This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist. Enjoy!

Question: I’ve read a lot of bad news about the real estate market, how is that playing out in Arlington?

Answer: Bad news sells… keep that in mind as you get your daily/weekly dose of headlines that the housing market is collapsing under the weight of high interest rates and overinflated prices. With that said, I’m not about to deliver a rosy picture of the Arlington real estate market, but it’s important to keep in mind that most of what you’ll see in the news will be cherry-picked statistics and stories around the country/region that are likely more extreme than what our market will experience overall.

Arlington remains one of the most stable, reliable real estate markets in the country. We are absolutely feeling the effects of a dramatic tide shift in demand, but just as our market didn’t see meteoric price increases like other markets from Loudoun County to Tampa to Boise during summer 2020 to spring 2022, we most likely won’t experience as extreme of a pullback while interest rates remain high.

Usually, you’d scroll down and see a lot of charts and data from me in an article like this, but I don’t think we have enough of the right data yet to tell an accurate story of property values in Arlington. So this week is more of a stream of conscious of my thoughts on property values, with a few data points sprinkled in. I welcome any and all theories, agreements, and disagreements in the comments section!

Have Prices Gone Down?

The short answer is “yes,” prices have come down from their 2022 peak. By how much? That is a very difficult question to answer and there’s no reliable way for us to know at this point. So let’s talk about how I think we should we talking about prices based on what we do and do not know at this stage:

What we do know:

- The prices we saw in the first half of this year are out of reach, in most cases.

- In the last seven days, 52 properties in Arlington (12.5% of homes for sale) have cut their asking price, which is a pace consistent with previous seven-day windows. Odds are this pace increases as we get closer to, and into, the holidays.

- Price reductions and sale prices are not being discounted anywhere close to enough to offset the difference in monthly payments between earlier this year and now

- The market always slows in the summer and continues to taper off through the end of the year (with the exception of September/early October), we’re just experiencing a more dramatic version of seasonality because of the sharp interest rate increases that have paralleled the traditional seasonal slowdown and because of where we’re coming from — insane demand for nearly two years.

- Supply coming to market is down, contract activity is down, and showing activity is down all about 20-30% year-over-year.

What we don’t know:

- What is the appropriate baseline to judge price change from? Is it the relatively short window of peak pricing from roughly February-May 2022? If you want headline news, sure, but if you want a more accurate/helpful perspective on market conditions, you probably want to use a wider data set that goes back to Q2/3 2021.

- We don’t have anywhere near enough data points after the market inflection this summer to assess market price changes in Arlington (or even Northern Virginia or the D.C. Metro, in my opinion) and because sold price data lags so much behind shifts in market condition, we won’t truly know what the pricing effects were on Q3/Q4 markets until at least February 2023 because many homes struggling to sell now won’t show up in sold data until then.

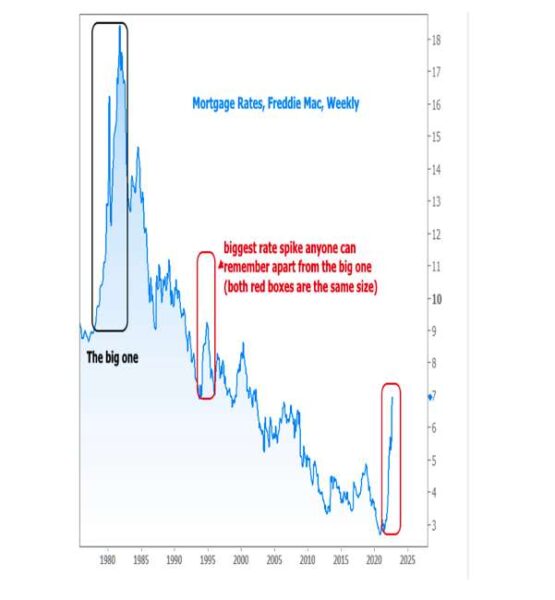

- There’s no precedent for how buyers as a whole will respond to such extreme interest rate increases (see chart below that I saw last week on mortgagenewsdaily.com that highlights the historical significance of recent rate increases), so it makes pricing challenging for sellers (and buyers, for that matter). Days on market has increased 2-3x or more for most sub-markets and the number of showings are down by about 30-35% year-over-year so it can also be very difficult for sellers to infer whether their time on market is price induced or not. A lot of current pricing is based on seller motivation and their hope/fears of market conditions 3-6 months from now.

The Big Unknown (hint: interest rates)

The most significant “what we don’t know” is what will happen with interest rates in the coming months/year. And please save me the “interest rates are still low relative to the last 30 years” non-sense. The fact is that buyers, homeowners, and prices have adjusted for sub-5% rates over the last 15 years and a long-term reversion back to the 6-8%+ range will be painful.

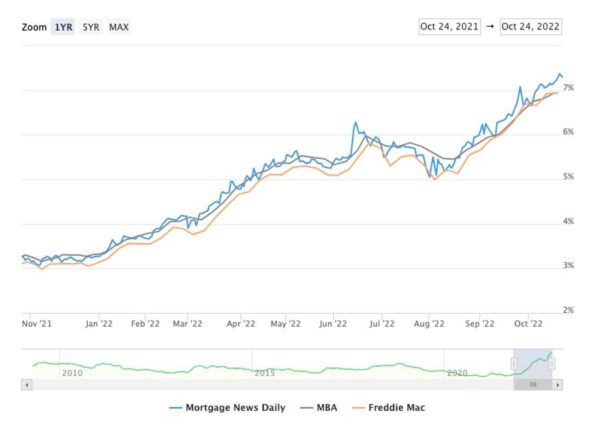

Per MortgageNewsDaily.com, the average 30yr fixed rate is ~7-7.3%, depending on the data source (see chart below). What we don’t know is how long we’ll have unusually high interest rates and that is ultimately what will drive changes in property values in Arlington, regionally, and nationally (I know, stating the obvious here).

Barring a change in Fed policy (e.g. reducing expected Fed Rate increases or bringing liquidity to the mortgage market), it seems unlikely rates will drop much or at all in Q4. High rates compounded with the normal seasonal slowdown means that there will be plenty of discounted sales from motivated sellers who don’t want to hold out until 2023, but when we eventually aggregate all the sales data from Q3/4, I’m not sure it will amount to an eye-popping drop in prices across the entire Arlington market (maybe 5-10%, depending on your baseline data).

I think the problems (aka a double digit drop in home values over a longer 6-12 month period) will show up in Q1/2 2023 if interest rates are still 7% or more through Q1 2023. I think that is when we’d start to see property values in and around Arlington drop as a whole, by uncomfortable amounts (maybe below 2021 prices).

On the flip side, if rates come down by late Q4/early Q1 and we start seeing 6% or lower averages on the 30yr fixed, that would coincide with our normal ramp-up period into the spring and the market could very quickly turn around. I would bet that if we see the average 30yr fixed rate get to the mid 5% range or less in Q1, we will see a rapid return to competition as buyers who have been sidelined due to high rates in the 2nd half of 2022 return to the market and meet the normal churn of new buyers introduced to the market in the new year.

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. (703) 390-9460