Airbnb is the only major homestay platform not paying a tax levied on third-party lodging providers in Arlington County, ARLnow has learned exclusively.

On Sept. 1, a new Virginia law went into effect requiring businesses that facilitate homestay transactions to collect and pay a locality’s Transient Occupancy Tax (TOT). Previously, individual hosts collected the tax.

Taxes under the new system were due on Oct. 20, and so far, Airbnb — the platform with an outsized share of Arlington’s short-term rentals — has yet to comply. Homestay platform Vacation Rental By Owner (VRBO), by contrast, appears to be complying.

“As of now, Airbnb is the only major homestay platform operator that has not complied with the new state law,” Susan Anderson, the communications director for the Office of the Commissioner of Revenue, tells ARLnow. “We are aware that other localities are also experiencing the same issue.”

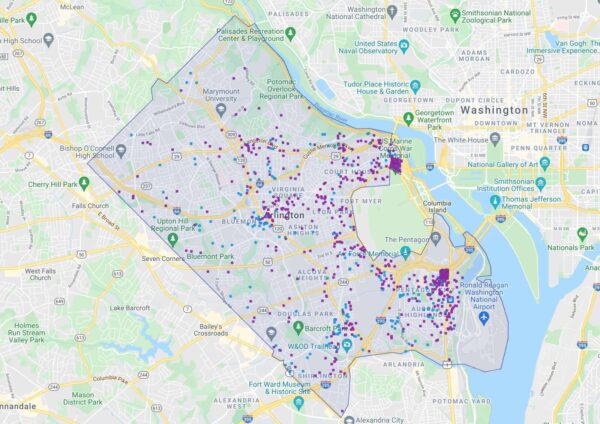

Arlington has 840 active homestay rentals listed on either Airbnb and VRBO, and Airbnb listings comprise 82% of rentals, with another 10% listed on both platforms, according to short-term rental data company AirDNA. That means the county could be losing out on significant tax income each month.

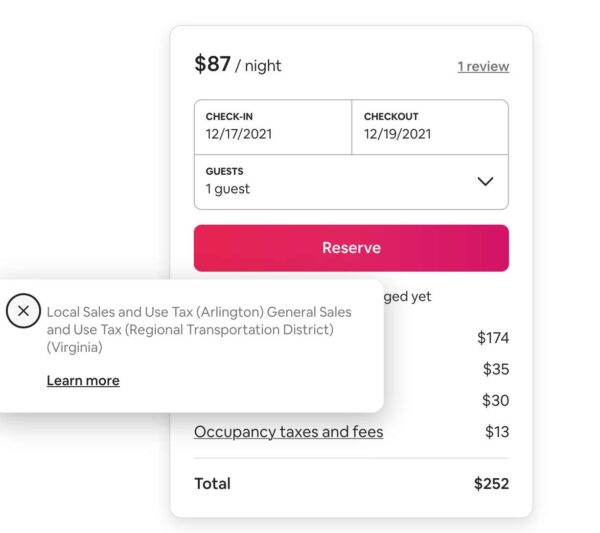

The tax comes out to 8.25%, including a 5% county TOT, a 0.25% local tourism TOT and the state’s 3% regional TOT.

Anderson said the office cannot disclose how much Airbnb owes due to a state law that prohibits the release of such information about individual taxpayers. However, we are told the office continues to assess Airbnb for the tax each month and is working to bring the lodging company into compliance.

A back-and-forth between county tax collectors and Airbnb appears to have been going on since at least Oct. 11, when the county notified Airbnb of its obligations in writing, per a copy of the letter obtained by ARLnow.

“The Commissioner of Revenue’s legal counsel has advised the company of its obligations and staff continues to follow up to ensure compliance,” Anderson said.

The Commissioner of Revenue has the power to determine how much should have been collected and can assess Airbnb for owed taxes, said William J. Burgess, the deputy commissioner and legal counsel for the Office of the Commissioner of Revenue.

The Arlington County Treasurer’s Office, meanwhile, “has the power and responsibility to collect payment of delinquent amounts,” he added.

Airbnb claims it hasn’t paid the TOT tax yet because of “ambiguity” in the state law. The company says it does not have the authority to collect this tax and has just started having conversations aimed at reaching a “technical solution” allowing it to collect this tax.

“Airbnb believes in helping our community pay taxes, and we have been collecting and remitting Virginia state sales tax on behalf of our Hosts since 2019, like we do in thousands of jurisdictions around the world,” said Laura Rillos, an Airbnb spokeswoman. “Unfortunately, as written, SB 1398 does not legally authorize Airbnb to collect and remit local transient occupancy taxes.”

“We are committed to working with lawmakers and stakeholders to find a technical solution so that all platform businesses have a basis to collect under the law,” Rillos continued. “We remain committed to working with communities and stakeholders across Virginia to support tourism recovery and help deliver these important tourism dollars.”

One local host who has been following this issue closely, reaching out to the county and Del. Patrick Hope (D-47) to see what is being done to get Airbnb in compliance, told ARLnow that the county could be getting shortchanged by hundreds of thousands of dollars.

“Airbnb was actually not collecting TOT from my guests, or guests in Arlington in general, as the company should have been,” said Diane Page, who has been letting out a suite attached to her Arlington Forest house since 2017. “I knew this because I saw my guest invoices, and when I randomly looked at other private (not corporate) Airbnb listings in Arlington, saw that Airbnb was not charging TOT.”

Using AirDNA data, Page estimates that the county could be missing out on more than $100,000 a month in taxes from Airbnb.

In late 2016 Airbnb hailed Arlington County for being the “first D.C. area municipality to pass an ordinance creating fair rules for middle class residents and families to continue sharing their homes.” While legalizing Airbnb rentals, at a time when some cities were cracking down on the company, the ordinance put the onus of tax collection on hosts.

The new state law alleviates that regulatory burden and puts it on rental intermediaries like Airbnb instead. In making that transition, Arlington County closed the online TOT payment accounts of many hosts, Page said.

“I was surprised to find my personal TOT account closed, with no prior notice,” she said, adding that she still needs for any direct, non-Airbnb bookings.

Revenue office staff eventually reinstated her account for direct bookings. Overall, Page said, she’s happy with the county’s handling of short-term home rentals and just hopes the tax collection issue can be solved soon.

“I think Arlington did an excellent job developing its accessory homestay rules to accommodate the operation of these small businesses while preserving housing availability and neighborhood character,” she said.