The original plan, as approved in 2009, was to take 48 units of the 140-apartment Buckingham Village 3 affordable housing community and sell them as condos to moderate-income households. Last night, that plan was officially scrapped after the Arlington County Board was told that the condos would be a tough sell.

The original plan, as approved in 2009, was to take 48 units of the 140-apartment Buckingham Village 3 affordable housing community and sell them as condos to moderate-income households. Last night, that plan was officially scrapped after the Arlington County Board was told that the condos would be a tough sell.

Buckingham Village 3, a series of 16 low-rise apartment buildings along the 300 block of block of N. George Mason Drive, was purchased by the county for $34.5 million in March 2009 as part of its ongoing effort to increase the supply of committed affordable housing in Arlington.

The initial goal for the community was to renovate the buildings, lease 92 apartments to households earning below 60 percent of Area Median Income (AMI), and sell the remaining 48 units to households making 60 to 80 percent AMI. The condo component was part of a county initiative to increase home ownership among moderate income households.

The condo plan, however, eventually became the victim of grim market realities, according to a staff report. As determined by two market studies commissioned at the request of the county, selling the condos to households in the target income range would have required “significant price reductions” due in part to the onerous affordability restrictions that would come with such a purchase. Also hurting sales: the difficulty in securing a mortgage for households in the income range. In the end, the market research suggested it could have taken up to four years to sell all 48 units, with a county subsidy of nearly $230,000 per unit.

The condo plan, however, eventually became the victim of grim market realities, according to a staff report. As determined by two market studies commissioned at the request of the county, selling the condos to households in the target income range would have required “significant price reductions” due in part to the onerous affordability restrictions that would come with such a purchase. Also hurting sales: the difficulty in securing a mortgage for households in the income range. In the end, the market research suggested it could have taken up to four years to sell all 48 units, with a county subsidy of nearly $230,000 per unit.

Last night, the County Board reluctantly but unanimously voted to keep the 48 would-be condos as committed affordable rental apartments.

“This is not the outcome the Board had hoped for when we set this project in motion in 2009,” County Board Chair Mary Hynes said in a statement. “However, the Board’s action today ensures that these 48 Buckingham 3 units will be preserved as affordable rentals for decades to come.”

The Board also directed staff to find new ways to help lower-income residents to buy a home.

“We also have given staff clear direction to devise a funding strategy to help qualified, low- and moderate-income, first-time vested Buckingham home buyers the chance to buy — either in the Buckingham neighborhood, or elsewhere in Arlington,” Hynes said.

Recent Stories

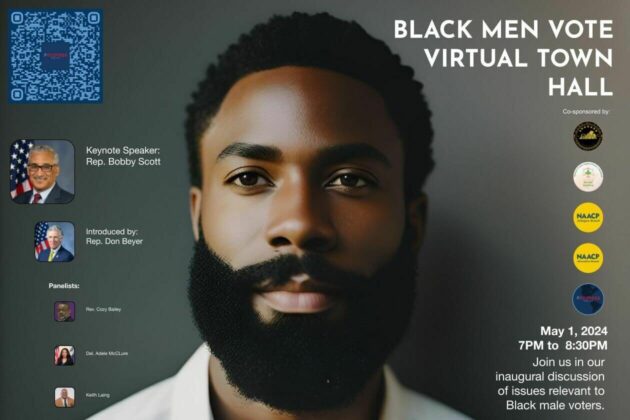

For Immediate Release

Progress for All Announces Inaugural Black Men Vote Virtual Town Hall

Date: April 19, 2024

Contact: Marc M. M. Peters

The Award is available to recent high school graduates and non-traditional students (see the application for more details). Each recipient may be awarded up to $20,000. Applicants are required to submit an online application form as well as a short video application.

The applicant must be an Arlington resident pursuing a career or technical education accredited program, within a high-growth career, that will be completed within two years.

The careers and programs include, but are not limited to:

-

Audio, Video, and Sound Engineering Technicians

-

Broadcast Technicians

-

Commercial Drivers

-

Culinary Arts

-

Early Childcare Education

-

Healthcare

-

Information Technology and Computer Science

-

Manufacturing and Skilled Trades (including welding, auto and aviation mechanics and technicians)

-

Public Safety

ACFCU’s Free Homebuying 101 Webinar: Steps to Getting Pre-Approved

Are you ready to jump into homeownership, or have you started considering it but don’t know where to start?

Financial preparation is key when thinking about purchasing your first home and the first step to getting pre-approved. Join ACFCU for

Sweeney Todd

A victim of a gross injustice that robbed him of his wife and child, Sweeney Todd sets about exacting a terrible revenge on society.