This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: We’re preparing to sell our home and are concerned that we won’t have enough time to move out after it sells. Is there a good time to ask the buyers if we can stay a bit longer?

Answer: A Seller’s Post-Settlement Occupancy, more commonly referred to as a rent-back, allows a home owner to sell their home, collect the proceeds and continue living in the home for a pre-determined period of time after closing.

The most common scenarios for a rent-back are:

1. You have a need for the sale proceeds quickly; such as applying them towards the purchase of your next home. A word of caution on this strategy — make sure that you’ll be able to find and close on your next home before the rent-back period ends (or already found it).

2. Moving out is burdensome and/or highly disruptive to your family and/or job that you don’t want to start the process until you’re under contract and all buyer contingencies have expired.

3. You need to remain in your home until the school year is finished.

How Rent-Backs Are Structured

The Northern Virginia Association of Realtors contracts (as well as other regional contracts) provide a standard form for a Seller’s Post-Settlement Occupancy Agreement so you don’t need to worry about hiring an attorney. It functions as a short-term lease including how much the seller will pay the buyer for the rent-back, how long the rent-back lasts, a security deposit, and a penalty for staying past the rent-back period.

Buyers will conduct a pre-closing walk-through before they purchase the home where they have all the rights provided to them in a normal sale. At the end of the rent-back, the new owners will conduct another walk-through once the previous owners move out, which is similar to that of a walk-through at the end of a normal rental period.

If the previous owners caused damage during the move-out, the new owners can make a claim against the security deposit, generally held by the Title Company who handled the sale.

Not Without Risk

For the new owners, a rent-back carries with it some of the same risks involved in being a landlord. Disputes over security deposit, damage in excess of the security deposit, or trouble with the previous owners moving out on time are all realities that buyers need to consider. As with many decisions in a real estate transaction, your willingness to agree to a rent-back is a matter of risk and reward.

The risk of problems like I mentioned is fairly low in most cases and the reward for accommodating a seller’s request for a rent-back can be the difference between them accepting your offer or taking somebody else’s.

Free Rent-Backs?

The fee for a rent-back is usually calculated off of the new owner’s carrying costs (mortgage + taxes + insurance), but in our hyper-competitive market, I’m seeing aggressive buyers offer seller’s a free rent-back as a way to increase the competitiveness of their offer. A free rent-back isn’t worth much if the seller is asking for an extra week, but it certainly adds up if they’re asking to stay for 6-8 weeks past closing.

On both sides of the transaction, the use and structure of a rent-back is one of many important strategic decisions you may face in this market. It’s a good example of an area where an agent who understands the local market and how to maximize your risk/reward position can add real value.

Whether you’re reaching out to me or not, I want to stress the importance of making sure you have the confidence in your agent to truly protect and maximize your interests through the entire transaction lifecycle.

If you’d like a question answered in my weekly column or to set-up an in-person meeting to discuss local real estate, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at (703) 539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with Real Living At Home, 2420 Wilson Blvd #101 Arlington, VA 22201, (202) 518-8781.

Recent Stories

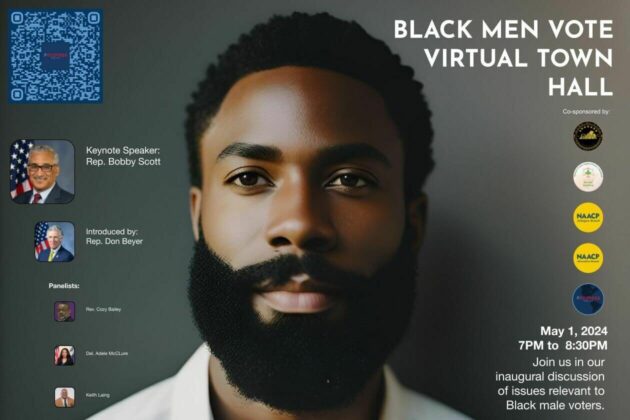

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.