This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: Are you able to tell how much of the appreciation in the overall Arlington housing market is from homes in the upper or lower price ranges?

Answer: I’ve often wondered if the appreciation in Arlington’s housing market is driven more by the lower, middle or upper end of the market. My theory, prior to doing an analysis, was that homes in the lower price ranges were appreciating faster than those in the upper ranges, thus affordability was suffering more than any other category of housing.

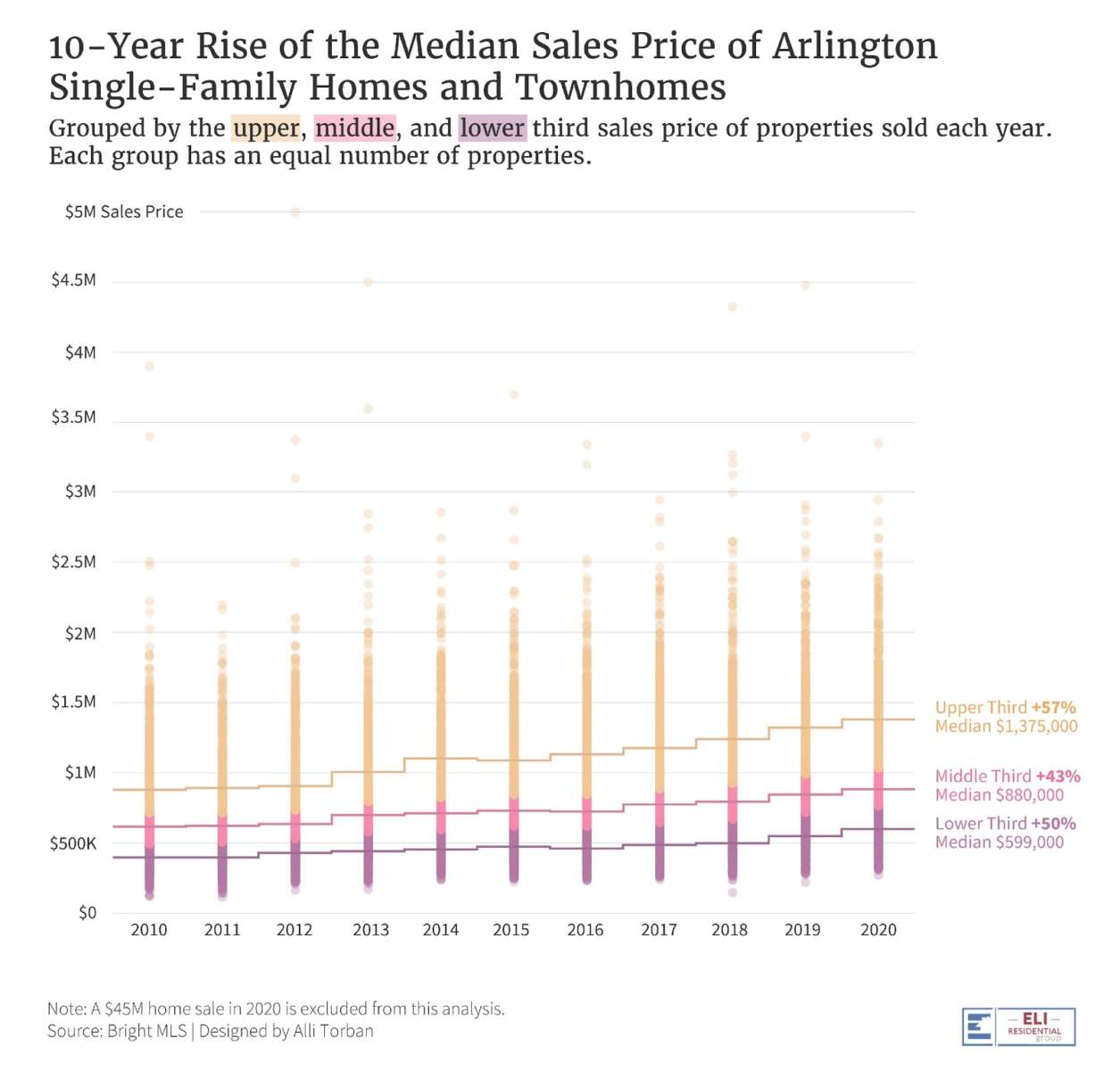

To test this theory, I split each year into a lower, middle and upper third and found the median price within each price range. (Note: The numbers for average prices looked very similar.) I split the market into single-family/townhouses and condos for a more accurate picture of actual market behavior.

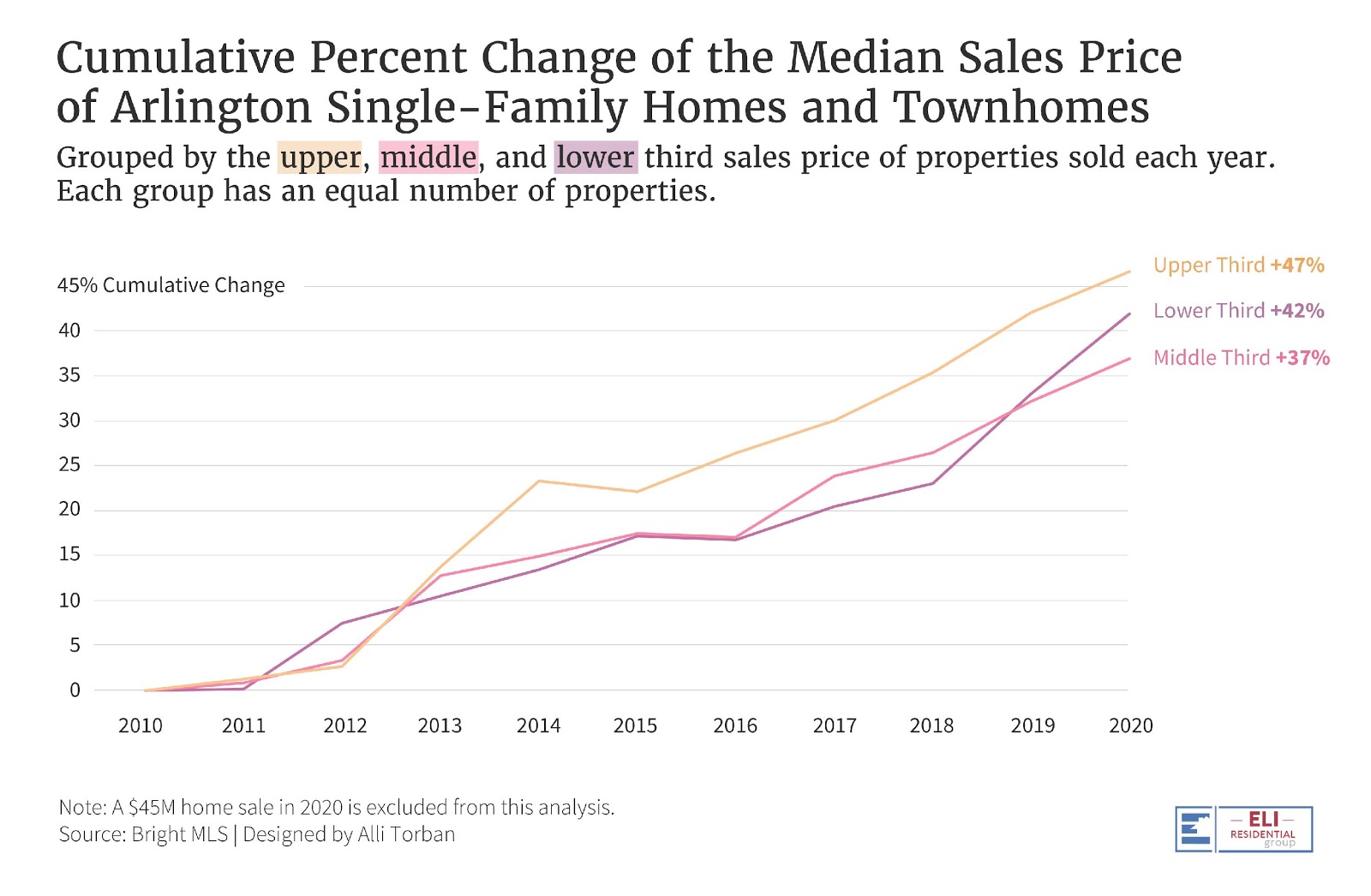

As it turns out, for the single-family/townhouse and condo markets, the upper third of the market has appreciated more over the past 10 years than the lower and middle thirds. As is usually the case, single-family homes and townhouses appreciated much faster than condos during the same period, with single-family/townhouses practically doubling the rate of condo appreciation over the past 10 years.

Explanation of Charts: Appreciation and Market Speed

Below you will see charts showing the median price of the lower, middle and upper price tiers for single-family/townhouses and condos in Arlington over the past 10 years. I also included a chart showing the cumulative appreciation for each price tier to highlight when each market experienced the greatest price jumps or most price stability.

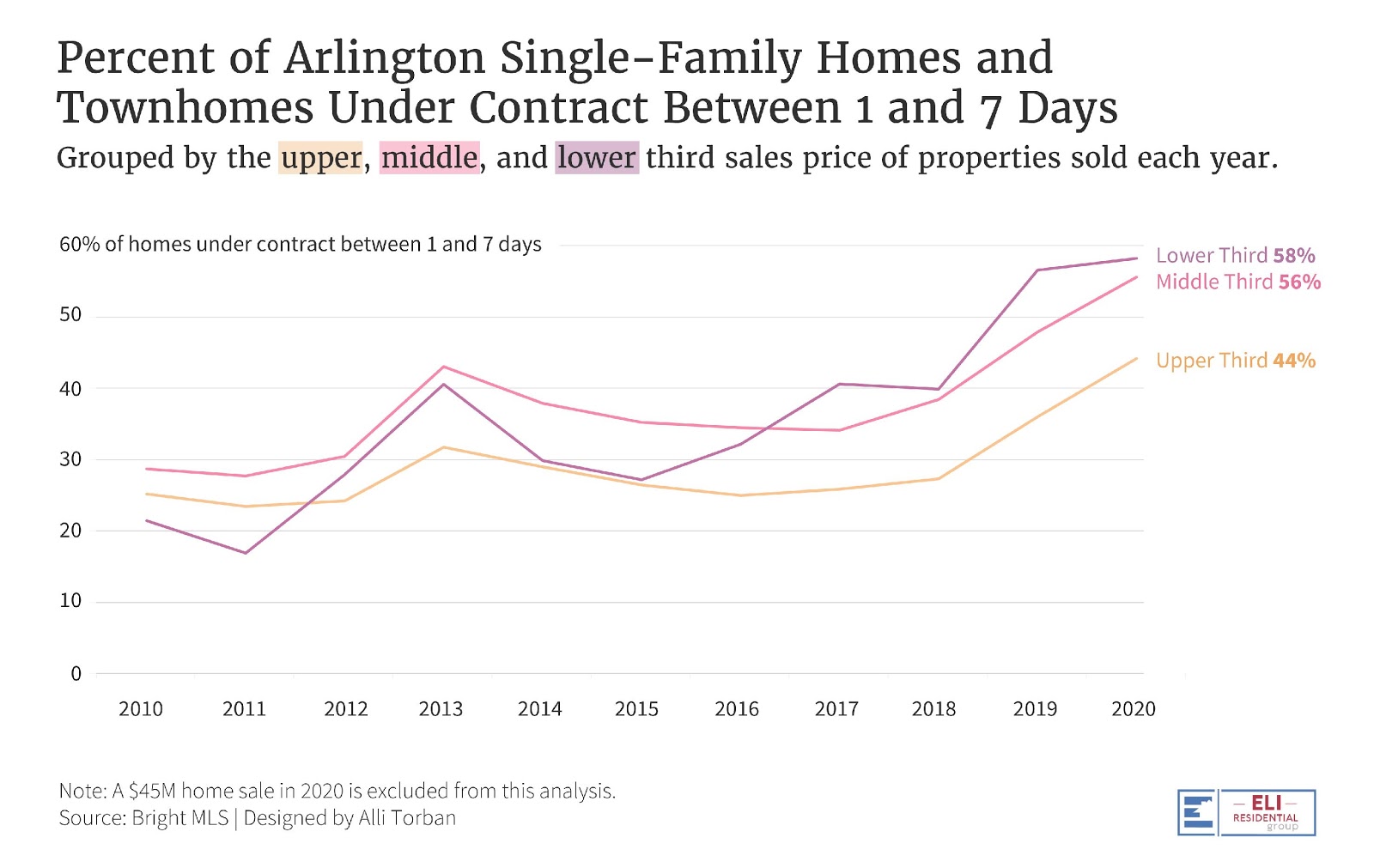

The last two charts show the same concept but applied to days on market. Specifically, looking at what percentage of homes went under contract within the first seven days on the market. I’ve always felt like this metric is one of the best ways to understand how fast the market is moving and the intensity of demand.

All three price tiers show similar speed/intensity of demand over the years, with the only noticeable difference being the upper third of single-family/townhouses, which is likely skewed by new construction. New construction often has a much higher days on market number because of how often homes are listed before they’re finished.

I hope you find these charts as interesting as I do! If you’d like to discuss buying or selling strategies, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to set-up an in-person meeting to discuss local Real Estate, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at 703-539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. 703-390-9460.