This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: Have you seen a decrease in condo values with all the inventory currently on the market?

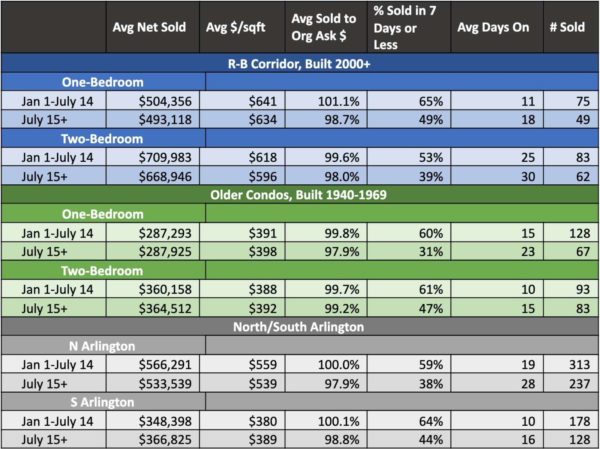

Answer: Over the past few months, I’ve written about the shift in the condo market, which began around July and can be attributed to a historical number of units listed for sale while demand simultaneously dropped due to COVID. Indicators such as Months of Supply, Absorption Rate, Days on Market and Sold to Ask Price Ratios have shown a more favorable market for buyers for the last four months, but it takes longer to establish changes in pricing (which requires having enough data).

It’s been my experience working in this market over the past few months that prices seem to be down about 2-5% in many sub-markets, compared to late 2019 and the first half of 2020 (after surging since 2018). However, I dug into the data a bit more to see how condos that went under contract after July 15 compare to the sales of condos that went under contract from January 1 to July 14, 2020. I used July 15 because that is when I really start to see changes taking shape in the condo market.

One point I’d like to make prior to sharing the data findings is that the data is based on condos that have sold/closed, and there are many condos still sitting on the market or under contract that won’t show up in this analysis. The market has also worsened (for sellers) each month since July, so properties that went under contract in July/August likely did better than those later on in the year. Therefore, it’s likely that, as the units close that are currently struggling to sell or just now coming to market, the data will get worse (larger decrease in values).

Data Summary

I chose to segment the market in a few different ways to get a sense of how different sub-markets are experiencing the condo shift. When comparing relatively small data sets (like we have here), the best conclusions can be drawn by analyzing market segments that have lot of similarities, such as condos along the R-B Corridor built in the last 20 years or mid-1900s (older) buildings.

Here are some highlights from the data sets I reviewed:

- 1 BR and 2 BR condos along the R-B Corridor, built in the last 20 years, sold an average of 2.2% and 5.8% less, respectively, after mid-July. If you look at price per square foot, prices have dropped 1.1% and 3.6%, respectively. I believe this is the data set that most accurately reflects what’s happening in the condo market.

- Older, less expensive condos across the county seem to have held onto their values better than newer, more expensive units. More expensive condos are closer in price to townhouses, and I’ve seen more buyers favor lower-priced townhouses over higher-priced condos, as a result of COVID concerns. Buyers of less expensive condos don’t have many alternatives at that price point, other than renting.

- The apparent appreciation of South Arlington since July 15 can be attributed to a different distribution of sales (higher volume of more expensive properties and lower follow of less expensive properties) than comparable units actually selling for more

- The indicators (Sold to Ask, % Sold in <7 Days, and Days On) are what I find most interesting and a sign that the actual decrease in condo pricing isn’t fully reflected yet in the current data set:

- Across every sub-market, including those where the average price didn’t drop, buyers negotiated significantly more off the original asking price. Earlier in the year, three sub-markets averaged buyers paying at least full price and since July 15 there were none.

- The most interesting indicator is the huge drop in the percentage of units that go under contract within the first week.

Looking Forward

As I mentioned, I expect future data sets for condos sold in the last quarter of 2020 and very early 2021 to show even larger decreases in values, relative to the first half of 2020. However, I think that with more positive news on COVID-19 vaccines, the start of the 2021 spring market and more people returning to work (and realizing they value commuting convenience over extra space), I believe there’s a good chance the negative trends of the last four to five months will level off soon and begin to reverse by February/March.

I will continue to track trends in the Arlington condo market and provide transparency into what we’re experiencing. The townhouse and single-family home markets remain strong, and I fully expect another appreciation cycle in 2021 for those sub-markets.

If you’d like to discuss buying or selling strategies, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to set-up an in-person meeting to discuss local Real Estate, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at 703-539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. 703-390-9460.