Arlington is seeing another big jump in residential property assessments this year, something that should bolster the county’s finances but hit the pocketbooks of local homeowners.

While a county press release, below, described “modest” growth in Arlington’s property tax base, it was a tale of two types of property.

On one hand, commercial property like office buildings and hotels, struggling with vacancy during the pandemic, is up only 0.6%. It’s an improvement from last year, when commercial property dipped 1.4%.

In line with the rise in local home prices, on the other hand, residential real estate assessments are up 5.8%, the county announced. That’s above the 5.6% rise in residential assessments last year and the 4.3% increase the year before that.

“The increase in property values for this year shows the attractiveness of our Arlington community, even as our community continues to face challenges brought by the ongoing COVID-19 pandemic,” County Manager Mark Schwartz said in a statement. The county’s press release notes that new construction “contributed 1 percent of the 3.4 percent overall tax base growth.”

The overall 3.4% rise in property values will mean a corresponding rise in property taxes, the county’s biggest single source of revenue.

Rising property taxes should help bolster the county’s finances as budget season gets underway. In its press release, however, the county said that rising workforce costs, Covid challenges and other pressures “will continue to be a challenge in balancing the FY 2023 Budget.”

Schwartz is set to present his recommended budget to the County Board next month.

The full press release is below.

Arlington’s overall property tax base grew modestly from 2021 due to continued residential growth, while commercial values were relatively flat.

Measured growth in residential property values buoyed the tax base, but the County continues to face challenges in balancing the FY 2023 budget due to the lingering effects of the COVID-19 pandemic.

Overall, the total assessed value of all residential and commercial property in Arlington increased 3.4 percent, compared to the 2.4 percent growth in 2021. Residential property values increased 5.8 percent overall, while commercial property values increased by 0.6 percent. Overall, new construction in the County contributed 1 percent of the 3.4 percent overall tax base growth.

“The increase in property values for this year shows the attractiveness of our Arlington community, even as our community continues to face challenges brought by the ongoing COVID-19 pandemic,” said County Manager Mark Schwartz.

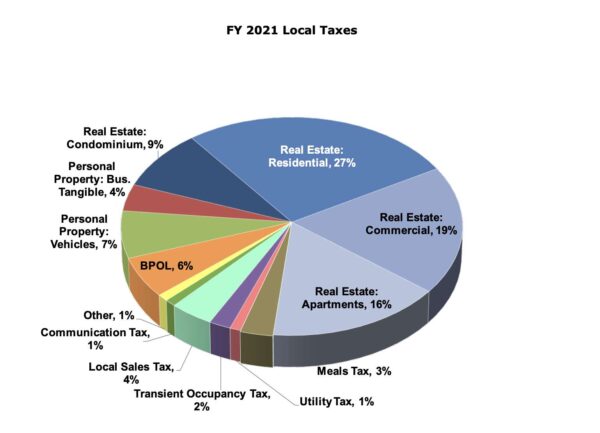

Real estate taxes provide almost 60 percent of total County revenues. The County’s real estate tax base is spilt roughly equally between residential (54%) and commercial (46%) property assessments.

The slight increase in commercial property assessments demonstrates some growth in our business market and a rebound closer to pre-pandemic levels. After experiencing double-digit decreases in 2021, hotel property values increased by 5.6 percent as occupancy and room rates gradually recover from the initial impacts of the pandemic.

Apartment property values also saw an improvement, growing 5.3 percent from the previous year. Just under half of the growth was due to new construction, reflecting continued demand for residential development.

General commercial property (malls, retail stores, gas stations, commercial condos) values decreased, reflecting continued impacts of the COVID-19 pandemic on retail stores and restaurants. Office property values also decreased due to rising vacancy rates and changing demand for office space.

The 5.8 percent increase in residential property values increased the average single-family property from $724,400 to $762,700. For CY 2022, approximately 73 percent of residential property owners saw their assessed value increase while the rest remained unchanged or declined. Residential properties include condominiums, townhouses and detached homes.

Notice of Assessments will be mailed to Arlington property owners beginning January 14. Assessment information will be available online Friday, Jan. 14, after 11 p.m.

Nearly two years into the COVID-19 pandemic, the County continues to feel the economic impacts from the slow recovery of sales, meals and hotel taxes, as well as cost increases and additional costs related to the pandemic. Expenditure pressures on transportation, human service needs, schools, workforce investment, and many other County services will continue to be a challenge in balancing the FY 2023 Budget.

In October, the Arlington County Board directed Schwartz to develop the FY 2023 budget with multiple options, including:

- Recognition of the County’s workforce with compensation adjustments.

- Continued focus on COVID-19 response to mitigate the community’s health and safety needs and impacts to the broader economy.

- Support long-term efficiencies and improvement in service delivery.

- Implement collective bargaining, Police Practices Group recommendations, and framework for racial equity, climate change and sustainability.

- Continue sharing tax revenue with Arlington Public Schools at the percent reflected in the FY 2022 adopted budget (53 percent County/47 percent Schools).

Schwartz will present his budget to the County Board in February.