This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist. Enjoy!

Question: Can you explain how the Earnest Money Deposit is used and what an acceptable amount is?

Answer:

What is the EMD?

I like to define Earnest Money Deposit (EMD) as an amount of money deposited by a Buyer as security for the Seller that the Buyer will perform under the obligation of the real estate contract. Assuming the Buyer completes the purchase transaction, the deposit is deducted against what they owe at closing (down payment + closing costs).

If the Buyer voids the contract within their contractual rights (e.g. Home Inspection Contingency), they receive their deposit back in full. If the Buyer defaults (cannot close or backs out without contractual protections), that money is at risk (more on this later).

In most cases, the deposit is held by the Title Company handling the transaction. They act as an unbiased administrator of the deposit and are also the ones handling the funds at closing. In some cases, one of the brokerages representing the Buyer or Seller may also hold the EMD, but this is much less common today. In either case, the handling and distribution of the deposit funds are strictly regulated to prevent co-mingling or improper distribution if the transaction falls through.

The contract also stipulates when the funds are due. In most cases, Buyers make the deposit within 3-5 days of an offer being ratified (accepted by both parties). If you’re a Buyer preparing to make an offer, I recommend making sure you have enough funds for your EMD in an account that you can easily transfer money out of (wire or check), not a brokerage or retirement fund that takes 5-10+ days for money to clear.

How Much is the EMD?

The amount of the deposit is a negotiable term in the contract and should be given serious consideration by both Buyers and Sellers. Buyers can use the deposit amount to increase the actual or perceived strength of their offer over others. In the current market where many Buyers are competing with other offers, a higher EMD can help you stand out if you’re in a tight race with another offer.

What does it mean to stand out with your EMD? In my opinion, 1% of the sale price is the lowest EMD that should be considered, but 2-3% of the sale price is appropriate in most non-competitive or lightly competitive situations. In competitive situations, it’s common to see at least a few Buyers offer EMD of 5% of the sale price or more. I’ve even seen Buyers offer to post their entire down payment as EMD.

Consider it from the perspective of a Seller. If you’re reviewing multiple great offers on a $1,000,000 home and one has a 2% EMD ($20,000) and the other has a 10% EMD ($100,000), wouldn’t you be drawn towards the offer with a substantially higher EMD?

As a Seller, other terms like price, contingencies and closing date will most likely rank higher in priority than EMD amount but it’s still important to ensure you have an acceptable deposit.

Consider this scenario… if you’re selling a $1,000,000 property and the EMD is 1% ($10,000), is that enough to keep your Buyer locked into the contract if, one week before closing, their dream home hits the market and they begin questioning the purchase of your home? Maybe yes, maybe not.

Is $10,000 enough money for you to offset the hassle and cost of going back on the market and uncertainty of getting the same or better price the second time around? Probably not.

So make sure that the deposit you’re receiving is enough to disincentivize the Buyer from defaulting and enough to offset the cost and hassle for you if the Buyer does default.

How Much Can the Seller Keep?

One may think that if the main purpose of the EMD is to give the Seller assurance that the Buyer will not default, the Seller should automatically get the entire deposit if the Buyer defaults, right? That is not the case and EMD distribution can be complicated.

EMD administration law requires that the Holder (Title Co or Broker) receive a signed EMD release form from the Buyer and Seller agreeing to how EMD is distributed before any money can be released to either party.

This is true for EMD release if the Buyer properly voids the contract within their contractual protections (e.g. Home Inspection Contingency) and is due 100% of the EMD or if the Buyer defaults and the Seller is due to receive money for damages.

It is rare for EMD to be disputed if the Buyer properly voids within their contractual protections because it would ultimately be a losing case for the Seller and put the Seller at risk for further legal action for withholding the release of funds. However, when a Buyer defaults without contractual protection, there’s often somewhat of a negotiation between both parties on how much of the deposit should be released to the Seller.

My experience is that Sellers often don’t walk away with the entire deposit, but that of course depends on the circumstances of the default, the relationship between the two parties, amount of the deposit, how likely it is for the Seller to find a new Buyer and at what price, and many other considerations. Side note: EMD disputes are often unexpected and a good reason why it’s so important for the Buyer and Seller to maintain a positive/cordial relationship because you never know when something can happen that will require cooperation.

Most EMD disputes are resolved between the Buyer and Seller, but if an agreement cannot be reached, no funds will be released to either party and legal action may be required by one party to resolve the dispute. This option is generally undesirable enough for one or both parties that EMD disputes are usually resolved without court involvement.

This article is applicable to Virginia, Washington, D.C., and Maryland and may not apply to other states/jurisdictions outside of the DMV.

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at 703-539-2529.

Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. 703)-390-9460.

Recent Stories

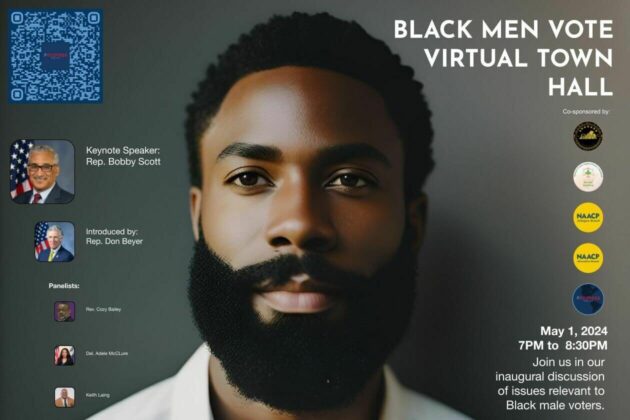

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.