This regularly scheduled sponsored Q&A column is written by Eli Tucker, Arlington-based Realtor and Arlington resident. Please submit your questions to him via email for response in future columns. Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist. Enjoy!

Question: How have you seen the Arlington housing market react to higher interest rates?

Answer: I hope everybody had a fantastic Thanksgiving. The results of last week’s Dark Meat vs White Meat poll were impressive. With 559 votes in as of this morning, only three votes separated white meat as the preferred part of the turkey over dark meat! We may have found the only vote closer than a Georgia Senate Race!

National vs Local Market Expectations

With daily news about the nationwide (and global) housing collapse resulting from parabolic price appreciation followed by parabolic interest rates, I want to use this week’s column to check-in on what we’re seeing locally and remind everybody that what you read in the news is generally going to be the most attention-grabbing data points and that our market is likely to experience a much more modest correction than many other markets nationwide, as we saw during the Great Recession.

My Take on Local Pricing Behavior

I shared some detailed thoughts and observations last month in a column addressing price drops in Arlington and the TL;DR version is that 1) yes prices have dropped relative to their peak this spring, 2) there’s not nearly enough data available locally to say with any statistical confidence how much that drop has been, and 3) my observation was/is that market-wide in Arlington we’ve lost most/all of the appreciation we saw in the first 4-5 months of 2022, but 2021 prices are still mostly holding up.

Keep in mind that in a volatile, low inventory market (current state) pricing is more randomized and case-by-case than it usually is, so you’ll see plenty of individual examples that buck the aggregated trends/assumptions.

Underlying Arlington Market Performance Data for Detached Homes

This week, I thought I’d share some charts of underlying market performance metrics to help illustrate what our market is experiencing. Here’s how I approached the data this week:

- Detached (single-family) homes only. I’ll probably look at condos next week.

- Resale data only aka no new construction because performance metrics used in this column for new construction aren’t usually representative of the market.

- I used data from 2017, 2019, 2021, and 2022 because I think it offers a helpful snapshot of recent Arlington markets to compare 2022 to. 2017 was our last “normal” market because Amazon HQ2 was announced Nov 2018 and that sent data in unusual directions. 2019 was the first full year with the Amazon bump, but pre-COVID market, and 2021 was a full year of COVID frenzy buying with normal seasonal behavior (2020 was totally out of whack on seasonality).

- All data is presented by the month a home was listed in so we can measure how home sales performed based on the month they came to market instead of the month they closed (closed data is a lagging performance indicator).

- Net Sold = Sold Price less Seller Credits

**An important caveat to this data is that I either did not use or must caution your interpretation of this year’s September, October, and November data because it is incomplete for purposes of this analysis. There are 15, 22, and 19 homes actively for sale that were listed in September, October, and November, respectively, which will have a significant influence on the performance metrics for those months when they do contract/close and most likely will result in worse performance metrics than those months currently show.

Note there are 2 homes for sale listed in each month May-July and 7 for sale from August that will likely pull down the performance metrics for those months once they contract/close, but not enough for me to be concerned about the resulting data being presented for those months.

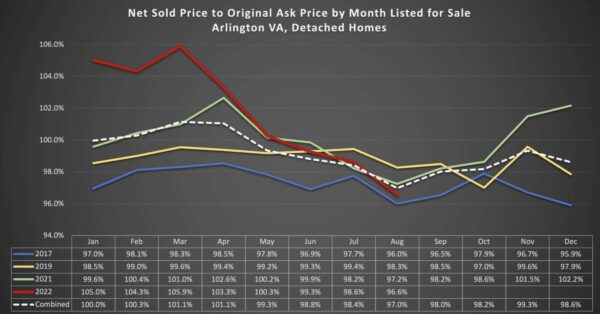

Net Sold Price to Original Ask down 9.3% in 6 Months

The average net sold to original ask dropped from a March peak of 105.9% to 96.6% in August. I suspect that once September-November listings close and we can start filling in those fields, we’ll see that number fall further but maybe not significantly because asking prices have started to react to weaker market conditions and many sellers are coming off their expectations for spring 2022 prices.

Of note, this performance metric is coming more in-line with 2017 metrics. I’ll be interested to see if performance metrics stabilize around 2017 numbers, pre-Amazon HQ2, or if they worsen. My guess is that they’ll worsen slightly compared to 2017 through the end of the year and come more into balance in 2023 (pending interest rate movements).

Average Days on Market 4.8x Higher in August than February ’22

Unsurprisingly, the average days on market has skyrocketed relative to earlier this year from 9 days in February to 43 days in August. August ’22 is still lower than August ’17, but the August average will increase once the 7 properties still for sale from August contract/close.

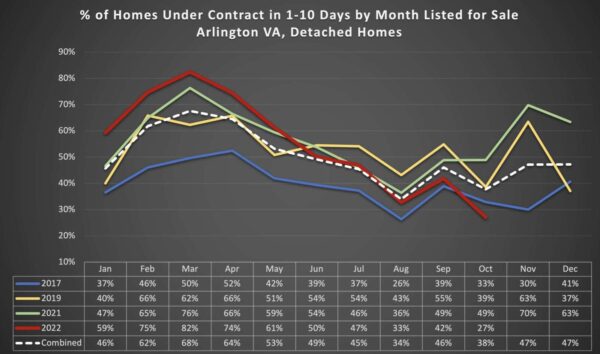

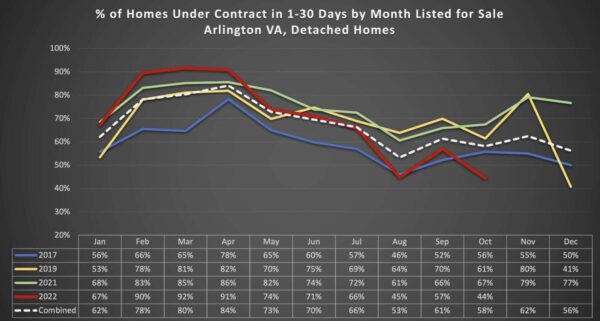

Homes Selling Within 10/30 Days Go from Record High to Low

One of my favorite performance metrics is the percentage of homes that sell within 10/30 days. I think it beats average and median days on market for a true understanding of the pace of a market. As opposed to average days on market, these charts indicate that our market pace is slower than 2017, on a seasonal basis.

We’ve gone from 82% of homes listed in March selling within 10 days to just 27% in October. Similarly, at least 90% of homes listed February-April sold within 30 days compared to 45% and 44% selling within 30 days in August and October, respectively. That is a massive change in market pace within 4 months!

Looking Ahead

I expect the performance metrics of August-October to worsen as more of those listings contract/close and November-December to come in below 2017 numbers. It’ll be a bit difficult to truly understand the aggregate effect on pricing because Arlington is a relatively small housing market, but I’ll do my best to come up with some accurate measures once we’re far enough into 2023 and enough 2022 listings have sold.

Ultimately, the tale of local home values will be told in how long it takes interest rates to settle back down into the expected 4.5-5.5% range (don’t hold out for sub-4% rates again).

If you’d like to discuss buying, selling, investing, or renting, don’t hesitate to reach out to me at [email protected].

If you’d like a question answered in my weekly column or to discuss buying, selling, renting, or investing, please send an email to [email protected]. To read any of my older posts, visit the blog section of my website at EliResidential.com. Call me directly at (703) 539-2529.

Video summaries of some articles can be found on YouTube on the Ask Eli, Live With Jean playlist.

Eli Tucker is a licensed Realtor in Virginia, Washington DC, and Maryland with RLAH Real Estate, 4040 N Fairfax Dr #10C Arlington VA 22203. (703) 390-9460