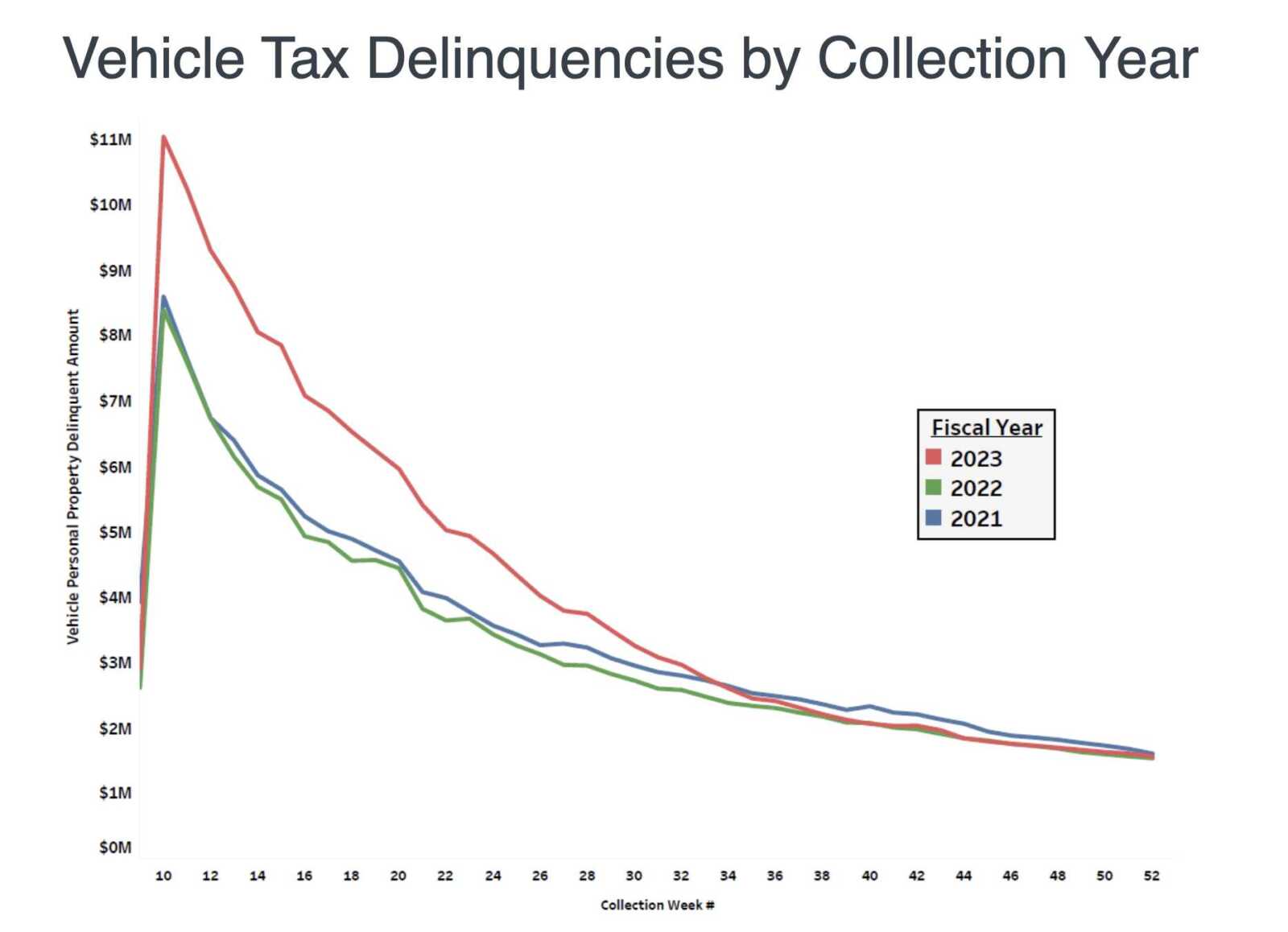

Last year’s soaring car tax values resulted in more people behind on their vehicle taxes, according to Arlington’s Treasurer.

Despite the uptick, Arlington County ended the 2023 fiscal year with historically few people behind on their taxes, Treasurer Carla de la Pava told the Arlington County Board on Tuesday.

The county closed out the fiscal year on June with the lowest delinquency rate in its history: under 0.16%.

Car assessments are determined by the office of Commissioner of Revenue Ingrid Morroy, weighing several factors including oil prices and supply-chain issues.

Bucking a century-long “depreciation pattern,” vehicle values — especially for SUVs, trucks and hybrid and used vehicles — rose last year due to widespread pandemic-era car shortages, Susan Anderson, a spokeswoman for the Office of the Commissioner of Revenue, tells ARLnow.

“Covid-19 had the largest impact when vehicle production and supply lines collapsed,” she said. “New cars were in tight supply and the laws of supply and demand were in full effect. Production of less-new cars available at elevated prices from dealers had a cascade effect on the used car market driving up prices.”

In response, the County Board in 2022 adopted a one-year-only reduced assessment rate at 88% of the clean trade-in value of vehicles. Despite this, the Treasurer’s Office, which collects the vehicle taxes, “still saw the highest tax delinquencies not just since the pandemic but the highest since the fallout of the Great Recession in 2008,” de la Pava said.

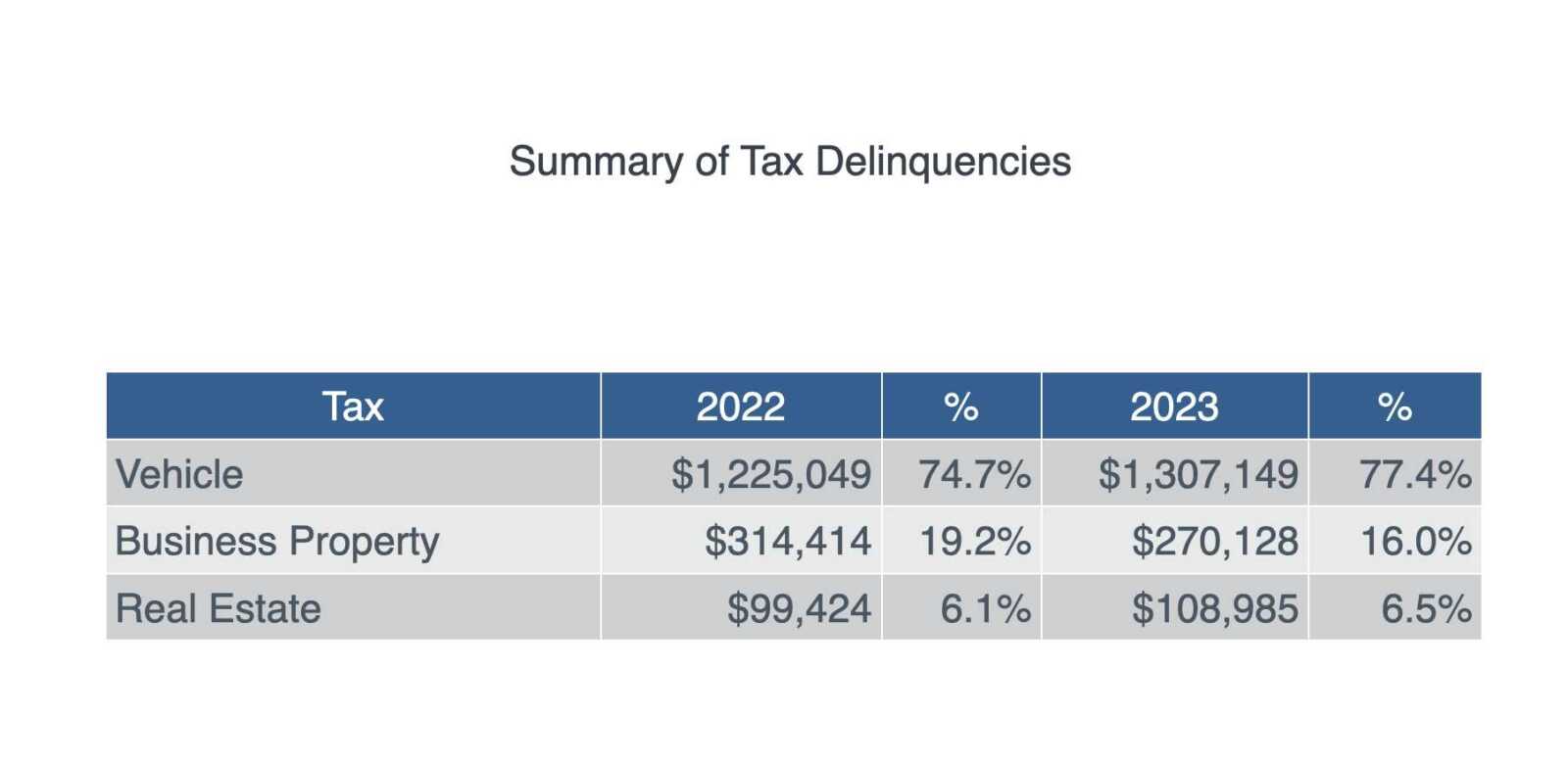

Taxes levied on vehicles make up the lion’s share of delinquencies, or 77% of the total delinquencies at the end of this fiscal year. Vehicle tax delinquencies went up 33% despite a far smaller increase in delinquent accounts, 3.4%. Almost half of these delinquencies involved vehicles worth at least $20,000.

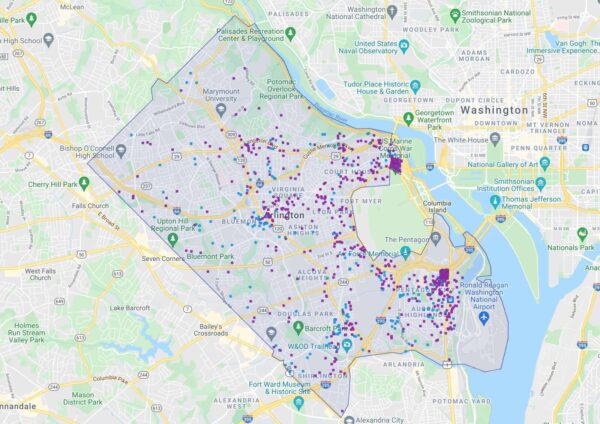

Most delinquent accounts were opened the year prior and are concentrated in densely populated, highly transient areas, de la Pava said, which she attributes to new or short-term residents unaccustomed to a vehicle tax. Her office also hears from residents surprised their taxes went up after buying a new car.

The treasurer credited the 2022 reduced rate and delinquency prevention efforts for avoiding a surfeit of delinquent vehicle owners.

Compared to vehicle taxes, real estate taxes make up most of 88% of taxes levied and only 6% of delinquent taxes.

Delinquencies for the business tangible tax — for furniture and equipment inside businesses — were half a million dollars higher last fiscal year, compared to the year prior, though still lower than pandemic years, she said.

De la Pava credited the county’s online payments system for helping to keep a lid on delinquencies.

“People ask me all the time: ‘How is it that we have such a low tax delinquency rate?'” she said. “Delinquency prevention is a big part of that. The Customer Assessment and Payment Portal, otherwise known… as CAPP, is one of the most important tools we have to prevent delinquency.”

Automated withdrawals via CAPP made up $51 million of the taxes Arlington collected, she noted.

(Updated at 3:50 p.m.) When Arlington Economic Development tried to help a local tech business take advantage of a county tax incentive program some 2.5 years ago, it hit a snag.

The Commissioner of Revenue denied the company’s application to be recognized as a “qualified technology business,” per a county report. Under this designation, as part of the county’s “Technology Zone” program, it would have paid half the rate normal rate for the Business, Professional, Occupational License (BPOL) tax.

“Technology Zone” allows qualifying companies in Arlington’s “high-technology business corridors” to pay $0.18 per $100 of gross receipts for 10 years, as opposed to the $0.36 that many companies pay for a business license.

AED says the program is one of its “most effective tools” to recruit and retain tech companies, and a spokeswoman for the division tells ARLnow that 105 businesses have been approved for this designation since its inception in 2014.

After talking with the tax assessor’s office, AED learned the business was denied because it used a third-party organization, known as a Professional Employer Organization, to manage company payroll. It also learned “several” other businesses had been turned away for the same reason.

To qualify for the tax break, businesses must show, and the Virginia Employment Commission must verify, they increased their full-time employees by at least 25% within the 12 months before applying for the program.

“PEOs report a company’s employees and wages to the VEC under the PEO’s federal employer identification number, and the reports indicate that the employees are affiliated with the PEO rather than with the company,” said the staff report to the Arlington County Board. “This leaves the company unable to demonstrate employment growth to the County via its own VEC filing and therefore unable to meet the Technology Zone program’s criteria.”

This affects between four and six companies interested in applying for the program every year, AED spokeswoman Cara O’Donnell said.

Now, AED and the Commissioner of Revenue are asking the County Board to allow businesses that use these services to be eligible. The Board is set to review the request during its meeting on Saturday.

“The language does not align with current business processes and trends in the technology industry, specifically the increasing usage of third-party organizations to manage and process company payroll,” the staff report says, asserting that this is “inconsistent with the original intent” of the ordinance.

The proposed changes would also update the definition of “qualified technology business,” which the county says is “vague and outdated.”

County code currently says that a “qualified technology business” has a “primary function in the creation, design, and/or research and development of technology hardware or software.”

It adds that using computers, telecommunications services or the internet “shall not, in itself, be sufficient to qualify as a qualified technology business.”

But AED says this “does not capture many new business models” and recommend emphasizing proprietary technology instead.

Lastly, businesses would have 24 months, rather than 18, to apply to be “qualified technology businesses” after setting up a business in Arlington.

“The proposed amendments are minor technical changes to the ordinance language, not expansive policy changes,” the staff report says. “Together, these changes would enhance the effectiveness of the Technology Zone incentive as a business attraction and retention tool.”

(Updated at 10:10 a.m.) Candidates are starting to emerge in the races to replace two retiring, long-time local elected officials.

Last night’s Arlington County Democratic Committee meeting featured candidate announcements from Jose Quiroz, who is running for Arlington County Sheriff, and Kim Klingler, who is running for Commissioner of Revenue.

Quiroz, a 21-year veteran of the Arlington County Sheriff’s Office who would be the county’s first Latino sheriff, has the endorsement of retiring sheriff Beth Arthur.

More from a press release:

Tonight, Jose Quiroz announced his candidacy to be the Democratic nominee for Arlington County Sheriff before the Arlington County Democratic Committee. Jose has served the Arlington County Sheriff’s Office for over 21 years, rising through the ranks of the office and gaining experience in virtually every division.

“As Sheriff, I am committed to running a safe and progressive jail focused on rehabilitation and refocusing lives.” said Jose, “As part of this commitment I will explore eliminating phone and video call fees from the jail so that people in jail are able to maintain contact with their friends and family, which will make it easier for them to rejoin the community after incarceration.”

Additionally, current Sheriff Beth Arthur announced her early retirement this evening. As Chief Deputy, Jose will succeed Sheriff Arthur in January 2023. “I am incredibly thankful to have the support of Sheriff Arthur, a true leader and trailblazer as the first female Sheriff in Arlington County. I wish her well in her retirement after nearly 36 years with the office.”

On assuming the office, Jose will be the first Latino Sheriff in Arlington County. More about his platform and experience can be found at his campaign website: joseforsheriff.us

In Arlington County, the Sheriff’s Office is responsible for running the jail, providing courtroom security, transporting prisoners, serving summonses and assisting with traffic enforcement.

Also announcing a run for public office last night was Kim Klingler, a local civic figure who currently runs the Columbia Pike Partnership. Klingler is running for Commissioner of Revenue — the elected head of the local tax collection office — and would replace Ingrid Morroy.

Morroy, who first took office in 2004, announced her retirement and endorsed Klingler, according to a press release from the Columbia Pike Partnership.

Last night during the Arlington Democrats monthly meeting, Ingrid Morroy announced her retirement as Commissioner of Revenue for Arlington County and endorsed Kim Klingler, Columbia Pike Partnership Executive Director as her successor.

The Columbia Pike Partnership supports Kim’s decision to run for Commissioner of Revenue. “We’re excited about this opportunity for Kim. During the campaign and months ahead, Kim, the staff, and the board will remain focused on our mission and work in the community,” says Columbia Pike Partnership Board Chair Shannon Bailey.

The Columbia Pike Partnership does not endorse any political candidate in the 2023 election.

Klingler has twice unsuccessfully sought the Democratic nomination for County Board, in 2012 and 2017.

Morroy and Arthur have both been relatively popular in their respective roles, re-elected with more than 95% of vote in 2019 after running unopposed.

More recently, Arthur has faced scrutiny after a series of deaths at the jail, primarily among Black men. A wrongful death lawsuit was filed against Arthur and the Sheriff’s Office earlier this year by the family of one of the men who died. The jail has since updated some of its medical protocols.

More candidate announcements are expected in the coming weeks and months. Two County Board seats will be on next year’s ballot and at least one will be open, with County Board Chair Katie Cristol not seeking reelection.

“We’ll have a lot more candidates announcing,” Arlington County Democratic Committee chairman Steve Baker told the Sun Gazette. “Next year will be a busy year.”

Next year’s Democratic primary will be held in June and will feature a ranked-choice voting system.

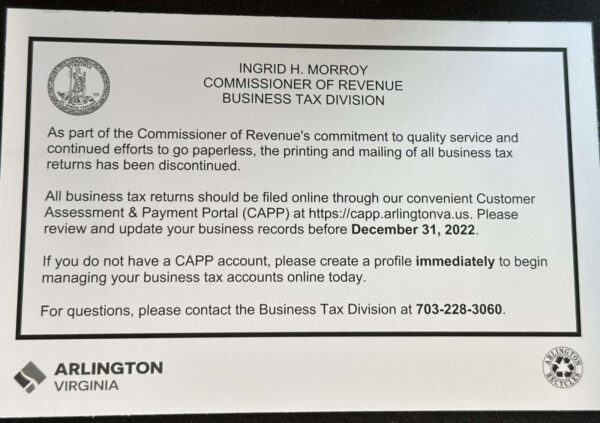

Well in advance of Tax Day, Arlington County is telling business owners they can no longer file their business tax returns via mail.

Arlington’s Commissioner of Revenue says the office is getting rid of the option and will now require people to file their taxes through an online payment portal.

On Oct. 13, the office mailed out postcards telling business customers that they will not receive Business License, Business Tangible or Custodial tax forms in 2023. Until now, the commissioner’s office has mailed out pre-printed business tax returns annually on Jan. 1, according to Susan Anderson, a spokeswoman for the Commissioner of Revenue’s office.

Instead, the office’s Business Division is encouraging customers to review and update their Customer Assessment and Payment Portal (CAPP) accounts or sign up for the portal no later than Dec. 31 of this year so they can receive courtesy reminders leading up to filing deadlines and file on time in 2023, she said.

“Our office also plans to send other courtesy reminders about the paperless initiative to customers before the end of this year,” said Anderson.

The paperless switch began in 2019 with monthly custodial tax return filings, including meals tax and transient occupancy tax, she said.

“Every year since, we have transitioned other tax types to the initiative, such as the annual business license and tangible property taxes, by phasing out the printing and mailing of pre-printed returns to customers who were already recurring online filers,” Anderson said.

Many businesses have already made the shift.

“During the pandemic, we experienced a record high of new online filings and successfully provided all business tax services electronically via phone, email and CAPP,” Anderson said. “Our goal is to aid any remaining customers without a CAPP profile to effectively manage their business tax accounts online for continued quality customer service.”

She says the paperless initiative aims to reduce recurring issues with processing business tax returns on time, such as invalid addresses and multiple submissions of the same tax filing. Messy handwriting, incomplete forms, missing or illegible postmarks, and third-party versions with inaccurate information also delay processing.

According to the Commissioner of Revenue’s office, there are a number of benefits to filing online. For taxpayers, she said it offers:

- Fast, secure, and convenient online submission with immediate confirmation

- The ability to file up to midnight EST on the due date

- One-stop access to all business documents and records

- No risk of returns lost in the mail or placed in the wrong mailbox

- No risk of delayed postal mailings and receipt of correspondence

- Safe and contactless correspondence

- Reduced clutter and paper to be stored, shredded, or discarded

In addition, by going paperless, the office is able to continue its services during events “beyond our control” and saves printing, postage and labor costs that can be spent in other ways, Anderson said.

The Business Tax team at the Commission of Revenue’s office is available to assist customers with their online filings via phone at (703) 228-3060 or in-person at the customer service window 208, located at county government headquarters in Courthouse (2100 Clarendon Blvd).

“In the near future, self-service kiosks will also be available,” Anderson said.

Airbnb is the only major homestay platform not paying a tax levied on third-party lodging providers in Arlington County, ARLnow has learned exclusively.

On Sept. 1, a new Virginia law went into effect requiring businesses that facilitate homestay transactions to collect and pay a locality’s Transient Occupancy Tax (TOT). Previously, individual hosts collected the tax.

Taxes under the new system were due on Oct. 20, and so far, Airbnb — the platform with an outsized share of Arlington’s short-term rentals — has yet to comply. Homestay platform Vacation Rental By Owner (VRBO), by contrast, appears to be complying.

“As of now, Airbnb is the only major homestay platform operator that has not complied with the new state law,” Susan Anderson, the communications director for the Office of the Commissioner of Revenue, tells ARLnow. “We are aware that other localities are also experiencing the same issue.”

Arlington has 840 active homestay rentals listed on either Airbnb and VRBO, and Airbnb listings comprise 82% of rentals, with another 10% listed on both platforms, according to short-term rental data company AirDNA. That means the county could be losing out on significant tax income each month.

The tax comes out to 8.25%, including a 5% county TOT, a 0.25% local tourism TOT and the state’s 3% regional TOT.

Anderson said the office cannot disclose how much Airbnb owes due to a state law that prohibits the release of such information about individual taxpayers. However, we are told the office continues to assess Airbnb for the tax each month and is working to bring the lodging company into compliance.

A back-and-forth between county tax collectors and Airbnb appears to have been going on since at least Oct. 11, when the county notified Airbnb of its obligations in writing, per a copy of the letter obtained by ARLnow.

“The Commissioner of Revenue’s legal counsel has advised the company of its obligations and staff continues to follow up to ensure compliance,” Anderson said.

The Commissioner of Revenue has the power to determine how much should have been collected and can assess Airbnb for owed taxes, said William J. Burgess, the deputy commissioner and legal counsel for the Office of the Commissioner of Revenue.

The Arlington County Treasurer’s Office, meanwhile, “has the power and responsibility to collect payment of delinquent amounts,” he added.

Airbnb claims it hasn’t paid the TOT tax yet because of “ambiguity” in the state law. The company says it does not have the authority to collect this tax and has just started having conversations aimed at reaching a “technical solution” allowing it to collect this tax.

“Airbnb believes in helping our community pay taxes, and we have been collecting and remitting Virginia state sales tax on behalf of our Hosts since 2019, like we do in thousands of jurisdictions around the world,” said Laura Rillos, an Airbnb spokeswoman. “Unfortunately, as written, SB 1398 does not legally authorize Airbnb to collect and remit local transient occupancy taxes.”

“We are committed to working with lawmakers and stakeholders to find a technical solution so that all platform businesses have a basis to collect under the law,” Rillos continued. “We remain committed to working with communities and stakeholders across Virginia to support tourism recovery and help deliver these important tourism dollars.”

One local host who has been following this issue closely, reaching out to the county and Del. Patrick Hope (D-47) to see what is being done to get Airbnb in compliance, told ARLnow that the county could be getting shortchanged by hundreds of thousands of dollars.

“Airbnb was actually not collecting TOT from my guests, or guests in Arlington in general, as the company should have been,” said Diane Page, who has been letting out a suite attached to her Arlington Forest house since 2017. “I knew this because I saw my guest invoices, and when I randomly looked at other private (not corporate) Airbnb listings in Arlington, saw that Airbnb was not charging TOT.”

Using AirDNA data, Page estimates that the county could be missing out on more than $100,000 a month in taxes from Airbnb.

Earlier this year, in the depths of the economic shock caused by the start of the pandemic, the federal government handed out a half-trillion dollars worth of expedited business loans.

The Paycheck Protection Program helped businesses — mostly small businesses — keep workers employed, with loans issued by banks but funded by the feds in the amount of 2.5 times a business’ average monthly payroll costs.

The portion of the loan spent on payroll, rent or mortgage payments and utilities can then be forgiven, after the business submits an application and proper documentation.

Though there has been criticism of the rushed roll-out of PPP, and of the larger businesses that received a sizable portion of the overall funds, a search of the recipients turns up plenty of small Arlington businesses — from restaurants to gyms to others — that received PPP loans that likely saved jobs or even the businesses themselves.

There is, however, a potential downside to the loans.

If a business received a loan and kept employees on, even if they continued to lose money, they’re now facing the reality that — absent a proposed fix from Congress — they may face extra tax liability and have to dig into emptied pockets at tax time next year. That’s because the expenses paid for by the forgiven portion of the loan are, under current guidance, not able to be deducted, effectively making the forgiven loan federally taxable for many businesses.

Fixes have been proposed by Congress as part of new coronavirus relief packages, but so far nothing has passed.

On the plus side, there is a bit of good news for businesses in Arlington. Officials from both the county and the Commonwealth expect that forgiven loans will not be taxed on a state or local level.

In the case of the county, there’s a question of whether the forgiven portion of the loan would be included in the “Gross Receipts” that are subject to the Business, Professional, and Occupational License (BPOL) tax, which is generally $0.36 to $0.18 per $100 of revenue — not profit, as is the case for federal corporate taxes.

William Burgess, an attorney with the Arlington Commissioner of Revenue’s office, tells ARLnow that the county does not currently think that forgiven loans are taxable.

“Per Virginia Code § 58.1-3732(A)(4), the loan proceeds received by a borrower are excluded from gross receipts,” Burgess said. “Therefore there is no provision addressing what happens if the loan is forgiven and no [state tax documents] interpreting this section.”

“Given that the statute expressly exempts loan proceeds and does not explicitly address forgiveness, our office believes that the loan proceeds do not become taxable upon forgiveness,” he continued.

Virginia officials, likewise, said the current expectation is that forgiven loans will not be taxed by the Commonwealth. An annual tax “conformity” bill that is expected to be passed by the state legislature should ensure that.

“The Virginia General Assembly would need to enact legislation advancing Virginia’s date of conformity in order for the state to adopt the Paycheck Protection Program loan forgiveness provision set forth in the CARES Act,” said Virginia Tax spokeswoman Stephanie Benson. “If the General Assembly conforms to this provision, the forgiven loans would not be subject to Virginia income taxation.”

“It is common practice for the Virginia General Assembly (GA) to adopt a conformity bill each session, and the GA generally conforms to the majority of federal tax provisions,” Benson noted.

Photo by Pepi Stojanovski on Unsplash

Changes to Stalled Ballston Development — “An Arlington homebuilder is reviving plans to redevelop a church in Ballston with a new proposal for a mix of townhomes and condos on the site… The site is currently home to the Portico Church, but the developer [BCN Homes] could someday replace it with 10 townhomes and 98 condo units.” [Washington Business Journal]

Beloved Former County Official Dies — “Ann Bisson, a long-time resident and former Deputy Commissioner of the Revenue for Arlington County, passed away peacefully on January 7, 2020… In addition to her work in the Commissioner’s office, Ann was very active in the community.” [Dignity Memorial]

History of Royal Visits to Arlington — “If Prince Harry and Meghan Markle ever decided to make their home in the DC area, they’d be in good company. Many members of the royal family have made their way to Arlington over the years.” [Arlington Public Library, Twitter]

Bill Proposes Funding for Local Cemeteries — “Three Arlington cemeteries would receive state funding under a program designed to preserve burial places of African-American Virginians. Del. Rip Sullivan (D-Fairfax-Arlington) has patroned legislation to add the three graveyards – at Calloway, Lomax and Mount Salvation churches – to the more than two dozen statewide that already receive support from the Virginia Department of Historic Resources.” [InsideNova]

Scooters May Be Allowed on Arlington Sidewalks — “The Board voted unanimously to advertise a public hearing at the Nov. 16, 2019 County Board Meeting to consider proposed regulations of shared mobility devices. The proposed revisions include allowing the [scooters] to be used on County streets, sidewalks and multi-use trails and putting in place a permit fee structure for private companies offering the devices. During the pilot program, the devices have been prohibited on County sidewalks.” [Arlington County]

Clarendon Cafe Rebrands as ‘Three Whistles’ — “CoworkCafe founder Ramzy Azar rebranded the space this week. In addition to a new name, Three Whistles (2719 Wilson Boulevard, Arlington, Virginia) has a new look and a new menu. Azar expects to roll out a menu full of Mediterranean small plates in the next few weeks. He says sharable dishes help create the feeling of a gathering place.” [Eater]

Arlington Man Sentenced for Gun Smuggling — “An Arlington man was sentenced today to 18 months in prison for his role in the trafficking of firearms to his native country of Honduras. According to court documents, in October 2018, Chris Rodriguez, 57, attempted to smuggle a firearm and 247 rounds of ammunition out of the United States, concealed in a bucket of roofing tar destined for Honduras.” [U.S. DOJ]

‘Verizon Site’ Building OKed — “Crystal City’s Verizon site will be redeveloped with a 19-story apartment tower within walking distance of Metro that will include 12 affordable housing units… The [County] Board voted unanimously to approve the vacation of a portion of the right-of-way for Old South Eads Street, a rezoning and site plan amendment for the proposed redevelopment.” [Arlington County]

Amazon Avoids Donating to Arlington Pols — “Amazon.com Inc. just sent $23,000 in campaign contributions to a total of 26 Virginia lawmakers, resuming its political giving in the state for the first time in months as a crucial statehouse election draws near… it only sent checks to six lawmakers in Northern Virginia (and did not send money to a single politician representing Arlington).” [Washington Business Journal]

DMV Select Staff Fights Fraud — “Three members of [the Commissioner of Revenue’s DMV Select office] staff (Isaac Kateregga, Ahmad Abdalla and supervisor Michelle Neves) recently were honored by the Virginia Department of Motor Vehicles in Richmond. They were presented with ‘Fraud Busters’ awards for their work in disrupting efforts to commit misdeeds… [involving] title fraud.” [InsideNova]

Reminder: Arlington Restaurant Week Kicking Off — “Arlington Restaurant Week, organized by the Arlington Chamber of Commerce, will run from October 21-28. Diners can visit a number of Arlington restaurants offering special menu items at discounted prices.” [ARLnow, Arlington Chamber of Commerce]

Flickr pool photo by John Sonderman

Two major property tax deadlines are next week.

Two major property tax deadlines are next week.

Thursday, October 5 is the final due date for the payment of both vehicle personal property tax and the second installment of real estate tax. Payments postmarked after October 5 are subject to penalties and interest charges.

Residents can manage and pay their bills online on the county’s Customer Assessment and Payment Portal.

And the deadline for displaying the new car decals is Wednesday, November 15. This year’s decal is entitled “Arlington Sees Stars,” designed by Amy Kohan in the county’s 13th Annual Decal Design Competition.

And the deadline for displaying the new car decals is Wednesday, November 15. This year’s decal is entitled “Arlington Sees Stars,” designed by Amy Kohan in the county’s 13th Annual Decal Design Competition.

The county treasurer’s web site has more information about paying tax bills and about the county’s Taxpayer Assistance Program. Residents can also contact the Treasurer’s Office directly by calling 703-228-4000 or emailing [email protected].

Representatives from 16 different countries will visit Arlington to learn how the county assesses properties for tax purposes.

Representatives from 16 different countries will visit Arlington to learn how the county assesses properties for tax purposes.

Arlington’s Dept. of Real Estate Assessments will be giving representatives from countries like China, India, Turkey and Greece “guidance on proper property tax management, including an overview of how Arlington County values land and property, and how these processes have generated revenue, while promoting fair and equitable property tax collection methods,” according to a press release from Thomson Reuters, which organized the meeting.

Thomson Reuters’ Tax & Accounting Division helps corporations and governments improve their bookkeeping and revenue-generating practices. Arlington boasts an enviable tax revenue split of 50 percent residential and 50 percent commercial tax revenue, and the assessor’s office is responsible for determining the value of each piece of property.

“Arlington County’s strong, successful tax management system has attracted the attention of government officials from emerging nations,” Brian Jaklitsch, a spokesman for Thomson Reuters, said in an email.

“Officials will get a first-person look at how a government in the US processes and records land rights, and how the information is then used to assign a land value and then to process and bill property tax,” according to a press release. “More than 70 percent of local government revenue in the US is generated from property tax, and generating similar revenue could be a major coup for countries that are impoverished and/or lacking proper recording channels.”

Photo via Google Maps