This regularly-scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Enjoy!

Question: How accurate are the County’s tax assessments when it comes to determining the market value of a home?

Answer: Arlington’s property tax rate will remain unchanged in 2021 at just over 1%, but many homeowners will pay more in property taxes because of higher assessed values from the County. For those with plans to sell in the near future, the rapid appreciation of Arlington real estate values is a good thing, but for those with no plans to sell, appreciation simply means a higher annual tax bill.

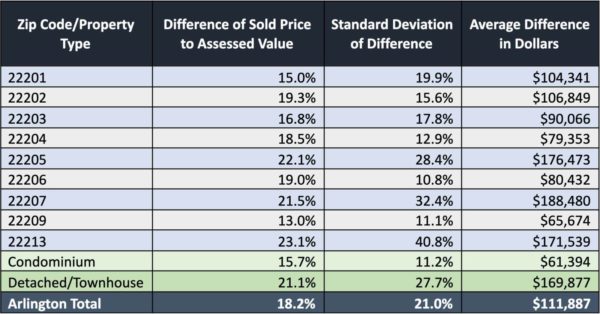

If you’re upset by recent increases in your home’s assessed value, just know that you’re most likely getting a significant break compared to your home’s actual market value. Homes that sold in 2020 sold for an average of 18.2% (14.9% median) more than their most recent assessed value by the County. Last year, the average difference was 14.2% and the year before it was just 7.6%.

If County assessments were representative of actual market values, the average Arlington homeowner would pay just over $1,100 more per year in property taxes. So don’t forget to send the Department of Real Estate Assessments a Christmas card this year for such generous valuations!

Only 5.9% of homes sold for less than their most recent assessed value. On the other end of the spectrum, 6% of homes sold for 38% or more over their most recent assessed value.

Let’s take a look at the data!

If you believe that the County’s assessment of your home’s value is too high, you have the right to appeal the assessed value, but that must be done by March 1. Here are the key steps in appealing your assessment:

Reminder: Your first appeal with the Department of Real Estate Assessments must be filed by March 1.

- Step 1: Call 703-228-3920 for information on how your assessment was determined.

- Step 2: File your appeal online here (first level).

- Step 3: An assessor will visit your home and you can provide relevant info to make your case.

- Step 4: If you’re not satisfied with the decision or have not received written notice by April 1, file your second appeal with the Board of Equalization online here (second level) by April 15.

- Step 5: If you’re not satisfied with the decision, your final option for appeal is with the Circuit Court, which will likely require you to hire an attorney.

If you’d like to discuss buying or selling strategies, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to set-up an in-person meeting to discuss local Real Estate, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at www.EliResidential.com. Call me directly at 703-539-2529.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. 703-390-9460.

Recent Stories

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.