so inventory levels have returned to 2015-2016 levels when we were in the midst of a near zero-growth condo market (in Arlington).

The return to 2015-2016 inventory levels isn’t a bad thing, but the suddenness of that shift was difficult for sellers to manage after we experienced a red-hot condo market from late 2018 (Amazon HQ2 announcement) to early 2020 (pre-pandemic).

Demand Metrics Down, Disaster Avoided

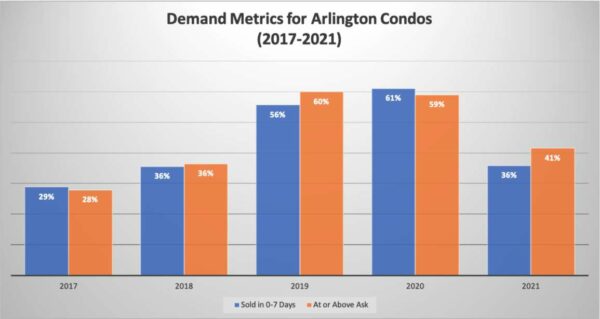

Demand metrics like days on market, percentage of homes selling within a week and the percentage of sold price to the original asking price are all down to 2017-2018 levels (pre-Amazon announcement), and prices are more reflective of what we saw in the first half of 2019.

During the pandemic, there were concerns of a fundamental shift in the condo market that would lead to a significant re-pricing of condo values, but that’s clearly not the case. Sure, it’s tough for condo owners to take a step backward while the single-family/townhouse market surges ahead, but the condo market looks to be recovered and safe at this point.

If you’re interested in seeing last week’s mid-year analysis of the single-family housing market, you can check it out here.

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at 703-539-2529.

Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. 703)-390-9460.