The pandemic and work from home trends are causing pain for owners of office buildings in Arlington and across the region.

Arlington’s office vacancy rate reached 20.8% this month, according to data from CoStar, as relayed by Arlington Economic Development. That’s up from 16.6% at the beginning of 2020, as the pandemic first took hold, and 18.7% at the beginning of 2021.

Arlington two main office submarkets, meanwhile, are seeing even higher vacancy rates. The Rosslyn-Ballston corridor’s office vacancy rate rose to 23.3% and that of National Landing (Crystal City and Pentagon City) rose to 24.4% as of the second quarter of 2022, according to new data from commercial real estate firm Colliers.

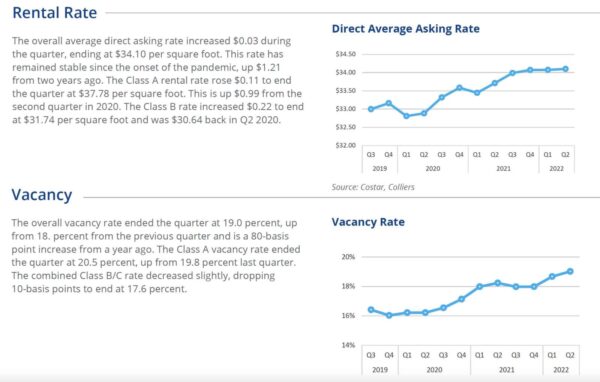

“The trend of rising vacancy and falling demand in the Northern Virginia market continued during the second quarter,” Colliers said in a report. “Vacancy rates reached 19.0 percent and over a million square feet of space has been returned so far in 2022.”

That’s despite some positive developments, like the renewal of Accenture’s 120,687 square foot lease at 800 N. Glebe Road in Ballston, the company said. Likewise, recent news of Boeing and Raytheon moving their corporate headquarters to Arlington are likely to mostly be moral victories for the county, as neither company is believed to be leasing any significant amount of additional office space.

Colliers noted that the highest-end office space (“Class A”) had the highest total area of additional vacancy. It also noted that a significant amount of office space is currently under construction in Arlington — though much of that can be attributed to Amazon’s forthcoming HQ2 in Pentagon City.

Demand in Northern Virginia fell for the third consecutive quarter returning 522,850 square feet of space to the market. In the second quarter, Class A product was the largest contributor to the negative demand, with 385,327 square feet of negative net absorption. The combined Class B and C product also registered negative demand, returning 137,523 square feet to the market. Subsequently, overall absorption figures for Northern Virginia in the first half of the year reached negative one million square feet.

[…] At the end of the quarter, just under four million square feet of construction was underway with half of that future inventory in Arlington County. This is down from the recent peak of over five million at the end of 2021.

On its face, high office vacancy rates might not seem like a problem for those living in Arlington, but in reality it could raise costs for residents. That’s because nearly half of Arlington’s local tax base comes from commercial property and more vacancy means less tax revenue for the county, which in turn puts pressure on residential property owners to make up the difference — or accept lower levels of local government services.

Arlington Economic Development, which helps to promote the county to potential office tenants, tells ARLnow that it is working to reverse the current trends.

“The commercial office market is an important component of the Arlington County tax base, which leads Arlington Economic Development to closely monitor vacancy trends and proactively direct resources to attracting and retaining businesses in Arlington,” the department said in a statement. “The COVID-19 pandemic has significantly altered the way businesses operate, particularly those in an office environment, and the elevated office vacancy rate across Northern Virginia is an indicator of this change.”

More from AED:

AED is committed to further reducing the office vacancy rate through a multi-faceted approach, including the following three areas:

- Targeted business attraction and retention efforts within our key industries to bring new operations to Arlington and support existing operations expand within the County

- Cultivating and catalyzing the local entrepreneurial ecosystem to further produce homegrown startups that mature into larger companies using more space.

- Enhanced regulatory flexibility that will expand the number of allowable uses within commercial buildings and quickly adapt to economic and market shifts.

- AED is pursuing this area In collaboration with the Department of Community Planning, Housing and Development and other County stakeholders.

AED is confident that communities like Arlington with a skilled workforce, flexible and proactive policies, and a high quality of life will be well-positioned to capture growth in the coming years.

Colliers, meanwhile, says it’s difficult to predict what will happen with office space down the road, though for many companies the days of bringing every employee into the office five days a week may be a relic of pre-pandemic times.

“The vacancy rate in Northern Virginia and Arlington continues to be elevated after space hit the market over the past two years,” Colliers Senior Research Analyst Miles Rodnan tells ARLnow. “While leasing activity has picked up from the lows of the pandemic, it is unclear what the future holds.”

“Companies continue to evaluate their work from home and hybrid options that are offered to their employees,” he continued. “The adoption of these options appears to be a trend that may be around, and while it may taper off, is not expected to reach pre-pandemic office occupancy for companies. The market still leans in favor of the tenant as buildings compete for tenants in search of space.”

Arlington, Northern Virginia and D.C. are not alone in seeing rising office vacancy. Cities like New York and San Francisco are facing significant vacancy challenges, with the former said to be in “turmoil” with “record-high availability.”

One potential way to relieve pressure on the office market is the conversion of office buildings into residential buildings, taking advantage of a housing shortage and surging apartment rents.

But that process is relatively slow and expensive, and only works for certain office buildings.

“This is always a possibility, if an owner is sitting on a vacant or under leased asset, the idea of a residential conversion may be tempting,” Rodnan said of office-to-residential conversions. “There are many factors that play into this though, whether a building floorplate lends well to residential units, approvals, cost of conversion.”

County officials have discussed how to streamline the regulatory process for such conversions, though at this point there are no significant projects of that nature currently taking place in Arlington.