This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: How has COVID-19 impacted Arlington’s rental market?

Answer: Recent articles have shed light onto just how much COVID-19 has hurt the apartment rental market in the D.C. metro area, including an article about rents dropping by 14% in Arlington and an article on rents in D.C.’s Class-A high-rise buildings dropping approximately 18%.

I have certainly experienced the difficult rental market in the past 10 months with clients who have struggled to find new tenants for their condos for months, even after significant price reductions. In some buildings, there are double-digit numbers of condos being offered for rent, with little interest.

I have also spoken to many condo owners who are turning to selling units after months of vacancy trying to rent them out, which is one of the reasons for last year’s explosion in condos listed for sale.

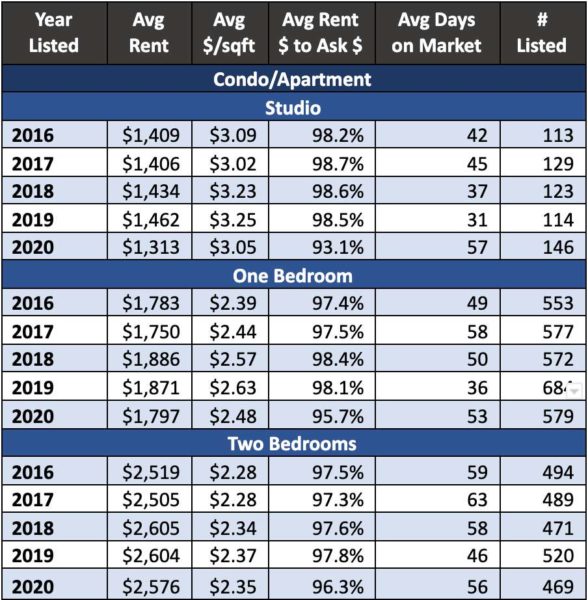

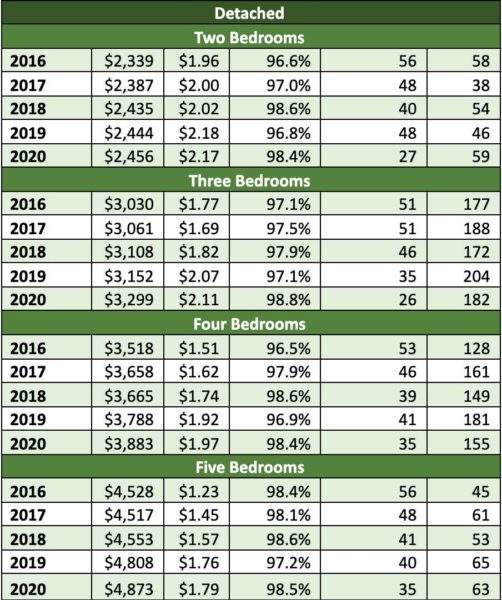

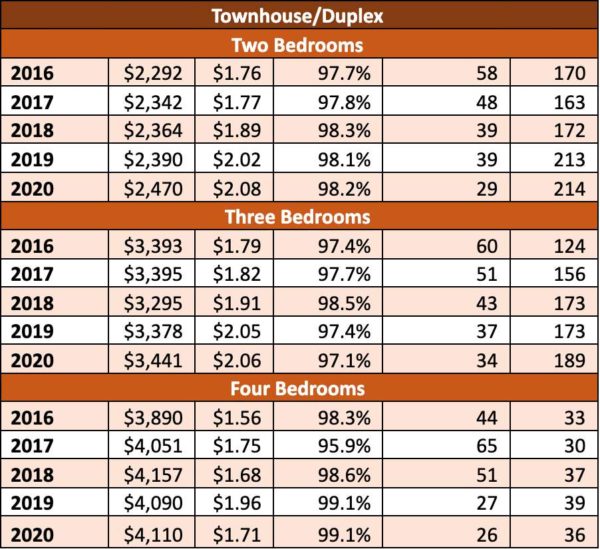

I took a look at last year’s rental market for apartments, townhouses and single-family homes and compared it the previous four years to see how each sub-market performed. There’s a summary of key findings below and a detailed data table to follow.

Note that this only includes properties in Arlington that were rented through Bright MLS. Most commercial rental buildings do not use the MLS and not every homeowner with an investment property rents through the MLS, but the number of properties rented through the MLS is enough to make this statistically reliable data.

Key Findings

- Condo rentals dropped in price for studios (-10.2%), one-bedrooms (-4%) and two-bedrooms (-1%). If you remove January and February (pre-COVID) listings, the price drops increase further. I suspect 2021 will see an even larger drop in rental prices because many owners are still trying to find a tenant.

- The average time to rent a unit increased by 50% to two months, and tenants negotiated significantly further below the asking price than ever before.

- Two-bedroom units struggled, but not nearly as much as studios and one-bedrooms units, likely because the second bedroom provides a much-needed home office.

- COVID-19 had the opposite effect on single-family and townhouse rentals with prices increasing to all-time highs, homes renting faster than ever before and owners securing prices closer to their asking price than ever before.

- Rentals of small two- and three-bedroom houses and large four-bedroom townhouses were in the most demand, with average days on market just 3.5 weeks and some of the highest rental price to asking price ratios of any property type.

- I expect single-family and townhouse rentals to have an even better 2021 (from the perspective of the homeowner) as people continue trying to get more space, avoid common living and find buying those homes to be cost-prohibitive and/or too difficult (competitive).

If you’d like to discuss buying or selling strategies, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to set-up an in-person meeting to discuss local Real Estate, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at 703-539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. 703-390-9460.