This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Eli Residential channel. Enjoy!

Question: How close are the County’s tax assessments to actual market values?

Answer: In January, Arlington announced that residential property tax assessments were increasing 3.2% across the entire County (this is overall, changes to individual home/land values will vary significantly). This change is meant to align with the increase in market values of Arlington homes, which based on my latest review of market performance for detached and condo properties, an overall 3.2% increase is accurate. Despite an accurate overall assessed value increase from 2023 to 2024, tax assessed values remain well below actual market values for most homes. In fact, 81% of homes sold in Arlington in 2023 sold for more than their most recent tax assessed value (notably, this is the exact same percentage as in 2022).

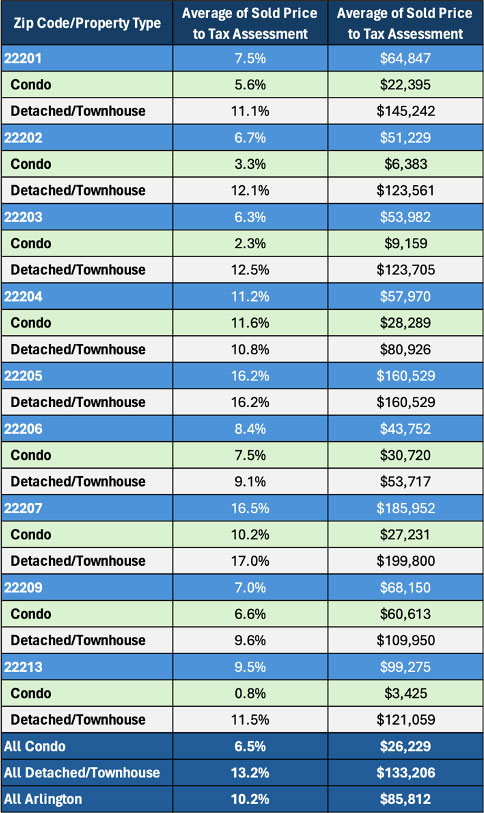

Arlington homes that sold in 2023 sold for an average of 10.2% (median 9%) above their most recent tax assessment.

Homeowners who own homes in the 22205 and 22207 zip codes (most of North Arlington) benefit the most by underassessments, with an average difference between 2023 sold prices and their most recent tax assessments of 16.5% and 16.2%, respectively, or over $160,500 and nearly $186,000, respectively. Owners of single-family homes and townhouses (13.2% average difference) benefit more from underassessments than condo owners (6.5% average difference).

If County assessments were representative of actual market values, the average Arlington homeowner would pay over $800 more per year in property taxes, so don’t forget to send the Department of Real Estate Assessments a thank you card!

The following chart shows much more the average home sold for in 2023 compared to its most recent tax assessed value (note: I’ve done some data clean-up like removing sales of new homes where the assessed value is still based on the original home’s value):

If you believe that the County’s assessment of your home’s value is too high, you have the right to appeal the assessed value; the deadline is March 1 each year.

If you’d like to discuss design trends, buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Eli Residential channel.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10CA