Well in advance of Tax Day, Arlington County is telling business owners they can no longer file their business tax returns via mail.

Arlington’s Commissioner of Revenue says the office is getting rid of the option and will now require people to file their taxes through an online payment portal.

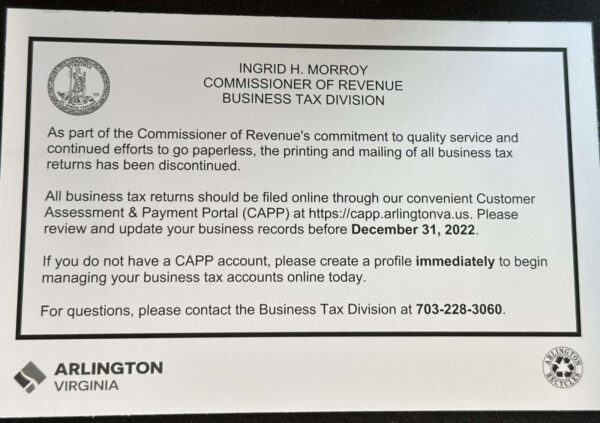

On Oct. 13, the office mailed out postcards telling business customers that they will not receive Business License, Business Tangible or Custodial tax forms in 2023. Until now, the commissioner’s office has mailed out pre-printed business tax returns annually on Jan. 1, according to Susan Anderson, a spokeswoman for the Commissioner of Revenue’s office.

Instead, the office’s Business Division is encouraging customers to review and update their Customer Assessment and Payment Portal (CAPP) accounts or sign up for the portal no later than Dec. 31 of this year so they can receive courtesy reminders leading up to filing deadlines and file on time in 2023, she said.

“Our office also plans to send other courtesy reminders about the paperless initiative to customers before the end of this year,” said Anderson.

The paperless switch began in 2019 with monthly custodial tax return filings, including meals tax and transient occupancy tax, she said.

“Every year since, we have transitioned other tax types to the initiative, such as the annual business license and tangible property taxes, by phasing out the printing and mailing of pre-printed returns to customers who were already recurring online filers,” Anderson said.

Many businesses have already made the shift.

“During the pandemic, we experienced a record high of new online filings and successfully provided all business tax services electronically via phone, email and CAPP,” Anderson said. “Our goal is to aid any remaining customers without a CAPP profile to effectively manage their business tax accounts online for continued quality customer service.”

She says the paperless initiative aims to reduce recurring issues with processing business tax returns on time, such as invalid addresses and multiple submissions of the same tax filing. Messy handwriting, incomplete forms, missing or illegible postmarks, and third-party versions with inaccurate information also delay processing.

According to the Commissioner of Revenue’s office, there are a number of benefits to filing online. For taxpayers, she said it offers:

- Fast, secure, and convenient online submission with immediate confirmation

- The ability to file up to midnight EST on the due date

- One-stop access to all business documents and records

- No risk of returns lost in the mail or placed in the wrong mailbox

- No risk of delayed postal mailings and receipt of correspondence

- Safe and contactless correspondence

- Reduced clutter and paper to be stored, shredded, or discarded

In addition, by going paperless, the office is able to continue its services during events “beyond our control” and saves printing, postage and labor costs that can be spent in other ways, Anderson said.

The Business Tax team at the Commission of Revenue’s office is available to assist customers with their online filings via phone at (703) 228-3060 or in-person at the customer service window 208, located at county government headquarters in Courthouse (2100 Clarendon Blvd).

“In the near future, self-service kiosks will also be available,” Anderson said.