Even with the national economy in the dumps three years ago, the economy in the D.C. region — and especially in Arlington — remained strong, with low unemployment and a healthy real estate market.

Even with the national economy in the dumps three years ago, the economy in the D.C. region — and especially in Arlington — remained strong, with low unemployment and a healthy real estate market.

Now, as the national economy teeters once again, there’s some question of whether the local economy can remain an island of vibrancy. With federal discretionary spending decreasing, and with the possibility of even steeper cuts down the road, Uncle Sam may not be able to provide the steady flow of cash that kept the local economy going during the last recessionary period.

The local economic indicators are a mixed bag. Unemployment in Arlington is still remarkably low, at 3.9 percent. Home sales are up in the most recent period, but home sale prices are down considerably in Arlington and in the D.C. metro area.

How do you feel about the direction the local economy is heading?

Recent Stories

For Immediate Release

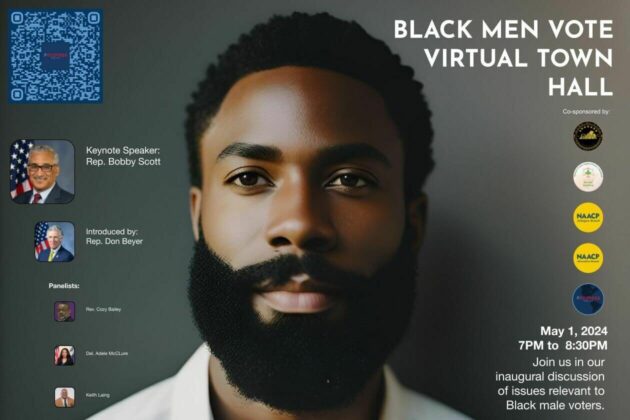

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.